Beyoncé’s Ivy Park collection. Photo: Supplied

There are dozens of high-profile lifestyle collaborations where celebrities meet big brands to sound the call to impressionable consumers. But what does it mean for the collaboration business model when these celebrity collections start to slump, both in sales and in the eye of the consumer?

Luxury houses use crossovers strategically to create quirky collectables. There are even posthumous collaborations between retailers and artists such as Keith Haring and Jean-Michel Basquiat, whose signature motifs are plastered on anything from hoodies to mugs.

South African celebrities with major collaborations under their belts include Thebe Magugu’s crossover with Dior and Bonang Mathebe’s shoe line for Steve Madden last year and, this month, artist Lulama Wolf is collaborating with H&M on a global homeware collection.

These collaborations tend to leverage the romance of individual genius and perceived affluence.

Consumers might turn to celebrities for inspiration but probably use them to compensate for their own lacklustre lives. The heights these collaborations have reached might simply be down to successful commercialised personalisation.

While celebrities and influencers are photographed wearing designer gear in luxury homes and fancy cars, they collaborate with brands that we all know and can own a piece of. But when they do not appear to wear these products in their everyday life, the essence can be lost. If these influencers are not using the products they are supposed have collaborated on, why should consumers?

Ivy Park drops the ball

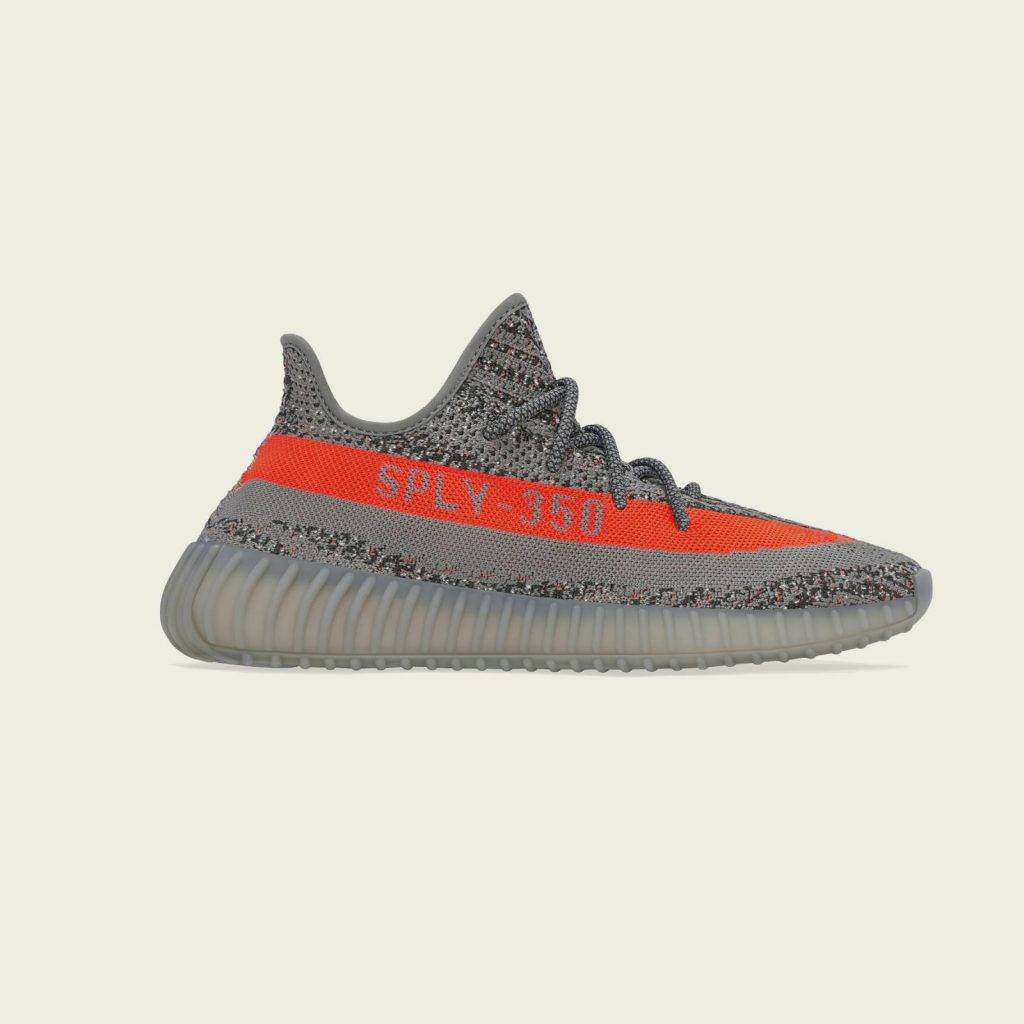

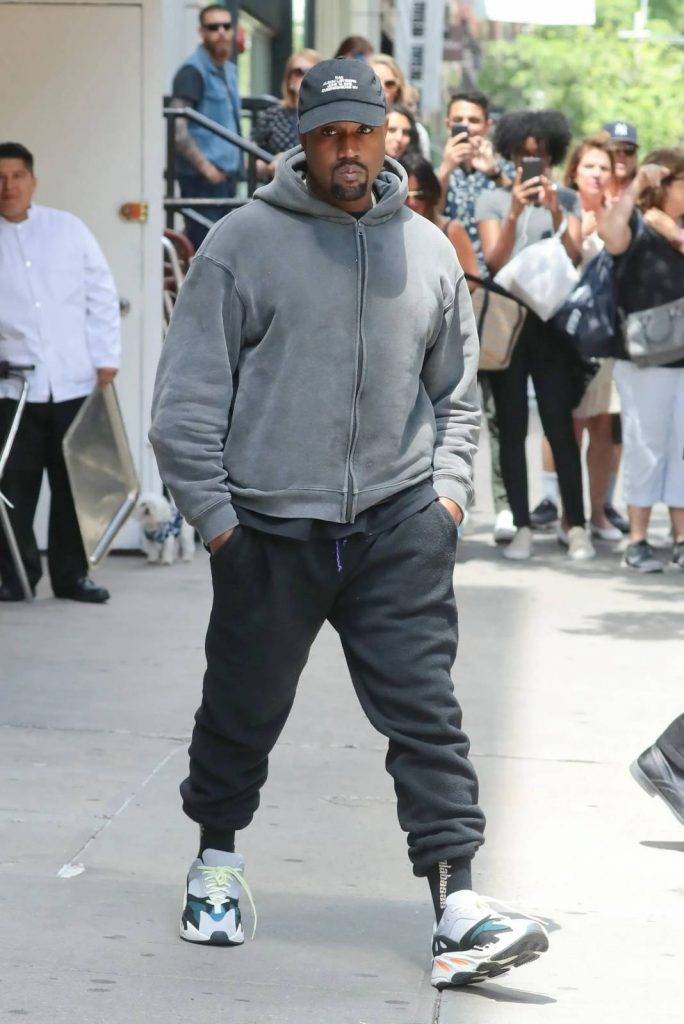

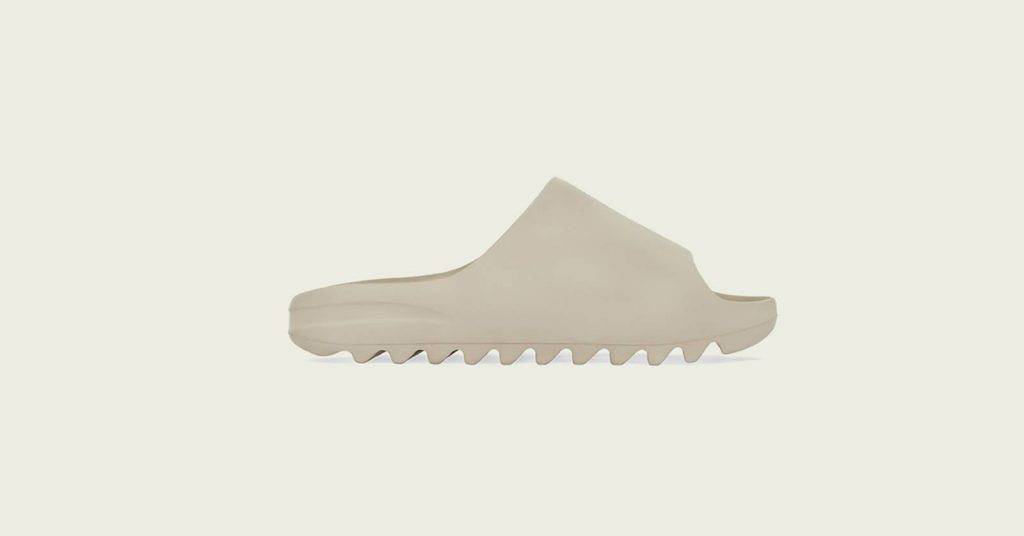

Among the dozens of collaborations are Adidas’s projects with Beyoncé to produce Ivy Park and Kanye West with his now discontinued Yeezy line. This year, Puma and Rihanna announced they had again teamed up for a Fenty collaboration, the first of which was in 2014.

What these three lines have in common is they sit under the “athleisure” umbrella, where casual style meets high-performance materials and silhouettes.

The luxury of this category (besides the perceived luxury of billionaire celebrity endorsement) is the fluid style that appeals to many sartorial tribes, fans’ affinities with celebrities, and scalability of the product in terms of size, materials and longevity, as long as consumers demand comfortable clothing and sneakers.

But Ivy Park and Yeezy have bee major financial losses for the sportswear giant recently. While Beyoncé fans claim wins by securing tickets to her tour this year, Adidas reported a $200 million loss on Ivy Park, according to The Wall Street Journal.

Last year, it reported that Ivy Park sales had fallen 50% to $40 million, far below the intended $250 million, despite Beyoncé’s annual $20 million pay cheque from the collaboration. The report also says the partnership could end this year.

Fans have noted the outfits styled in Ivy Park’s latest collections are a few years behind. Colour palettes, silhouettes and choice of accessories speak more to 2018 and 2019 trends.

Today, flashy logos are leaving the collections of high-profile brands, while Ivy Park has splashed “IV” across this year’s Park Trail collection. Its bright oranges — called “safety orange” by Pantone — were more common in 2018.

Beyoncé is rarely photographed wearing Ivy Park, apart from the occasional editorial shoot or promotional Instagram post, while West and Rihanna’s street styles more often include items from their lines.

Although Ivy Park sales figures have slumped, it is unlikely that the line will disappear from South African Adidas stores anytime soon.

Yeezy dilemma

At the same time, Adidas hints at discarding excess Yeezy inventory, which it initially said it would sell without the label. It might opt to destroy merchandise, says Adidas’s new chief executive, Bjorn Gulden.

Gulden recently spoke about the brand’s tricky position of sitting on $1.3 billion of unsold Yeezy products after terminating its partnership with West in October because of his anti-Semitic rhetoric. Adidas said the severance would cost it €250 million.

“The value of the product is not the physical value of the ingredient. It’s the brand and merchandise that is sold at a high price,” Gulden said.

Defining Adidas’s collaboration strategy is part of refurbishing its stalling lifestyle range, which leans heavily on collaborations, he said. Focusing on big names and long-term collaborations is said to continue after working with brands like Gucci, Balenciaga and Prada, which didn’t fully resonate with consumers.

“Should we irrevocably decide not to repurpose any of the existing Yeezy products, this would result in the write-off of the existing Yeezy inventory and would lower operating profit by an additional €500 million [in 2023],” Adidas says in its 2022 annual report.

The Yeezy dilemma speaks to how much social capital is tied to these collaborations. The celebrity’s actions are as important as what wearing a pair of Yeezys means, if not more. Collaborations no longer have an ephemeral, one-off feel — they flood retail and resale markets.

But if the collaborations are only as valuable as the artist’s reputation, then is the collaboration’s downfall caused by the ongoing partnerships instead of ephemeral qualities?

Collaboration calamities

By wearing the products with their names on them celebrities push their collaborations into the democratic luxury space too. Like athleisure, democratic luxury is broad-reaching, and it sells more expensive products that might not change the consumer’s life but are status markers.

Some collaborations project an affinity with artistic sensibilities but others don’t hold the same social capital. Yeezy Boosts were highly coveted, with a price tag to match, before Adidas flooded the market with a million pairs in 2018. If you were seen wearing a pair of Yeezy Boosts in 2016, it meant you understood avant-garde design and had a lot of money to throw at sneakers. Today, consumers and Yeezy’s manufacturer want nothing to do with them.

As American economist Thorstein Veblen said in his 1899 treatise The Theory of the Leisure Class, spending has become the way people establish their position in an affluent society.

Luxury as we know it today has changed. Luxury lifestyles are rooted in old European royal courts, (think Louis XIV), which set the standards for lavish living. Today’s version of royalty are celebrities whose well-documented sumptuous lifestyles are aspirational and set the tone for what consumers deem desirable enough to buy.

If celebrities are collaborating with brands the everyday consumer can afford, it gives the illusion they can own a piece of an affluent lifestyle.

Obvious metrics to measure the success of collaborations are sales and media impressions but what is at the intersection of the consumer’s personal indulgence and conspicuous consumption? At the crux of luxury collaborations is the convergence of the collaborators’ individual histories with their realities.

Fenty failures

Although fans rejoiced at the announcement of another Puma- Fenty collaboration this year, Rihanna, like some of her billionaire peers, is not immune to a failed collaborative project. Remember when LVMH collaborated with her on a Fenty fashion label in 2019?

“The new maison, named Fenty, is centred on Rihanna, developed by her, and takes shape with her vision in terms of ready-to-wear, shoes and accessories, including commerciality and communication of the brand,” said LVMH, announcing the partnership.

However, it said in Women’s Wear Daily in 2021: “Rihanna and LVMH have jointly made the decision to put on hold the ready-to-wear activity, based in Europe, pending better conditions.”

The pause was credited to factors such as the Covid-19 pandemic and a shift in focus on Rihanna’s main cash cows, Fenty Beauty, also owned by LVMH, and the Savage x Fenty lingerie lines. But these projects speak more to the demographics of Rihanna’s fan base conditioned to expect Rihanna-adjacent products on the basis of inclusivity, accessibility and democratic luxury.

It is not surprising LVMH would bank on a fashion label boasting Rihanna, who is known for her style, ties with other LVMH designers and helped revive Puma’s lifestyle offering. But, if there is one thing that has changed in luxury fashion in the last 30 years, it is the single-minded focus on profitability, thanks to LVMH chief executive Bernard Arnault.

Luxury tycoons such as Arnault have shifted the focus from what the product is to what it represents: wealth, status and power.

“The result of all this hype is [that] a product line, Arnault says, fulfils a fantasy. It is so new and unique you want to buy it. You feel as if you must buy it, in fact, or else you won’t be in the moment, you will be left behind,” writes Dana Thomas in Deluxe: How Luxury Lost its Lustre.

But Rihanna’s previous projects and collaborations contrast the exclusionary nature of luxury, which calls to consumers to buy into this fantasy. Instead Fenty Beauty, Savage x Fenty and Puma x Fenty spoke to the reality that not all consumers can buy $940 Fenty denim jackets, unwearable Victoria’s Secret lingerie or $1 000 Yeezy sneakers.

The failed luxury fashion house shows Rihanna might have good style and a bankable image but she is a business figure, not a designer. Collaboration campaigns may put stars in consumers’ eyes, but Beyoncé is not sitting at a bench sewing Ivy Park clothing. Neither West nor Rihanna are sitting with shoemakers producing their latest sneakers.

What does this say about power of influence, if not the fantasy that you too, for a moment in your day, can live as if your life is endorsed by your favourite billionaire?