Eskom’s financial situation renders it unable to service utilities from its own revenue. Over R200 billion of the utility’s debt has been considered distressed debt — which must be paid back with urgency — by Eskom chief financial officer Calib Cassim.

Eskom, which is in debt of R396 billion, blames the National Energy Regulator of South Africa (Nersa) for its financial state and, by extension, the inability to do its job efficiently.

Eskom’s financial situation renders it unable to service utilities from its own revenue. Over R200 billion of the utility’s debt has been considered distressed debt — which must be paid back with urgency — by Eskom chief financial officer Calib Cassim.

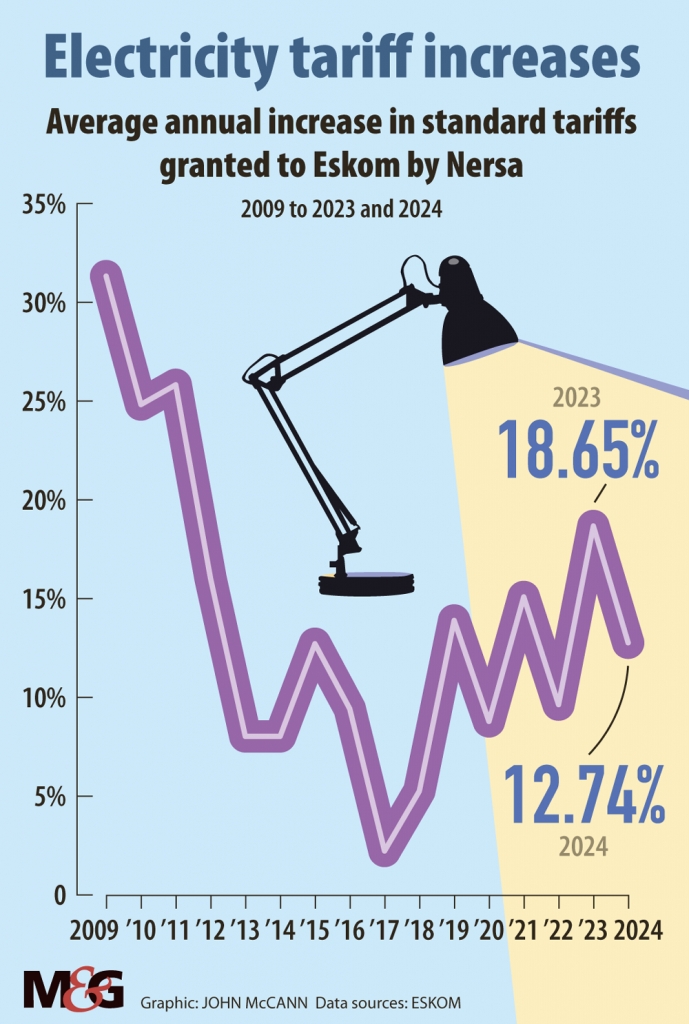

To recoup its money from lenders, Eskom applies for tariff increases from Nersa. In 2021, the utility asked for a 32% increase in tariffs, but was granted 18.65% instead.

In general, Eskom has received less than what it requests. Last year, Nersa granted Eskom one of the lowest tariff increases to date for 2022‑23 at 3.49% after it had requested a 20.5% increase from the regulator.

The Eskom application caused an outcry from the public, business and industry, which condemned it as unaffordable and dangerous for the economy. People also lamented the fact that the utility requested an increase when it has demonstrated its inability to keep the lights on.

Announcing the decision, Nersa’s full-time member for electricity, Nhlanhla Gumede, said it had been made “in the interests of Eskom, the economy and stakeholders”.

Municipalities’ shortfall

Every year when the utility applies for a tariff increase, there is a political uproar against the utility, which increases the pressure on the regulator to reject the tariff hikes. Another major reason for Eskom’s revenue shortfall is the inability of municipalities to pay the R68 billion it owes to the power utility.

One of Eskom’s main problems is that it has run out of diesel which powers open-cycle gas turbines and it has become a constant struggle to find money to buy more.

According to energy expert Chris Yelland, these turbines should only be used in emergency situations to help stabilise the grid. But Eskom has become reliant on the turbines as primary generators. They can produce over 2 000MW, which can stave of two stages of load-shedding.

Political parties and non-governmental organisations have lobbied against the utility, and have taken it and the regulator to court to reverse the decision to approve a hike in tariffs of 18.65%, 13.35% less than what the utility had requested.

This is despite the political parties previously being in favour of lesser tariffs, which have placed the utility in the position where it is in debt and unable to service its plants.

The only route open

Last year, South Africa was in the dark for more than 200 days. Eskom estimates more than R1 trillion is needed by 2030 to improve its energy availability factor and, because of this, Eskom plans to hold onto Nersa’s decision to approve its 18.65% tariff hike despite political pressure to reverse the decision.

Responding to questions from the Mail & Guardian, Eskom said it would not be bullied into rejecting the tariff hike increase which the energy regulator has approved as it urgently needs the funds to recover from the debt it has.

“Nersa allows Eskom to recover efficient costs. These relate to commitments such as coal contracts, independent power producer contracts, diesel purchases, the implementation of maintenance, employee contracts and debt commitments.

“If Eskom does not recover from the consumer, then the burden on the taxpayer increases. Thus efficient costs will need to be recovered — they do not just disappear,” the power utility said.

It added that the only route open to challenge Nersa’s decision is to launch an application with a high court to review and set aside the regulator’s determination.

Those “aggrieved” by the 18.65% tariff hike will have to lodge a court application to challenge the regulator’s decision, Eskom said.

President Cyril Ramaphosa asked the Eskom board, according to Eskom’s chairperson Mpho Makwana, to look at how the utility could ease the impact of the increase.

“We did not receive an instruction from the president not to implement the increase. That would be negligent, and if we did, we would not be entitled to receive a single cent from the national treasury on budget day,” he said.

Money urgently needed

On Monday, the outgoing Eskom chief executive, André de Ruyter, said the utility needs debt relief in combination with tariff increases if it is to survive.

“If debt relief isn’t accompanied by reform to the tariff, then we will be back with our begging bowl at the national treasury’s door in three to five years’ time.”

The South African Local Government Association’s (Salga) spokesperson, Tebogo Mosala, said Eskom should not have any complaints about tariff increases, because it has received more than the 32% it requested within the next two years.

“The approved tariff by Nersa amounts to a total of 33% increase over the next two years. “Effectively this is the increase Eskom asked for and is an increase of more than inflation,” he said.

Nersa’s decisions about tariff applications do, however, have an impact on the utility’s bank balance and are the reason why the utility keeps going back to the national treasury for more money. Because, let’s face it, where else is it supposed to come from?