IRFA President Geraldine Fowler says: “Gender inequality, social injustice, the climate crisis, the struggling economy and unacceptable high unemployment are factors that have again harshly been highlighted by the Covid-19 pandemic. Meaningful and practical change must be found and strategies must be aligned to this. The retirement sector with its substantial resources can play a crucial role in socio-economic development and growth.”

2021 and beyond: The new direction for the Institute of Retirement Funds Africa

Recognising that in the face of the Covid-19 pandemic the world has changed and so must the way we think, act and behave. Organisations and individuals need to be flexible, innovative and entrepreneurial in their thinking. The incoming Management Board of IRFA has accordingly aligned its core strategy to deliver maximum value to the retirement sector, its beneficiaries on the African continent and society at large.

IRFA President Geraldine Fowler says: “No longer can the world continue on the same path, now is the time for immediate action in terms of transformation, sustainability and contribution. Organisational strategies must be aligned to, and without waiver or deviation incorporate social and economic realities and injustices and provide ways in which positive, practical and meaningful contribution can be made.”

She continues: “In drafting our 2021 Strategic Plan the IRFA Management Board has considered how the retirement sector could and should contribute to bring this meaningful and practical change.”

Fowler says the Institute plans to deliver on the following key areas as it moves forward:

• Develop strategies to build on an already strong membership

• To be recognised as the leading representative body in the retirement fund industry that provides a solid voice and advocacy for both the sector and society at large

• To develop strategies and projects aimed at giving back to the industry and the public through targeting inter alia transformation, inequality, education, the elderly, women and the impoverished

• To achieve impact through inclusion with an emphasis on strategic action in collaboration with industry stakeholders so as to ensure impactful outcomes in terms of gender, social and racial inequalities, climate change as well as socio-economic benefits

• Stakeholder engagement and the forging of new relationships in achieving core objectives.

Fowler says that under her stewardship the IRFA Management Board will forge ahead to create transformation in a visible and meaningful manner and that critical initiatives identified at the planning stage will be subject to continuous evaluation ensuring success and progress.

She concludes: “In formulating our strategy for the year and beyond we have redirected our goals, defined roles and provided the necessary resources for our various committees to move IRFA and the sector into the new reality. These are both challenging and exciting times and will call for interactive, meaningful, energetic and sometimes controversial debate; the Institute of Retirement Funds Africa is ready to move forward.”

Draft Regulation 28 amendments — supportive, but there are some concerns

National Treasury released its draft amendments to Regulation 28 of the Pension Funds Act on 26 February 2021. The purpose of the proposed amendments is to make it easier for pension funds to invest in infrastructure.

Futuregrowth supports the aim of this initiative and believes it is important to highlight the active role the pension fund industry can play in assisting economic growth through infrastructure investment.

However, we do not agree with three aspects of the draft amendments, which we outline below.

1. Work towards an all-encompassing definition of infrastructure

The draft amendments use the definition for infrastructure set out in the Infrastructure Development Act of 2014. This is very restrictive as it excludes all non-government infrastructure initiatives — and would mean that no private infrastructure initiatives would be recognised as infrastructure. We therefore believe that the proposed definition is to a degree tantamount to prescription.

Our proposal

We have been involved in funding various privately-led initiatives over the past two decades, which have ensured tangible returns for both the country and pension funds. Our proposal on the draft definition is therefore that it includes both government and private infrastructure initiatives, and is an adaptation of the ASISA definition.

Our proposed definition of “infrastructure” is:

“The basic physical structures and systems (e.g. buildings, roads, power supplies, water supplies and communication networks) for the provision of utilities or services and constructed for public use, benefit or enjoyment. This includes both public and private infrastructure.”

2. Limit of 45% on combined infrastructure investment across all asset classes

The draft amendments include an overarching limit of 45% to domestic infrastructure exposure. It is our view that this is too low and could potentially be breached at the onset.

Our proposal

We believe that the overall limit should either be increased meaningfully or deleted in its entirety, thereby allowing the individual asset class limits to dictate the level of risk that a pension fund is able to take — without the creation of another limit.

3. Unnecessary infrastructure sub-limits

The draft amendments also propose sub-limits to infrastructure exposure within the existing asset classes defined in Regulation 28.

We believe there to be no real benefit to be derived from having sub-limits per asset class, as has been suggested. This will likely create confusion and potentially result in onerous reporting requirements for pension funds.

Our proposal

It is our view that the underlying risks that National Treasury needs to manage are already well catered for in the existing and well-defined asset class limits of Regulation 28, in terms of preventing over-exposure and ensuring adequate liquidity levels. It is therefore unnecessary to stipulate further sub-limits for infrastructure investment.

The way forward

Some pension funds already make meaningful investments in infrastructure and related investments but are willing to invest further, but some have not invested at all due to lack of understanding and/or fear.

We are well aware of the infrastructure funding shortfall over the next two decades, and pension funds can play a meaningful role in that regard — particularly those that haven’t made much investment in this sector. This, however, needs to be done within the constraints of simplified and straight-forward legislation that is not obfuscated and places onerous obligations on pension funds.

We therefore believe that the straight-forward solution to creating meaningful investment in infrastructure is to allow for an all-encompassing definition, and also create some relaxation in terms of the over-arching limits to unlisted assets. We are moving towards a world where JSE listings are declining and don’t really offer any meaningful protections — and where alternative assets are deemed suitable replacements for the long-term needs of pension funds.

Futuregrowth Asset Management is a licensed discretionary

financial services provider

Ryan Kieser is Head of Compliance @ Futuregrowth Asset Management

Introducing the incoming IRFA Management Board

The Institute of Retirement Funds Africa, a leading industry body, has served the retirement industry and its members for over 35 years. According to President Geraldine Fowler inclusion, diversity and contribution to the sector and beyond will be the key factors driving strategy as the new board moves forward.

Geraldine Fowler

Geraldine FowlerPresident Geraldine Fowler is also founding Director and CEO of GQM Fund Administrators. She has over 30 years’ experience in the industry in the areas of administration, consulting and trusteeship. She has held senior positions with Private Fund Administration and Consulting Houses. She has academic qualifications in insurance, business studies, financial planning and writing.

Amanda Khoza

Amanda KhozaVice-President Amanda Khoza has over 20 years’ experience in financial services, serving in a number of senior roles. She has worked in institutional investments, management accounting, transformation and research for companies listed on the JSE’s main board. Her roles have included the strategic development and implementation of business development programmes, writing and speaking engagements and development and management of transformation programmes. She previously served as a non-executive director of the ASISA ESD Fund, ASISA Foundation and the INSETA boards. Amanda is also an independent trustee on a number of large umbrella funds.

Enos Ngutshane

Enos NgutshaneEnos Ngutshane is the former IRFA President and still serves as an Executive Committee Member of the Institute of Retirement Funds Africa (IRFA). He is an authority in Corporate Governance, Local Government, Rail Safety, Occupational Health and Safety. He has worked for different institutions such as Gauteng Government as Deputy Director-General, Wits Business School as lecturer, and South African Foundation for Public Management (SAFPUM) as a CEO. He was the Chairperson and a Trustee of the Prasa Provident Fund for 15 years. Enos is currently the Chairperson of the CCMA as well as a director of SASRIA and the Chairperson of PensionMatters (Pty) Ltd.

Nancy Andrews

Nancy AndrewsExecutive Board member and Chair of IRFA’s legal and technical committee Nancy Andrews is the Head of Legal for Discovery Employee Benefits & Invest. She is responsible for the legal , compliance and tax and she is actively involved with the regulators when it comes to aligning the law and pension and tax practices. She has served as the past President of the Pension Lawyers Association of South Africa and as a trustee and principal officer on a number of boards with her past employers.

Cheryl Ward

Cheryl WardCheryl Ward is the Chief Operating Officer at one of the larger retirement funds in South Africa. She has over 25 years’ experience in the retirement funding industry in the areas of fund administration, fund consulting and communication. Providing an efficient administration system backed by technical expertise and good governance are her areas of focus. Cheryl is also dedicated to communicating and educating members using technology and robust financial literacy programmes. Her studies include financial planning, investment, property and banking.

Mkuseli Mbomvu

Mkuseli MbomvuMkuseli Mbomvu has worked in financial services for more than two decades with Old Mutual, Sanlam Investments Management, Mineworkers Provident Fund and Sanlam Corporate.

He has served as a trustee for Sanlam Umbrella Funds, as Principal Officer for MWPF Beneficiary Fund and as an executive for Old Mutual Super Fund. He has passion for and understanding of the retirement regime, both in terms of member needs as well as appreciation of the regulatory frameworks.

In his current role, he is charged with the responsibility of governance (Risk, Legal and Compliance) which are the cornerstone in preserving the integrity of retirement funds.

Mandla Nkosi

Mandla NkosiMandla Nkosi is the Managing Director at Ingcambu Fiduciary Solutions, an Authorised Financial Services Provider, that renders fiduciary solutions, legal and advisory services to corporate, institutional, union and retail clients. He has over 20 years of experience.

Voet Du Plessis

Voet Du PlessisVoet du Plessis is a Professor Emeritus, Faculty of Law at the University of the Free State, specialising in Labour Law and Retirement Fund Law. He is an Advocate of the Supreme Court of South Africa and a long serving Board member of IRFA. He also serves on the Legal and Tax Committee of the Institute.

How to better measure the value and impact of your investments

South African pension funds have directed capital into impact funds for more than two decades. This is evidenced through Futuregrowth’s track record in managing impact investments for more than 25 years on behalf of our clients, with approximately R48-billion invested in infrastructure and developmental sectors.

These have been held across a variety of debt and equity asset classes and have delivered risk-adjusted returns, in addition to tangible social and developmental impact over the years.

In considering the complexities of impact investing, we have to remind ourselves of our role as institutional investors. When we have a mandate from pension funds to deploy funds into impact investments, we also have a fiduciary duty to the pension fund beneficiaries to create commercial risk-adjusted returns, in addition to creating impact. Therefore, we should report equally and diligently on both — yet as an industry we continue to fall short in evidencing the impact of our investments.

Show me the impact

Why is impact measurement and reporting such a challenge for investors? After all, we have the necessary frameworks, tools and metrics to support the process. Could this be a function of the fact that in some instances, the effect cannot easily be captured into a metric, and that the inherent human element inevitably brings subjectivity into the process?

There is a wide divergence of opinion on what is meant by meaningful impact and where priorities should be placed. One investor might place a bigger preference on affordable housing to address the backlog in the country, whereas another might prefer to address the infrastructure backlog, believing that this achieves impact on a broader scale. How does one rate the social value of one project over another?

In our experience, a combination of all of the above needs to be taken into consideration when measuring and reporting on the impact of any investment. Having a credible foundation, then planning, reviewing and adjusting our approach in response to new insights can assist in overcoming the above challenges.

Where do investors start if we want to make a measurable impact?

Creating an impact measurement pathway:

A good place to start is to see if we can align our broader impact goals and outcomes to SA’s National Development Plan (NDP). As an emerging economy, the government has outlined several areas that are intended to promote economic, social and environmental impact and stimulate the economy in order to eliminate poverty and reduce inequality by 2030.

The next step in creating an impact measurement pathway is to identify the areas or sectors of focus that align with our impact goals and objectives. We then need to identify investable opportunities (through debt or equity or a combination of both) to deploy capital.

Moving from impact goals to intent and measurement:

The impact goal and intent is what differentiates impact investors from so-called ordinary investors.

A clear intent outlines what we expect to achieve by investing in a specific sector or company. This means that social outputs and outcomes can then be defined up front. Specific indicators and metrics can then be used to measure the “success” of the investment, and reported to beneficiaries and stakeholders as evidence of the outcome and impact achieved.

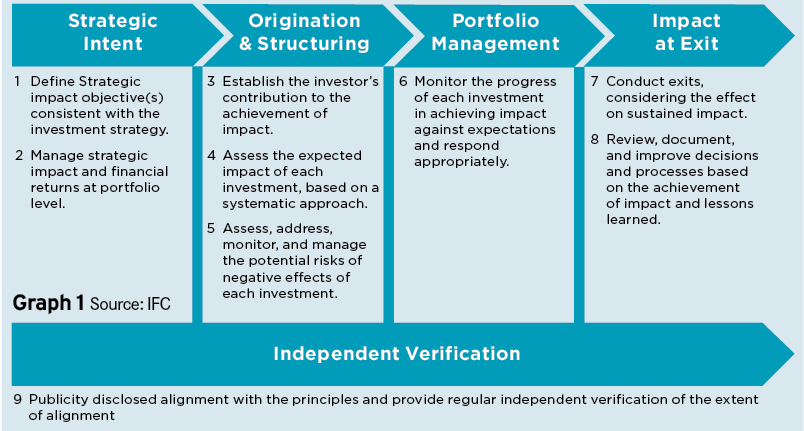

A framework for incorporating impact considerations into all stages of the investment process will ensure that there is cohesion and integration throughout the life cycle of the investment. The International Finance Corporation (IFC) Operating Principles for Impact Management outlines this process across four pillars:

Graph 1 Source: IFC

Case study

Applying the theory:

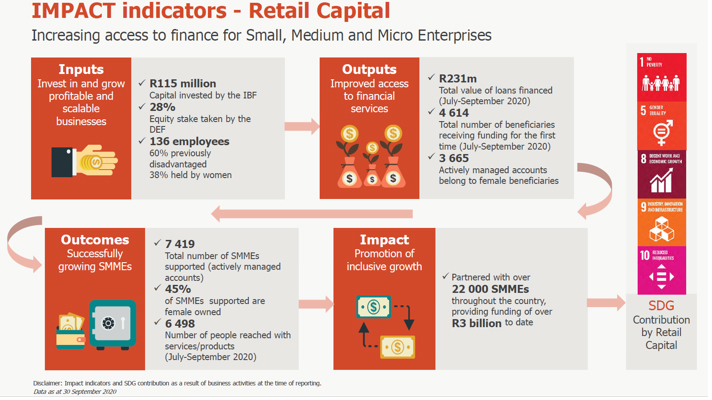

A case study may help to illustrate how the steps set out above might play out in practice. This is a study of Futuregrowth’s investment in Retail Capital, a merchant cash advance business that focuses on funding the South African SME market.

Alignment with the NDP and United Nations Sustainable Development Goals (SDGs):

Access to working capital is considered the biggest challenge faced by SMEs in South Africa. This exclusion has consequences for a country’s economic growth and transformation. Accordingly, the South African Government has prioritised the acceleration of financial inclusion in the NDP, with plans to increase financial inclusion by 90% by 2030.

The Role of Financial Inclusion published by CGAP and the UNSGSA emphasises how including small to medium-sized businesses in the financial system can play a major role in achieving many of the Sustainable Development Goals with the aim of “ending poverty, improving health and education, reducing inequality, and spurring economic growth”.

Graph 2

Impact goals and intent:

Both studies prompted Futuregrowth to consider a broad impact goal to “promote inclusive growth and financial inclusion” with the strategic intent to “seek opportunities to close the existing gaps in access to finance for SMEs in South Africa”.

Such an opportunity arose in 2017, when Futuregrowth, on behalf of its clients, took a non-controlling stake in the shareholding of Retail Capital, a merchant cash advance business that focuses on funding the South African SME market.

“Retail Capital partners with you through innovative funding solutions, where flexible repayment options are determined by your business performance. Since 2011, we have provided businesses with innovative, flexible and convenient alternatives to traditional business loans. Business owners still identify access to working capital as the single biggest challenge that they are faced with.

“With small to medium-sized businesses (SMEs) responsible for 50% of the country’s GDP and contributing to over 65% of employment, we are devoted to partnering with entrepreneurs to grow the South African economy. We are proud to have partnered with over 22,000 SMEs in providing funding of over R3bn to date,” says Retail Capital.

Graph 3:

Measuring impact:

In addition, the impact was monitored against predetermined metrics to assess whether the desired outcome and impact was achieved, as illustrated in the graph. This process was refined over time, to ensure its integrity and that it remained relevant.

Graph 4

Risk management, but not at the expense of impact:

As indicated in the backdrop to this article, risk-adjusted returns are a vital part of impact investing.

Any number of financial and non-financial risks could impact the long-term sustainability of such an investment. In addition to understanding the impact of an investment, it is prudent to understand the risks (these include financial and non-financial risks e.g. environmental, social and governance), since these could affect the long-term sustainability of the business. This element should form part of the investment life cycle and be embedded as part of the investment process.

The potential risks associated with the Retail Capital business were researched, debated and deliberated at length prior to investment and priced for accordingly, based on the materiality of the risks. In this way, a level of comfort was achieved that the fiduciary responsibility in the use of our clients’ funds was honoured.

Final word

Each investment is likely to be unique, with its own idiosyncrasies and metrics, which will vary from sector to sector. As indicated above, impact investing is an evolving process, with ongoing improvements based on the lessons learned as we go along. Clearly defining our intent, objectives and measurements up front, so that there is alignment between investors, investee organisations and beneficiaries can go a long way to making this a meaningful and sustainable process.

Futuregrowth Asset Management is a licensed discretionary financial services provider.

Angelique Kalam is Manager: Sustainable Investment Practices and Rirhandzu Sithole is an Impact Investment Analyst @ Futuregrowth Asset Management

Investing in a future that matters

As investors become increasingly focused on the impacts of environmental and social issues, we’re seeing new terms flooding the sector: Environmental, Social and Governance (ESG) integration, Socially Responsible Investing (SRI), Impact Investing, and Investor Activism.

More about Investor activism

Investor activism refers to the actions taken by investors to engage with their investee companies on both financial and non-financial matters. Traditionally, they do this through public campaigns, attending company Annual General Meetings (AGMs), being vocal and voting on key matters, and presenting shareholder resolutions to deal with important ESG issues.

In doing so, investors can encourage corporates to think beyond mere short-term profits but also to consider their long-term sustainability and overall impact on society.

Investor activism can take different forms depending on the type of investment instrument.

Shareholder activism

Equity investors buy shares in a company and, in doing so, become part owners of the company. This means that they benefit financially when the company does well, through dividends and capital appreciation in the value of the shares. But it also means that as part owners of the business, they are partially responsible for ensuring that the company is a good corporate citizen in terms of how it is governed, how it treats its staff, how it impacts the community within which it operates and what its environmental footprint is.

Shareholders are becoming increasingly aware these issues and are using their power to demand greater accountability and transparency from companies.

One form of shareholder activism is simply exercising the right to vote on important matters. But as a minority shareholder an investor may not be able to materially influence the outcome of the vote. So shareholder activism in that case could take the form of attending the AGM and being vocal about contentious matters — and asking the “hard” questions around the company’s corporate practices, particularly if investors identify practices that they believe to be unsustainable, harmful or against the principals of good corporate governance.

If these efforts prove unsuccessful, the only remaining form of shareholder activism may be to “vote with your feet” by choosing to divest in the face of pervasive issues that are not adequately addressed by the company.

Bondholder activism

Bondholder activism is a lot less commonly understood than shareholder activism. Bondholders provide debt funding to companies (or governments). They do not have an ownership stake in the investee companies, and as such cannot necessarily vote on matters relating to how the company is run. As the providers of large amounts of debt capital needed to fund the operations or growth of these entities, bondholders are nonetheless able to effect change in the borrowers’ behaviour in the following ways:

1. Firstly, they can vote with their feet, by walking away from bonds of companies or entities that have pervasive issues.

2. They can negotiate for specific protections in their loan agreements, which require the borrower to uphold certain standards of governance that demand transparency on important matters or that outright prohibit certain actions. A simple example of this would be requiring a State-owned Entity to adopt a Conflicts of Interest policy to prevent the risk of tenders going to the directors’ friends or family.

3. Bondholders, much like shareholders, can also hold their investee companies accountable through direct engagement with management or by being vocal in the public domain on matters that they believe require attention.

Investor activism can also include the way that investors engage with market regulators and other capital markets participants (such as the stock exchange) to promote safer, more transparent capital markets for investors. An example of this would be a South African investor pushing for more stringent requirements for companies wanting to list their shares or bonds on the JSE. As Futuregrowth, we have exercised bondholder activism through our constant engagement around strengthening the JSE’s debt listing requirements.

What can you do as a pension fund trustee?

People who invest directly in the stock/bond market can be investor activists on their own behalf: they can choose not to invest in a company that they know treats its employees unfairly or is a huge emitter of greenhouse gases, for example. The challenge, however, is that many people do not invest directly in the market. For most people, a large part, if not all, of their savings are invested in a pension or provident fund, which is managed on their behalf by an asset manager.

As an asset manager, we are the custodian of large amounts of capital that we invest on behalf of our clients. Given that we are entrusted with this responsibility, we have a fiduciary duty to deploy that capital not only to sustainable investments that will yield positive financial returns, but also to entities that are responsible corporate citizens. We essentially hold the key to keeping our clients’ investments accountable for maintaining high environmental, social and governance standards.

But there is a step before the involvement of the asset manager — and that involves the employee-elected pension fund trustee. The trustee is the first link in a chain that stretches from the workplace, through several levels of advisors, to an investment in a company that may go on to thrive or fail, either through its financial performance or through the effect it has on the environment or society within which it operates. In terms of the law, trustees have an immense responsibility: their fiduciary duty is equivalent to a director’s responsibility in a company.

In terms of Regulation 28 of the Pension Funds Act trustees are obliged, in their investment decision-making, to appropriately consider ESG factors which may affect the sustainable long-term performance of a fund’s assets. They are also required to have an investment policy statement which clearly sets out their approach to ESG issues.

Be a responsible investor

But, as a trustee, why not take this a step further — why not become an Investor Activist in the execution of your fiduciary duty? Equipped with what you now know about ESG integration, responsible investing and investor activism, hold the asset managers you are considering allocating funds to, or have already allocated funds to, accountable to the highest possible standards.

Pension fund trustees are urged to be aware of their capacity and potential to ensure that responsible investment in South Africa generates not only financial returns but also meaningful social and economic outcomes, while preserving environmental sustainability. Consider how you can use your fiduciary responsibility to contribute to a fairer society, a healthier environment and a more inclusive economy — for a future that matters to you and your beneficiaries.

Futuregrowth Asset Management is a licensed discretionary financial services provider.

Melissa Moore is an Investment Analyst @ Futuregrowth Asset Management

What do all of these terms mean?

| ESG integration is concerned with understanding and measuring the non-financial ESG risks that a company faces as part of the investor’s overall investment screening and analysis process. | Socially Responsible Investing refers to the practice of integrating ESG into the investment process and avoiding investing in companies deemed to have negative social or environmental exposures. | Impact Investing talks to investing with the intention of generating positive and measurable social and/or environmental impact alongside a financial return. | Investor activism, on the other hand, talks to how investors use their position as shareholders or debt funders of a company to effect positive change in corporate behaviour, or in the capital markets as a whole. |

Achieving retirement industry transformation and sustainability

Aligned with IRFA’s core strategy, Vice-President and change agent Amanda Khoza told the Mail & Guardian of the way in which the institute hopes to achieve it crucial goals. Khoza defines this transformation as increasing the representation and inclusion of all its stakeholders, thereby enhancing the value proposition of the sector.

“As the lead on the relevant committee, we are focused on becoming the thought leader in this critical area. We will develop best practice guidelines for transformation and sustainability through research and engagement, and constantly monitor developments locally and internationally in the fields of policy, legislation, regulation and administration. In partnership with all stakeholders we will work to determine the barriers to achieving sector transformation and sustainability, promote partnerships with industry regulators and industry bodies and co-ordinate member input relating to the relevant elements of the Financial Sector Code.”