Managing money: One way to prevent a cash crisis and cut debt is to tailor your tastes to match your purse. Photo: Dean Hutton/Bloomberg/Getty Images

Money matters. The use of it infiltrates every aspect of people’s lives. But, in pursuit of it, many have landed in debt. A recent report has revealed that South Africans earning between R5 000 and R20 000 are drowning in debt.

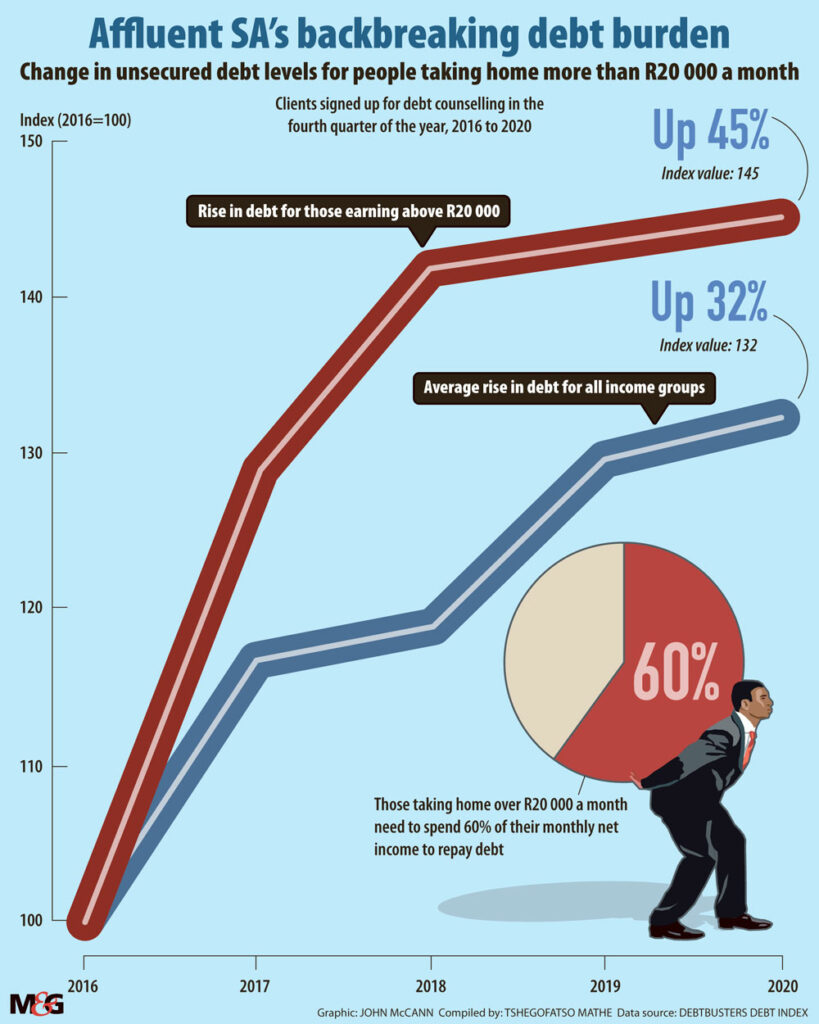

Debt counselling company DebtBusters’ debt index for the fourth quarter of 2020 shows that this group spends more than 60% of their net monthly salaries servicing debt. In addition, the debt-to-income ratio — which is the percentage of a person’s monthly income that goes toward paying debts — for those in an income band of more than R20 000, is about 130%, the highest in years.

Benay Sager, chief financial officer at DebtBusters, says most money goes into servicing unsecured debt such as store cards, credit cards, credit overdrafts. The biggest portion of their salaries goes into repaying personal loans.

The unsecured debt levels of those earning more than R20 000 is about 45%, while that of the R5 000 to R20 000 band stood at an average of about 32%.

Financial planner Tsungai Masendeke says the first money mistake people make is trying to keep up a lifestyle they do not have the financial means to maintain.

She says people need to understand that debt is only useful when it increases their net worth or income-generating capacity.

“Anything else is bad because it’s very consumptive and you have nothing to show afterwards.”

Student loans and taking out a bond are not bad debt because they lead to a better life.

Another mistake people make is not planning for unforeseeable events such as sudden death or sickness.

Sager says income levels have declined in real terms, and consumers are using unsecured debt to make up the shortfall.

Compared to 2016, nominal income has shrunk by 2%. When cumulative inflation of 18% is factored in, real income has shrunk by 20% over the past four years.

Sager adds that employees also had to take pay cuts because of the economic effect of the pandemic, which worsened the issue.

DebtBusters says that most of their customers were assisted by the South African Reserve Bank’s intervention of lowering the interest rate by 300 basis points last year. This resulted in interest rates for bonds and vehicle finance decreasing.

Starting in the second quarter, their client’s interest rate on bonds decreased from 11.1% to 8.3% a year, whereas for vehicle finance, the decrease was from 13.7% to 12.0%.

But consumers serving unsecured debt did not benefit from these decreases because their interest rates are 21% a year.

Although some consumers are amassing debt to keep up with the Joneses or because of foreseeable eventualities, Sager notes that others simply do not have enough information or understanding when they sign a loan agreement.

The company says it noticed that vehicle finance debt increased by 21% in 2016 to 23% in 2020, with three out of five cars purchased through a balloon payment agreement. Balloon payments allow borrowers to reduce the amount of their fixed monthly instalments to make a larger payment at the end of the loan’s term.

“All of a sudden you get this massive amount that becomes payable,” says Sager, adding that it seemed DebtBusters’ clients had not understood that they would have this big lump sum of money they had to pay when they took out the loan.

Sam Beckbessinger, author of Manage Your Money Like a F*cking Grown Up: The Best Money Advice You Never Got, says the financial industry is “predatory and seeks to get people into debt and keep them in debt”.

She says the numbers are sad. “But they are not an individual’s failing; it’s not that consumers are spending without caring. I think most people are afraid of debt. They get into debt because they do not have a choice.”

Masendeke says consumers need to first “accept” and “acknowledge that they have a problem” before they tackle their debt. After that, they can look into finding solutions.

Depending on how deep a person is in debt, people can seek a debt counsellor. She recommends three methods of tackling debt.

The snowflake method involves borrowers paying small amounts towards their debt. They can seek side gigs to continuously give them a small amount of money to put towards their debt.

“We tend to underestimate the power of small things done constantly, ” says Masendeke.

Using the snowball method, borrowers pay off their smallest debt and then go on to pay off the others.

She adds that a lifestyle change is necessary to pay off debt. This involves assessing where expenditure can be cut down to free up money to pay the debt. Getting an additional stream of income applies here as well.

The debt avalanche method involves paying the debt with the lowest interest rate.

While a borrower is clearing up their debt, they need to introduce good ways of handling money. Saving is one such way.

“You need to retrain your brain to resist instant gratification. Saving reprogrammes your brain so that you are not inclined to want things now.”

One way to save is to create an emergency fund for any eventualities. “Then you look at ways that you can invest your money,” Masendeke advises.

Beckbessinger and Masendeke do not encourage people to put their money in a bank because it takes time for it to bear any fruits.

“I will not recommend saving for more than a year at a bank because the interest rates are very nominal,” says Masendeke.

She advises that if people want to keep their money in a bank, they should ensure that their interest rate aligns with inflation.

Beckbessinger says the worst thing about debt is it keeps you stuck in the past. It keeps you paying for something you already bought, and you cannot start investing in things you care about in the future.

She says a person should instead focus on “being the person who owns bank shares rather than the person who owes the bank money”.

This, however, will require a person to be a money manager, says Masendeke.

A borrower will have to shift into the mentality of using the money and resources they have to get a maximum return. This will include being introspective about how they spend their money, which can be done by budgeting. “You want to make sure that every penny is allocated because [if you don’t] that will result in leakage and spillage.”

Beckbessinger encourages consumers to look at their credit report continually. By law, every South African is allowed a free copy once a year. The report enables consumers to see whether there are any fraudulent activities on their account and to check their credit score.

When it comes to the credit score, she says that lenders look at two things: the length of credit history and credit use. The former is how long you’ve had credit and latter is the amount of credit available and how a consumer uses it.

Tshegofatso Mathe is an Adamela Trust business reporter at the M&G