Ndumi Hadebe's elf-help books tackle issues of money and finance. (Tendai Mhlanga)

For many working professionals, engaging with their financial problems is stressful and can even lead to mental health issues.

In a declining economy filled with anxieties and uncertainties about our financial security, how can individuals and families have better conversations around money?

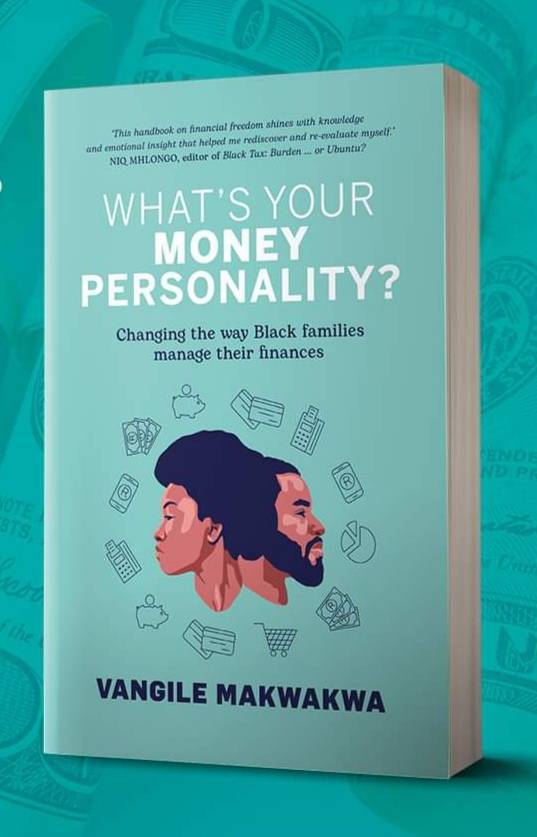

“It’s not just about money mistakes; it’s about how our money traumas and family dynamics shape our spending habits,” says author and money trauma coach Vangile Makwakwa.

In her book What’s Your Money Personality? Changing The Way Black Families Manage Their Finances, she explores the money traumas troubling many individuals and families — particularly in black communities.

Makwakwa’s aim was to help readers explore the individual money styles within their families.

“By understanding their money archetype or money personality and the associated core wounds, readers can gain insights into how they shape their family dynamics and their relationship with money.”

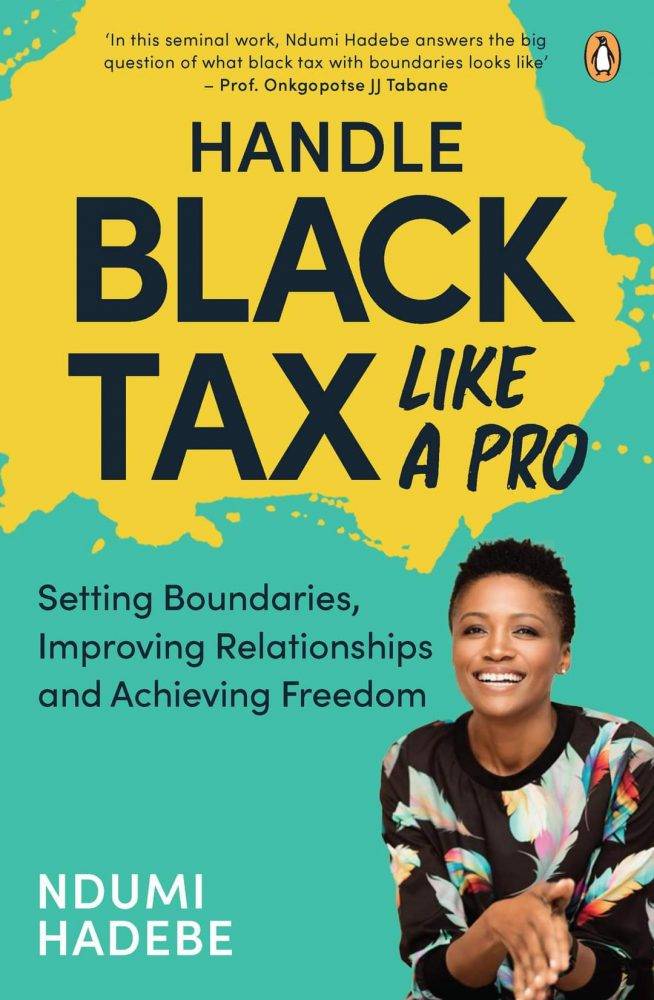

“Black tax” is another complex and sensitive issue some working professionals battle with. A term originating in South Africa, black tax refers to the financial responsibility assigned to high-salaried people to support their less fortunate family members.

Some see this as a burden, while others believe it is an act of humility and a way to counter the poverty affecting many communities.

“If we truly want to end the cycle of poverty, we should commit to doing black tax differently, by making sure that we don’t become our children’s black tax when we retire,” says author and self-leadership coach Ndumi Hadebe. In her book Handle Black Tax Like A Pro, Hadebe offers a guide for working professionals struggling with this issue.

Both Makwakwa’s and Hadebe’s books provide a refreshing perspective, inspiring black working professionals and their families to engage differently on money matters, which can cause conflict, depression and break-ups.

During our interview, both authors encouraged healing from money traumas through honest conversations with themselves and their loved ones.

Vangile Makwakwa’s self-help books tackle issues of money and finance.

Vangile Makwakwa’s self-help books tackle issues of money and finance.

Money troubles can hinder you on the road to starting a career, family or marriage. And money wounds, among other unresolved and even invisible wounds, come to bear when people are confronted with challenges around finances.

As a money trauma coach, Makwakwa observed how many people unknowingly block their financial abundance, engage in reckless spending and struggle to save — without comprehending the root causes. This lack of awareness holds back professionals and their families.

“It’s like you’re cruising along, thinking you’ve got your strategy in place, and then, boom, you’re frozen, unable to take action,” she explains. Makwakwa’s views on money were developed as a child witnessing the constant arguments over funds among family members. She contends that money trauma is a trans-generational epigenetic inheritance passed from one generation to another.

“It’s been a continuous journey because money trauma isn’t a one-and-done deal. It’s an ancestral thing, a process ingrained in our DNA by the countless ancestors we carry in our bloodline.”

She admits that writing the book was no walk in the park because she had to confront her own money traumas. In 2022 and last year, she went through some seriously dark times in her business and money was at the heart of it all.

And, as if that wasn’t enough, she found herself going through a public shaming on social media.

This led to an internal struggle, Makwakwa adds, of wanting to run away, to not be vulnerable, to shy away from putting her story out there.

Hadebe’s money struggles were around black tax expectations from her loved ones.

Feelings of annoyance, guilt, fear and resentment when engaging with finances, Hadebe argues, are negative emotions linked to money traumas.

These low-vibration sentiments affect our ability to connect with the frequency to empower our ability to earn more money and better manage what we do have. She contends that creating boundaries is a difficult, but necessary, decision for one’s mental and financial health.

Hadebe believes boundaries are the foundation for us to be aligned with our innermost selves.

Better money management is an act of self-love and helps us reclaim our personal power.

Like Makwakwa, Hadebe’s writing process was cathartic. By the time she started writing her book, she had been on a personal journey of applying healthy boundaries for more than a year.

“So, it was fairly doable for me to set boundaries across the board — for money, time and energy.”

Hadebe quickly learned that she had to be honest and upfront about what she could and couldn’t afford.

“I was no longer concerned about being judged or labelled,” she says.

The conversation around money matters can, however, be sensitive, especially among black families in the lower economic strata.

It is important for us to become familiar with talking about money matters, in general, with our families, when they are genuinely invested in our growth and progress, Hadebe says.

For the payer of black tax, there must be a focus on addressing the issue with love and compassion.

“People shouldn’t wish the issue of black tax away by not talking about it. As difficult as it may be, it must be discussed.”

Hadebe adds that it’s advisable that you assess thoroughly how much you can afford to allocate to your family’s needs.

“Once you’ve communicated what you can afford, you can take action based on the budget set.”

She adds that selling the idea of ending the cycle of poverty for yourself and the entire family is also vital.

“Let them see that your financial boundaries are there for your benefit, theirs and future generations.

“It might take time for them to get it but you keep it at it through love and compassion.”

Makwakwa agrees with Hadebe on the enormous impact of having daily talks about money.

Of course, some people might feel anxious about starting the conversation, due to fears of being shunned or seen as boastful.

Joining a community focused on money issues can go a long way to helping with financial management, Makwakwa advises. However, the pursuit of personal mastery should be the priority.

For those who can afford it, Makwakwa suggests getting a financial adviser, a money coach or even a life coach.

She concludes that money isn’t just about the numbers, it’s about our core wounds from childhood and our family dynamics.

“It’s about the intricate dance we have with money and the relationships we build around it. So, next time someone says financial literacy is the key, remind them that it’s a bit more complex.”

Both books aim to foster better money relationships that can pave the way for collective generational wealth, particularly for black working professionals and their families.