MultiChoice’s Showmax has been struggling to compete with Netflix because of its technology interface, but a new deal is set to change that. (Waldo Swiegers/Bloomberg via Getty Images)

A Showmax deal by parent company MultiChoice is said to give the streaming service a fighting chance against Netflix, Amazon Prime and Disney, which have taken the lion’s share of the South African streaming market.

MultiChoice recently announced an agreement with multinational telecommunications conglomerate Comcast’s subsidiaries NBCUniversal and Sky that will see South Africa’s broadcasting giant sell a 30% stake in Showmax.

Peter Takaendesa, an investment analyst at Mergence Investment Managers, said the deal gives Showmax a higher chance of success.

“They have been battling to compete with Netflix. So now what came out of some of the surveys I saw was that their technology interface, or what a customer has to interact with for Showmax, was not at the quality that Netflix is. So, through this transaction that is what they are trying to solve because their US partners will bring a matching platform to the one Netflix has to some extent,” he said.

According to MultiChoice, the new service will operate as Showmax but with the current Showmax structure being overhauled.

The new group, which will be called the Earth UK and registered in the United Kingdom, will trade as the Showmax Group and will be powered by Peacock’s globally-scaled technology. The new company will be 70% owned by MultiChoice and 30% by NBCUniversal.

Peacock is NBCUniversal’s video streaming service.

“MultiChoice is letting go of some of the shareholding [in Showmax] because the US partners are putting their technology into Showmax so they have to get something for it. They are giving up some of the shareholding with the expectation that with stronger partnerships the overall pie will get bigger. They now can compete much stronger with Netflix because they now have a partner who is giving them more resources from a technology and financial point of view,” Takaendesa said.

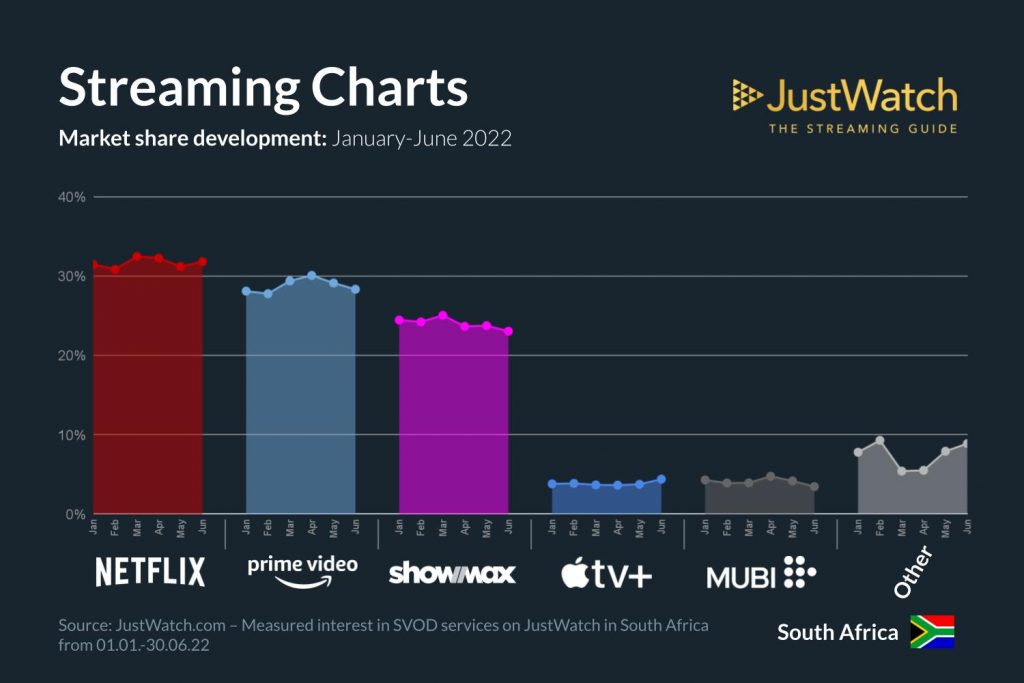

According to data from JustWatch published in June 2022, an international streaming guide, the top three players in the market are Netflix, Prime Video and Showmax. These take up 84% of South Africa’s streaming market. Prime Video is hot on Netflix’s heels for first place with only a 3% gap between the two streaming giants. Local platform, Showmax, was in third place.

JustWatch said Netflix steadily won over more shares by the end of June, adding +1%. On the other hand, Amazon Prime Video remained at a standstill as Showmax lost ground, decreasing by 1%.

The group said the relaunched Showmax will combine Multichoice’s investment in local content with international content licensed from NBCUniversal and Sky in hope of gaining market share. This will be complemented by third-party content from HBO, Warner Brothers International, Sony and live English Premier League (EPL) football.

“I wouldn’t say it’s a silver bullet because it is also a function of how competitors push from here onwards,” Takaendesa said.

He said the other streaming services may come out more aggressively after seeing that MultiChoice is bolstering its offering.

“For example, Amazon has not been firing on all cylinders in Africa, in general. They are only just starting and I don’t know to what extent they are going to accelerate and intensify their fight for market share. The only guys who have been strong are Netflix and MultiChoice has been trying a number of things to compete with them.”

MultiChoice thought the reason its market share was being eaten away was the high cost of data and it tried various initiatives to attract customers.

In April last year, Showmax introduced Max Data Saving mode that allows users to stream up to 50 megabytes an hour, giving subscribers more control over data use and expenses.

Mail & Guardian previously reported that Barry Dubovsky, chief operations officer at MultiChoice Connected Video, said: “Showmax is designed for Africa: a mobile-first continent where the cost of data remains a barrier to streaming.”

Guarding against satellite television failure

Takaendesa said this new deal is a win for MultiChoice because, if the satellite business (DSTV) starts to face pressure, then MultiChoice can have some of those customers leaving satellite television.

Mybroadband reported that MultiChoice started to experience a decline in DStv Premium subscribers seven years ago and that between 2015 and 2018, DStv Premium subscriptions declined from 2.35 million to 1.92 million. Between 2018 and 2022, DStv premium subscribers declined from 1.7 million to 1.4 million.

Fibre network operators are rolling out fibre across South Africa and Africa and mobile network operators are offering uncapped 4G and 5G data packages. This means the number of households that can replace their DStv service with affordable streaming options such as Netflix, Disney+ and Showmax is increasing.

This is the space MultiChoice is trying to get into.

“The more people use streaming services like Showmax then there’s growth and MultiChoice needs to grab that to defend their business but also for potential further growth,” Takaendesa said.

He explained that not many people in Africa can afford satellite television but, if there is a shift to digital, then more people can afford it because it is cheaper.

“With streaming there isn’t that huge cost from satellite, it’s mostly just the internet. The consumer is already paying for the internet anyway. Netflix does not have to rent satellite capacity from someone else but the consumer has their own data … that is the space MultiChoice hopes Showmax will fill.”