What is Binance?

Binance is a cryptocurrency trading exchange founded by Changpeng Zhao, known in the crypto community as “CZ”. A cryptocurrency trading exchange is similar to that of the JSE or the NYSE, but for crypto-related products.

Over the past four years Binance has grown to superstardom. Binance offers a vast variety of cryptocurrencies and trading features to its clients, so it is a bit like the Amazon of crypto exchanges. Binance focuses mainly on traders — those looking to buy in and out of a cryptocurrency over a shorter time period than longer-term investors. The platform has features that entice trading, including high-risk leverage and complicated investment products such as futures and options.

Because of this, Binance has become a “go-to” exchange for many crypto enthusiasts and traders, with 2020 crypto exchange volume of around $2-trillion.

Believe it or not, this trading volume is continuing to grow. In 2021, the total trading volumes have bounced between $60- to $90-billion a day. This means Binance could be on track to go north of $20-trillion in trading volume this year.

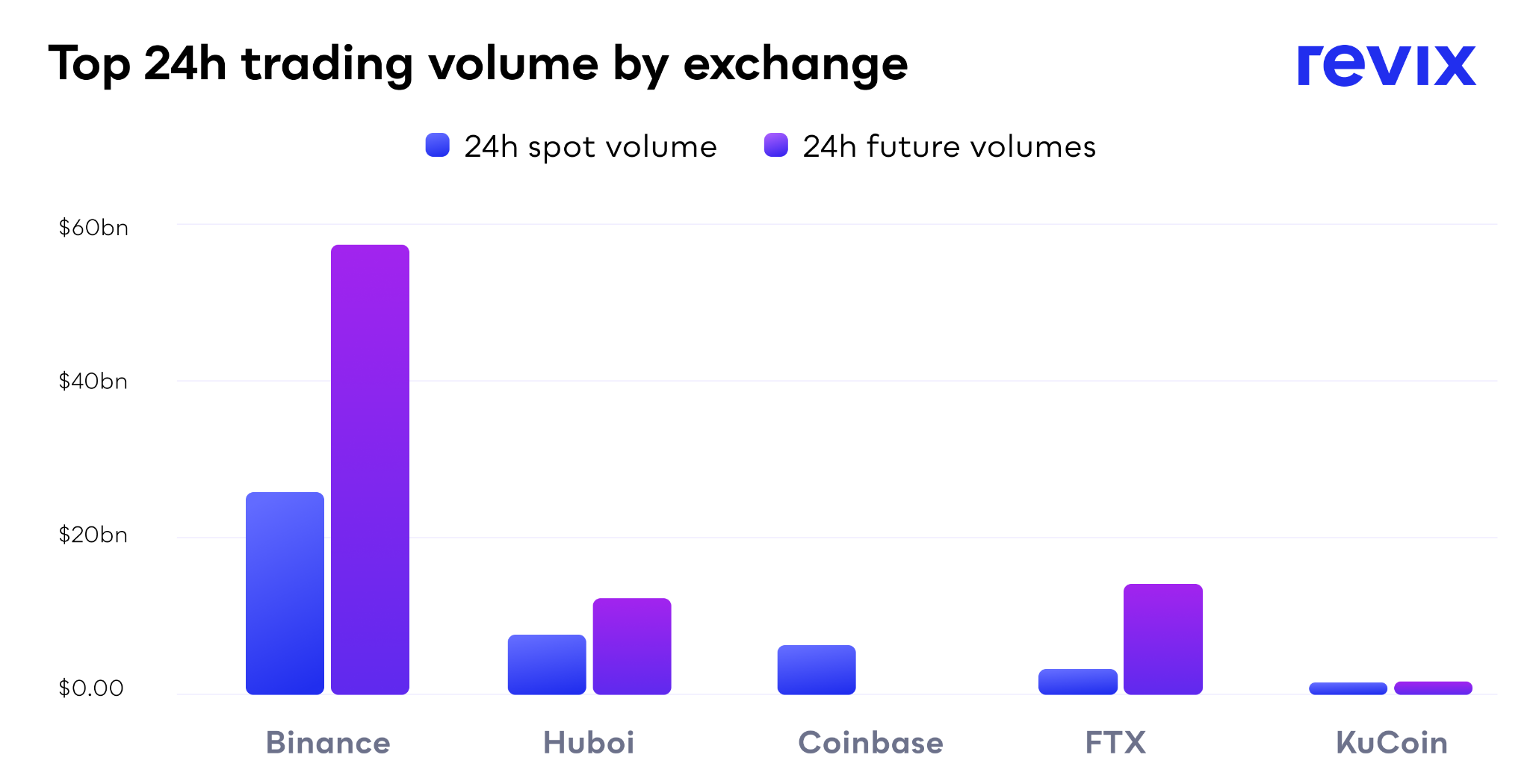

From the above graphic, you can see the extent of Binance’s dominance in trading volume compared to its competitors. To put this into perspective, the second-largest exchange is only about a fifth of Binance’s volume.

But is Binance just an exchange?

No, it’s a lot more. Besides being an exchange for trading cryptos, Binance also has its own blockchain — the Binance Smart Chain (BSC).

The BSC offers similar features to Ethereum, Solana and Cardano, and with that, it seeks to develop an ecosystem of decentralised finance (DeFi) products and services by facilitating these financial transactions using smart contracts.

DeFi is a subsector of the cryptocurrency industry challenging traditional financial institutions, including banks, insurance companies and stockbrokers, where entrepreneurs build semi-automated trading and lending systems atop blockchain networks.

Like Solana, BSC offers faster transaction times, lower fees and a programming capability that makes it easy for developers to create complex smart contracts.

But what did they give up to get this speed?

While the BSC might offer much faster transactions and lower costs, it does compromise to get it.

The reason Ethereum is “slower” is because it’s far more decentralised — in an order of the magnitude of 20x more decentralised — and a decentralised network operates across thousands of nodes (or computers) around the world, and therefore it takes time for this network to reach a consensus and add the next block of verified transactions to its blockchain.

Don’t be alarmed by the word ‘consensus”. It’s just a fancy way of saying that the network “agrees”.

The reason the Binance network can operate at a much faster transaction speed is due to the fact that it only uses 21 validators. Therefore, much like Solana, it would appear that the BSC is giving up some decentralisation to bring about faster transactions.

What is Binance coin’s (BNB) purpose?

Binance Coin (BNB) is the native cryptocurrency of the Binance network. The Binance Coin was originally created as an ERC-20 token on the Ethereum network but has since moved away from this and developed its own blockchain network, the Binance Smart Chain (BSC).

BNB has multiple uses, and this is where this network’s potential gets exciting. BNB is:

- A utility token for the Binance exchange,

- “Gas” for the BSC,

- It is used to pay for travel expenses (such as hotels and flight bookings).

A utility token is a token that cannot be considered as money but rather gives users access to products and services on that specific platform.

For example, Binance enables users to participate in multiple features such as trading, earning interest, lending, borrowing and much more. For all these features, Binance will charge a fee.

When trading, users would pay a lower fee if they paid in BNB, that is, they would receive utility for owning the token — hence the name “utility token”. Furthermore, the more BNB you hold, the more of a discount you can get on these trading fees.

“Gas” refers to the fee it costs a network to execute an operation successfully. In the same way, a car needs gas to get from point A to point B, a blockchain network requires a certain amount of gas to get a transaction or operation from one point to another.

Under the use of the BSC — much like using Ethereum to pay fees when interacting with Ethereum protocols — users will need to use BNB to interact with the BSC and all the applications built on top of it.

Why should I invest in Binance coin?

- Revenues

Binance charges a fee for every transaction that takes place on their network. With a daily trading volume of $60-$90 billion per day, this creates substantial revenues for the company. These revenues are directly driven by highly leveraged traders who hold large amounts of BNB to reduce their trading fees. The more trading volumes grow on Binance, the more BNB is demanded by traders.

Remember, when you buy BNB — the cryptocurrency — you’re not directly buying any shares of Binance — the exchange. You’re only buying the cryptocurrency which derives part of its value from Binance’s success.

- Low fees and scalability

Binance’s Smart Chain is solving the high fee issues many blockchains (such as Ethereum) are experiencing today. Binance’s fees are close to negligible at $0.01 per transaction. Binance also handles around 100 transactions per second, while Bitcoin and Ethereum process five and 15 transactions per second, respectively.

- Smart contract growth

Based on the total value locked (TVL) into smart contract platforms, Binance Smart Chain is the second-largest behind Ethereum, with 13% of all smart contract value locked.

The total value locked (TVL) is calculated as the value of assets currently being held in smart contract platforms. TVL, therefore, shows exactly which smart contract platforms are attracting the most money and hence the most adoption.

- Centralised exchange exposure

Binance is the world’s largest centralised exchange cryptocurrency, with a daily trading volume five times greater than its closest competitor.

Where do I buy Binance Coin?

Cape Town based crypto investment platform Revix (www.revix.com), which is backed by JSE listed Sabvest, will be one of the first platforms in South Africa to offer Binance Coin as a standalone cryptocurrency investment option.

Revix will be offering BNB Binance Coin from 24 September, with an enticing fee-free promotion.

Revix promotions

- Revix is offering zero buying fees on Binance Coin purchases when using ZAR for one week (from 24-30 September 2021).

- Revix will also be offering a refer a friend promotion: if you refer one or multiple friends using your referral code, you’ll receive double the Revix rewards, to the value of R600 per referral, while the person you invite gets R200 straight into their Revix account. (This promotion is valid from 17th-30 September 2021).

Revix also offers multiple standalone cryptocurrencies, such as Bitcoin, Ethereum, Solana, Uniswap, Polkadot and many others.

Through Revix, you can also gain access to their ready-made “Crypto Bundles”. Their Bundles enable you to effortlessly own an equally-weighted basket of the world’s largest and, by default, most successful cryptocurrencies without having to build and manage a crypto portfolio yourself. They’re like the JSE Top 40 or S&P 500 but for crypto.

About Revix

Revix brings simplicity, trust and great customer service when investing in cryptocurrencies. Its easy-to-use online platform enables anyone to securely own the world’s top cryptocurrencies in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

Remember, cryptocurrencies are high-risk investments. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

This article is intended for informational purposes only. The views expressed are opinions, not facts, and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any cryptocurrency.

To learn more, visit www.revix.com