The wind farm out near the town of Darling on the West Coast. (David Harrison/M&G)

South Africa can look forward to less load-shedding once independent power producers (IPPs) supply Eskom with electricity — by March 2022, or earlier.

This follows the Government Gazette published last month by Mineral Resources and Energy Minister Gwede Mantashe, paving the way for Eskom to procure renewable energy from IPPs.

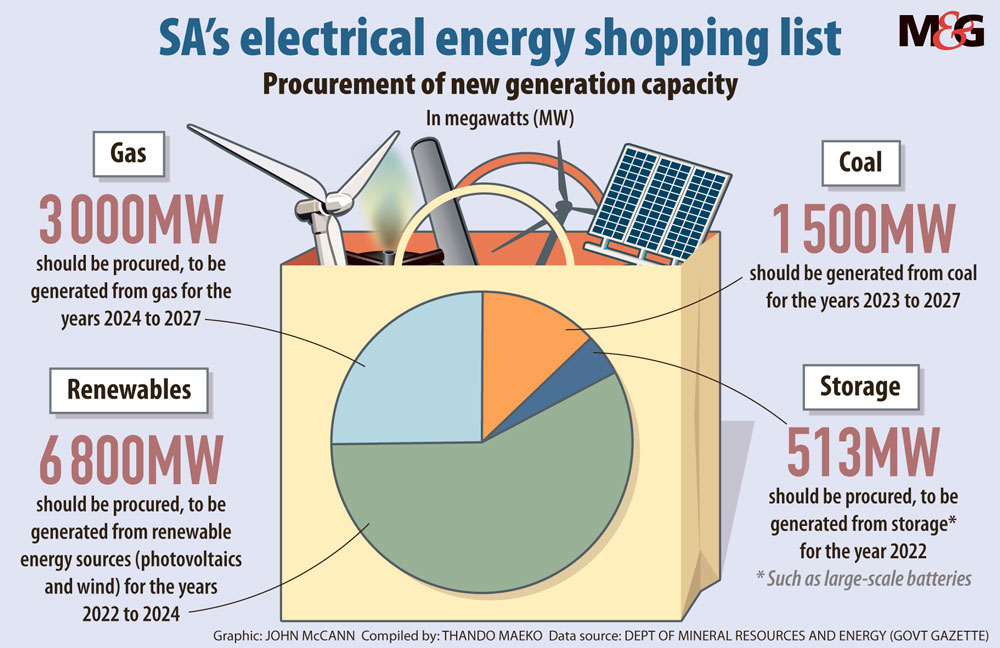

The gazette stipulates that Eskom will be able to procure power from a variety of sources: wind and solar photovoltaic power (6 800 megawatts), storage (513MW), gas and diesel (3 000MW) and coal (1 500MW), giving a total of 11 813MW.

The renewable energy projects are expected to be connected to the grid from 2022.

This new power will go some way to alleviating the electricity supply crisis. Eskom is unable to run its fleets at full capacity — with even its new plants failing to operate at capacity on a sustained basis.

Last month, the utility told Parliament’s standing committee on public accounts that power cuts would continue until at least March 2022.

This week, Eskom’s Sikonathi Mantshantsha told the Mail & Guardian the additional electricity provided by independent producers will give the utility space to do more maintenance on its unreliable infrastructure.

“The effect of additional capacity will indeed [result in] less load-shedding,” he said. “But when the economy starts growing people use more electricity so that means increasing demand.”

The gazetted section 34 determination of the Electricity Regulation Act is in addition to the emergency 2 000MW of power that will be connected to the grid through the Risk Mitigation Power Purchase Programme, passed on 7 July, to meet the current energy shortfall.

At the moment Eskom has the capacity to produce 44 000MW — although up to half of this is regularly offline. This means the 11 800MW of new capacity is a big jump in the national capacity.

In his latest weekly newsletter, President Cyril Ramaphosa acknowledged that fixing Eskom and the supply of electricity is central to rebuilding the economy. He said new power generation projects that can be connected to the grid as soon as possible will be prioritised.

Additionally, regulations on municipalities procuring electricity from independent power producers will be gazetted soon.

Experts in the power production field have welcomed the IPP move as the country works to rebuild its economy that has been battered by the Covid-19 pandemic and the preceding recession.

But the Democratic Alliance’s Kevin Mileham says the determination is not enough to pull the country out of its energy crisis.

“What Eskom needs to do is clean up their systems, repair their failing infrastructure and get their maintenance problems [sorted out].

“While we welcome the determinations, they are overdue and the minister is taking baby steps when he should be taking strides,” he said.

Jesse Burton, an energy analyst at the Cape Town-based Energy Research Centre, says the section 34 determination is welcome, given the negative economic effects of rotational power cuts and the pollutants associated with coal power.

But she said the inclusion of the additional 1 500MW of coal is a risk because it is not in line with the country’s climate change commitments. Furthermore, coal power plants take a longer time to build than wind or solar, “so [it] doesn’t help with load-shedding”.

The independent power producer process is done through bidding windows, unlike the process followed for building Eskom’s two giant coal-fired power plants, Medupi and Kusile, which are years behind schedule and riddled with corruption.

In the IPP process, the government says how much power it needs — in this case 11 800MW — and companies bid to supply portions of that. In the past the lowest-priced bidder won.

Burton says: “It is very clear that, based on global trends, wind and solar will be the cheapest options. How cheap will depend on exchange rates, technology costs internationally and how projects are structured.”

In the past, the best bidder signed a 20-year contract with Eskom, which has a monopoly on power transmission.

Mantshantsha says the planned unbundling of Eskom will result in transmission coming from another company, and this company will buy power from independent power producers. “This company will have nothing to do with Eskom.”

He says the move will force Eskom to compete with the IPPs on the price of electricity.

Thando Maeko is an Adamela Trust business reporter at the M&G