SA Express employees beat out 16 other interested parties to buy a stake in the troubled state-owned airline.

SA Express employees have been given the green light to buy the beleaguered airline. The proposed ownership structure will see the government, represented by the public enterprise’s department sharing ownership of the airline with 691 employees, crowd investors and an anchor investor.

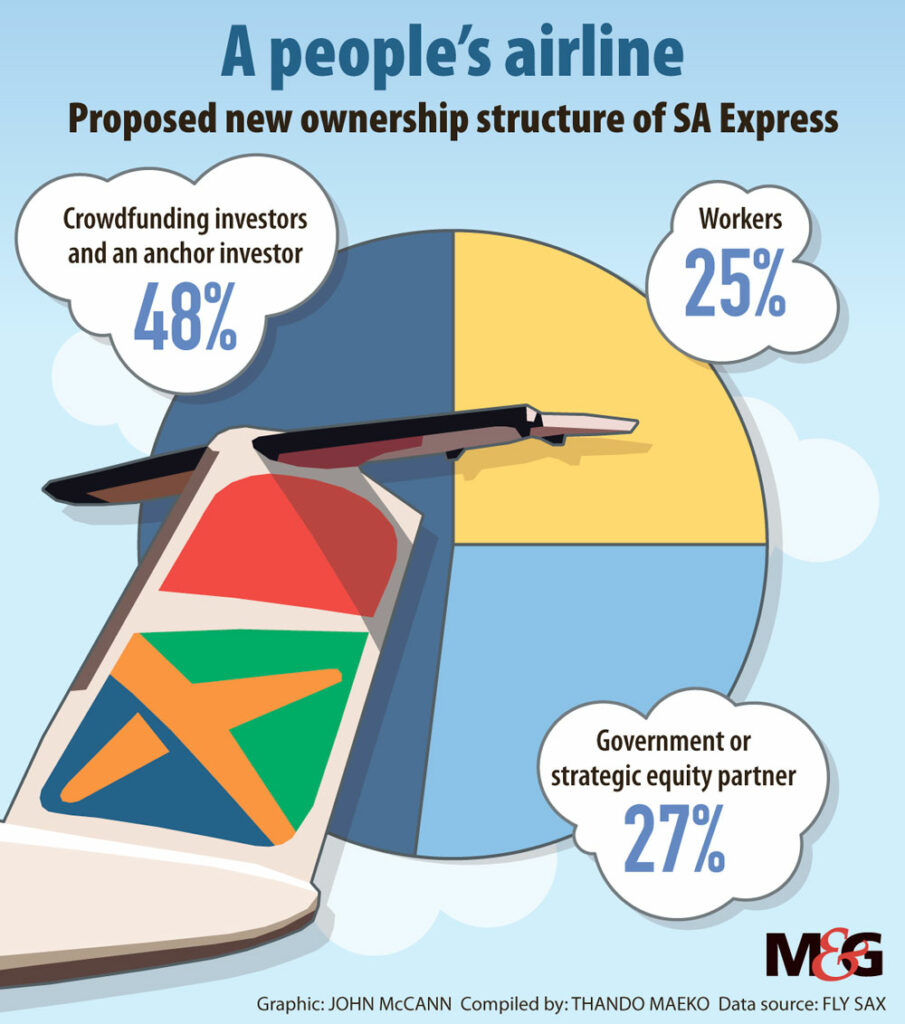

The bid proposal submitted to the airline’s provisional liquidators, Tshwane Trust, sets out the new proposed ownership structure of SA Express. Under this structure, the workers’ Fly SAX Group will own 25% of the airline, 27% will be owned by the government or a strategic equity partner and 48% by investors from crowdfunding platform Uprise Africa and an anchor investor.

Fly SAX envisions a “people’s airline” where the capital raised will be through an equity crowdfunding model to finance and scale employee ownership. According to the bid, the funding model vests ownership in SA Express employees with a goal to “create a vehicle that leaves substantial value with stakeholders”.

The employees beat out 16 other interested parties to buy a stake in the troubled state-owned airline. The sale means that SA Express, which went into business rescue in February will not be liquidated.

At the time the airline entered into business rescue, it was drowning in debt of R11.3-million. The airline had been placed under provisional liquidation in April after rescue practitioners were unable to secure the post-commencement finance for the entity to continue operating.

Fly SAX spokesperson Thabisile Sikakane told the Mail & Guardian that discussions with the public enterprises department are likely to be held within the next two weeks to “find out just how far they are willing to let go of SA Express”.

If the government has no appetite to own a part of the airline then a strategic equity partner will be sought.

Sikakane says Fly SAX is looking at local and international strategic equity partners who would be interested in buying a stake of the airline.

Fly SAX requires R250-million as start-up capital for the airline; R200‑million will be sourced from the anchor investor and equity crowdfunding. The remaining R50‑million will be sourced from the sale of the airline’s assets, crowdfunding as well as the anchor investor.

In a circular to creditors on Monday, the provisional liquidators confirmed that the R50-million “is payable in the form of a bank guarantee to be provided to the joint liquidators.”

The airline’s assets will be disposed of through a public auction and the profit will go towards the sale of SA Express. Any shortfall will be recovered from the bank guarantee provided to the joint liquidators.

The R200-million will be sourced from the crowdfunding platform Uprise Africa. Investors from the crowdfunding platform will not directly own shares in Fly SAX as it is a privately owned company and not permitted to offer shares to the public.

(John McCann/M&G)

(John McCann/M&G)

According to the bid proposal, Uprise Fund 1 will subscribe to Fly SAX shares from proceeds from the capital raised from the crowdfunding campaign and “will in turn issue shares in itself to the crowdfunding investors”.

Before Fly SAX’s profile can go live on the Uprise Africa platform, 20% to 30% of the R200-million will need to be raised from an anchor investor. In a statement on Tuesday, Sikanane said once the campaign launches following a successful seed investment from the anchor investor, the Fly SAX profile will be made available for the public to invest for a period of 30 to 60 days.

If there is not enough money raised at the end of 60 days, the campaign will be deemed unsuccessful and all pledge money that was received by Uprise Africa will be refunded to investors. Should the campaign instead be oversubscribed, Fly SAX will have “to decide the maximum amount of investments they will take, thus the maximum amount of equity that can be sold in the business”.

Crowd investors who participated in equity crowdfunding campaigns may be able to trade their crowd shares on the ZARX trading platform, an alternative stock exchange that has entered into a partnership with Uprise Africa.

Thando Maeko is an Adamela Trust business reporter at the Mail & Guardian