Altcoins have shown extraordinary growth over the past year as more people start to adopt and understand the technology behind them. You’ve most likely heard of smart contracts and decentralised applications (DApps) being spoken about around the dinner table. Names such as Ethereum, Solana, Polkadot and maybe even some lesser-known ones like Terra and Binance Coin are becoming more recognisable. But what do they really do, what sets them apart from Bitcoin and, more importantly, from each other?

What are smart contracts?

A smart contract refers to a computer programme that lives on the blockchain. These programmes automatically run or execute specific actions when predetermined conditions are met. Think of it like putting money into a vending machine to buy something. It works like this: the seller sets out the conditions under which the item is released and the buyer pays what is required, after which the item will be released to them. This means there is no need for a third party to see if the conditions have been met or see the transaction through.

With the help of smart contracts, the blockchain network becomes a programmable platform that can host other applications — much like how apps work on your phone’s operating system. Smart contracts have become a game-changer in the cryptocurrency market and have created one of the biggest sectors in crypto, Decentralised Finance (DeFi).

Ethereum

The second most popular cryptocurrency after Bitcoin. Like all fiat currencies, Bitcoin’s primary use-case was to be a decentralised peer-to-peer digital cash and store of value. Ethereum was founded with the intention to be much more than simply a medium of exchange or a store of value. Below are some of the major advantages of Ethereum:

- Smart contract capability: Ethereum is the biggest smart contract platform around today, with over $118-billion of value locked in its smart contracts. Ethereum’s goal is to use its smart contract functionality to empower thousands of applications to decentralise the financial system.

- Possibly becoming “ultrasound money”: Unlike regular fiat currencies, Etherum is working on making its monetary supply (token supply) deflationary, giving it a greater value proposition than of fiat. This deflationary asset is used as the payment when transacting with Ethereum-based applications.

- Decentralisation: Ethereum is one of the most decentralised cryptocurrencies in the world. Decentralisation is one of, if not the most, important characteristic that a blockchain can possess. Not having a central point of failure is paramount and being able to withstand any kind of attack relies on decentralisation.

- Robust Developer Community: Ethereum has the largest developer community in the world, even larger than Bitcoin’s. Solidity is the programming language of Ethereum and developers love to programme with it because of its ease of use. Ethereum not only has the highest number of active developers working on the network, it also has the highest number of nodes (linked computers securing the network).

Even though Ethereum is the world’s most popular smart contract platform, many have pointed out flaws in its armour. Several of these flaws include poor transaction speeds as a result of congestion, high fees, as well as significant power usage. While the Ethereum 2 upgrade is set to tackle these issues, many Ethereum competitors have arrived on the scene to solve these issues and steal Ethereum’s market dominance.

Who are Ethereum’s competitors?

Blockchains are constantly evolving and improving as each new blockchain tries to solve the problems of the other. This has started a race to see which blockchain can emerge victorious as the “Ethereum Killer”. Blockchains that are trying to do just that are Solana, Binance, Cardano, Terra and Polkadot, amongst others. Let’s have a look at some of these competitors and what they have to offer.

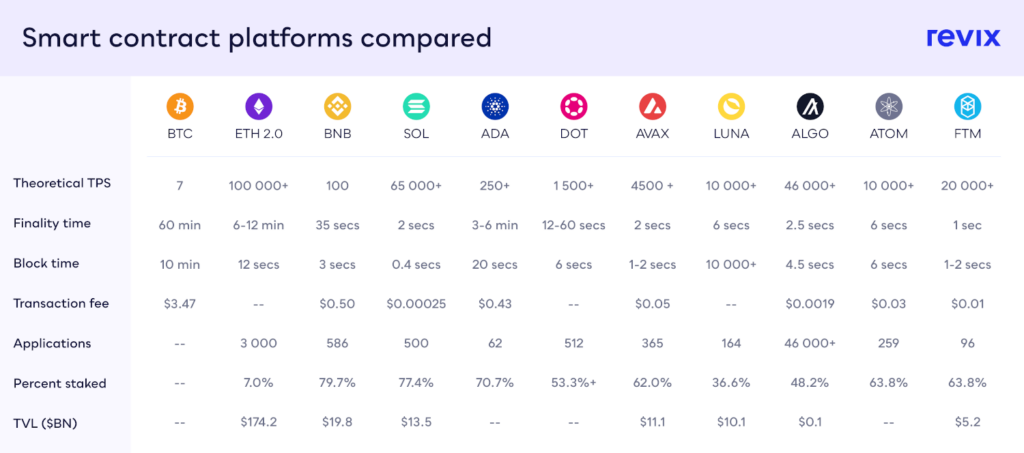

Note: TPS = Transactions per second.

TVL = Total Value Locked

Solana (SOL)

Solana is a blockchain network that seeks to develop an ecosystem of cryptocurrency-powered products and services.

Solana differentiates itself from Ethereum’s network by providing far faster transaction times, lower fees and a programming capability that focuses on flexibility.

Binance Coin (BNB)

Binance coin (BNB) is the native cryptocurrency of the Binance network. The Binance coin was originally created as an ERC-20 token on the Ethereum network but has since moved away from this and developed its own network, The Binance Smart Chain (BSC).

Like Solana, BSC offers faster transaction times, lower fees and a programming capability that makes it easy for developers to create complex smart contracts.

What’s the catch?

While the BSC and the Solana network might offer much faster transactions and lower costs, they have to compromise to get it. The reason Ethereum is “slower” is because a decentralised network operates across thousands of nodes or computers. It therefore takes time for this network to reach a consensus. This is just a fancy way of saying “agreement”.

The reason the Binance network can operate at a much faster transaction speed is because it only uses 21 validators. Therefore, much like Solana, it would appear that Binance is giving up some decentralisation to bring about faster transactions.

Is decentralisation valued over transaction speeds or costs in the future?

Or do these semi-centralisation blockchains take over?

It’s important to ask these questions before investing in smart contract platforms.

Cardano (ADA)

Cardano is a proof-of-stake blockchain with its native cryptocurrency, ADA. It was founded by Ethereum co-founder Charles Hoskinson and aims to directly compete with the current decentralised crypto platform, Ethereum.

Cardano has long been hailed as the potential “Ethereum-killer” as it seeks to offer many of Ethereum’s most compelling capabilities, such as robust smart contracts. Cardano’s benefits include:

- Scalability: If Cardano’s upgrade goes to plan it could get up to one million transactions per second.

- Limited in supply: Cardano has a strict cap of 45-billion coins

- Reducing blockchain energy consumption

Polkadot (DOT)

To understand what Polkadot is and why it’s so promising, we need to start by outlining one of the largest problems in the blockchain and crypto space right now: blockchain interoperability.

Basically it’s how blockchain networks communicate with one another.

Blockchains can’t really communicate with one another, which really limits crypto’s whole “rebuild the financial world from the ground up” narrative.

If you choose to develop on Cardano, you won’t be able to interact with the Ethereum blockchain, and thus, you lose the large ecosystem Ethereum has to offer.

Polkadot is a protocol that solves this problem by allowing unrelated blockchains to securely talk to each other so that the value and data can flow between them without any intermediary. Polkadot’s uniqueness lies in its parallel processing chains or parachains, which connect different blockchains into a single unified network. Parachains have uplifted Polkadot in the following ways:

- High scalability: Polkadot allows for over 1 500 TPS.

- Interoperability: parachains enable blockchain to blockchain communication

- Flexibility: The parachain model can better evolve and adapt to a changing environment and in doing so continue to remain relevant as new technologies become available.

Terra (LUNA)

Terra is a smart contract proof of stake blockchain which aims to revolutionise the stablecoin space. It allows participants to use their native token, LUNA, to create and redeem stablecoins pegged to the value of any Fiat currency. How Terra adds value:

- Stablecoin issuance: This is the asset that controls all of the Fiat currency issued on Terra. Stablecoins have opened a multi-trillion-dollar opportunity in the payments and finance space as more money is coming into crypto for payment efficiency and high-interest rates.

- Network growth: Luna was the best performing digital asset for the year of 2021 and UST (TerraUSD) grew to over $10-billion. The Total Value Locked (TVL) on the Terra network increased over 341 000% in 2021. It hit $18.45-billion and is now the second biggest by TVL behind Ethereum.

How do I pick a winner?

We broke down the big players and compared them to each other. But there are so many smart contracts out there that it’s difficult to pick one that will win.

But why go through all the work of an analyst when you don’t have to?

Luckily, it’s possible to invest in a diverse selection of top-performing cryptocurrencies without having to predict which one might be the best. So rather than trying to pick that once off winner, you can simply invest in the sector, not the individual asset.

In the case of smart contracts, Revix, a Cape Town-based investment firm, have made that simple for you. Revix offers its customers access to three ready-made Crypto Bundles that hold the most reputable cryptocurrencies in each sector. These Bundles automatically rebalance every month to make sure your Bundle is up to date with the fast-changing world of cryptocurrencies. They’re a way to diversify your portfolio and enjoy passive investing without having to worry about actively seeking out the next individual winner.

As we can see, the Revix Bundles have outperformed their sector counterparts while also producing a less volatile investment vehicle.

- The Smart Contract Bundle has outperformed the top smart contract player Ethereum by +58%.

- The Top 10 Bundle has outperformed the biggest cryptocurrency, Bitcoin, by +57%.

- The Payment Bundle has outperformed one of the largest payment tokens, Litecoin, by over +22%.

This proves the true power of diversified bundles.

What are these Bundles made up of?

The Top 10 Bundle is like the JSE Top40 or S&P 500 for crypto. It provides equally weighted exposure to the top 10 cryptocurrencies that make up more than 75% of the crypto market. This bundle has significantly outperformed Bitcoin over the last 12 months.

The Smart Contract Bundle provides equally weighted exposure to the top five smart contract-focused cryptocurrencies such as Ethereum, Solana and Polkadot. These cryptocurrencies allow developers to build applications on top of their blockchains, similar to how Apple builds apps on top of its iOS operating system.

The Payment Bundle provides equally weighted exposure to the top five payment-focused cryptocurrencies looking to make payments cheaper, faster and more global. These cryptos include the likes of Bitcoin, Ripple, Stellar and Litecoin.

January headstart promotion

We’re making investing even more rewarding!

Get R500 added to your account when you invest R5 000 or more in any Revix product and hold it for a month.

Just sign-up using the promo code “REVIX500”, verify your account, deposit and invest

R5 000 or more in one of our investable products holding it for a month, and we will reward you with R500.

Terms and conditions apply. This promotion is valid from 21 January 2022 to 31 January 2022.

About Revix

Revix brings simplicity, trust and great customer service to investing. Their easy to use online platform enables anyone to securely own the world’s top investments in just a few clicks.

Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

For more information, please visit www.revix.com

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose.