Growing: Outgoing Telkom chief executive Sipho Maseko leaves behind a stronger telecommunications company, having largely completed the move from voice and fixed-line to mobile. (Waldo Swiegers/Bloomberg/Getty)

Telkom has been playing catch-up in the mobile market for more than a decade. But now that the partly state-owned telecommunications firm has muscled its way into the big leagues, analysts say Telkom still has a long game to play ahead.

Late last month, Telkom announced Sipho Maseko would be stepping down as its chief executive.

Maseko will leave behind a company better off than he found it in April 2013, when it was still struggling to find its footing in a rapidly changing mobile market and still reeling from a near-ruinous foray into Nigeria.

After eight years at the helm — and 10 years since Telkom launched its own mobile arm — Maseko has steered the company towards becoming South Africa’s third-largest mobile operator, nudging out Cell C last year.

Of this achievement, analyst and trader Simon Brown said: “Telkom has established itself as number three in the telco [telecommunications] space, which is a great place to be. But it is going to take some time and effort to significantly grow that. It’s done the exponential growth. I think from here on it is going to be slower and slightly more pedestrian.”

False start

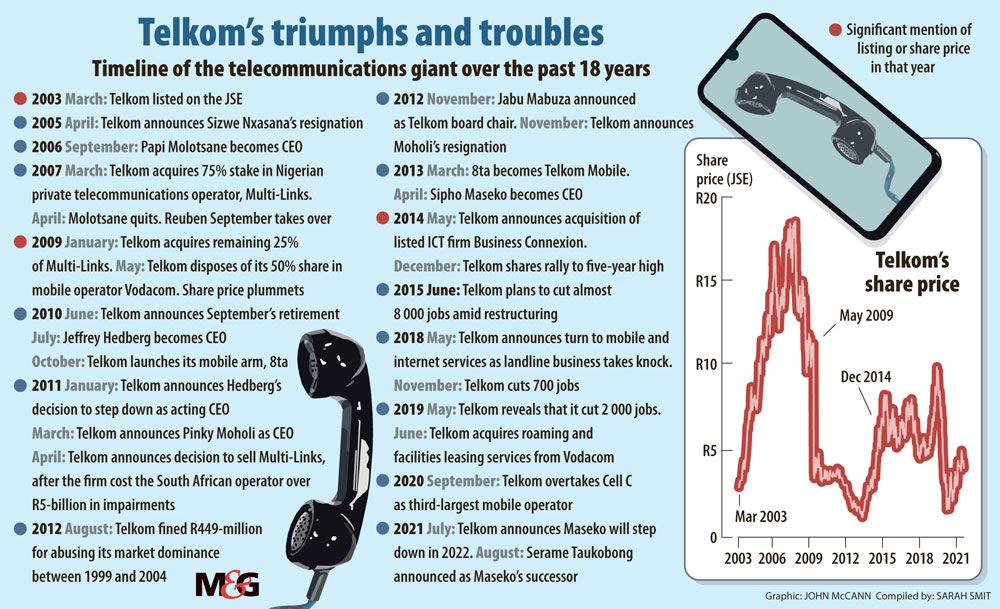

Before Maseko, Telkom as we know it, as the first state-owned entity to become publicly listed, had five other chief executives: Sizwe Nxasana, Papi Molotsane, Reuben September, Jeffrey Hedberg and Pinky Moholi.

In the years since the resignation of Nxasana, who steered Telkom through its first years as a majority privatised company, its revolving door of leaders struggled to turn the company around as its voice and fixed-line businesses languished.

Telkom’s former leadership also saddled it with an albatross in the form of a failed investment in Nigerian mobile business Multi-Links. Telkom’s stake in Multi-Links cost it R9.8-billion. The hit accounted for more than half of Telkom’s value in 2011, when it decided to cut ties with the Nigerian company.

Maseko has been credited with saving Telkom from inevitable doom by giving it a chance to move away from its stale fixed-line business, which has seen a dramatic decline in users, from almost 5.5-million in 2000 to just 1.4-million last year, and by finally making inroads in the mobile market.

Brown noted that Telkom’s share price has remained modest over the last decade, failing to reach the levels it climbed before 2009, when it disposed of its stake in its main profit driver Vodacom.

The Vodacom divorce caused Telkom’s share price to plummet, but was meant to signal the 39% state-owned company’s bid to make its own way in the overcrowded mobile market. However, Telkom’s share price has not recovered since and continued to tumble until Maseko, a former Vodacom executive, took the reins.

Having Vodacom in its stable helped Telkom significantly, Brown said. “Vodacom is a leading telco in South Africa. It is a fairly stable profit and dividend stream, mostly because it is not MTN. It’s not in 20-odd countries. So I think that significantly helped [Telkom] in the lead-up to 2009.”

After parting ways with Telkom, Vodacom listed on the JSE. Since listing, Vodacom’s stock has gone up 134%.

Subsequent to the Vodacom disposal, Brown said, “there were concerns about the Telkom Mobile roll-out, which took a lot of time and a lot of money to gain traction. And it certainly has now.”

Gaining traction

In the 18 months from when Maseko first joined Telkom in 2013, the company’s share price rallied almost 500%.

Telkom’s share price floated well above the low levels it touched prior to Maseko’s tenure — until the Covid-19 pandemic last year stirred uncertainty among the telecommunications company’s customer base, triggering a rise in defaults.

But the company’s most recent set of results, released last week, signals continued growth. According to Telkom’s first-quarter results, group revenue was up 3.5% year-on-year to R10.6-billion.

Telkom’s growth in 2021 was mainly driven by the mobile business. Mobile data revenue rose by 11.1%, supported by growth in mobile broadband customers (up 30.9% to 10.5-million). Active mobile customers were up by 36.3% year-on-year to 16.1-million.

Telkom Mobile, which got its start as 8ta in 2010, now has more than 15-million customers and generates R20-billion revenue for the group — almost double what it was three years ago.

Telkom announced Maseko’s successor last week. Serame Taukobong, like Maseko, comes from a mobile operations background, having spent 10 years at MTN prior to joining Telkom in 2018. Taukobong was the chief executive of Telkom Consumer Business.

(John McCann/M&G)

(John McCann/M&G)

On the back foot

Though its push into the mobile business has started to pay out, Brown said the market may not be big enough for Vodacom, MTN and Telkom.

“That is a concern. But I think they’ve got it working and I do think their telco is now well established. It is going to take a lot from Cell C to dislodge Telkom. I think without too much effort they can hold on to that spot. And then, of course, try and pick up more from the two big players, MTN and Vodacom.”

First National Bank portfolio manager Wayne McCurrie said Telkom has managed “under extremely difficult conditions”. “Voice, let alone fixed-line, is in a permanent decline. Everything’s data. They had to start from scratch with cellphones to try and match Vodacom and MTN in a declining environment … I think they have done very well in very trying circumstances.”

McCurrie noted that it takes an enormous amount of capital expenditure “just to stand still, let alone to get ahead” in the mobile business. “It is a very hard task to be the third player … The other two just dominate so massively.”

In order to compete against Vodacom and MTN, Telkom has to capture 20% of the mobile market, McCurrie said. Currently Telkom has about 14% of South African mobile customers, while Vodacom dominates with 42.5%, followed by MTN with 30% of the market. “Whether that’s possible or not, I don’t know. Without that 20%, its capital expenditure is just too high and it has to give away its margin to pay for roaming.”

A tough operating environment and dominant competitors mean that Telkom is not the best company to bet on, McCurrie said. “They have done an extremely good job. But that doesn’t mean I am going to buy their shares, simply because they are always on the back foot.”