Different stories: DA councillor Simon Lapping alleges that FNB head Jacques Celliers tried to bribe him to keep his mouth shut

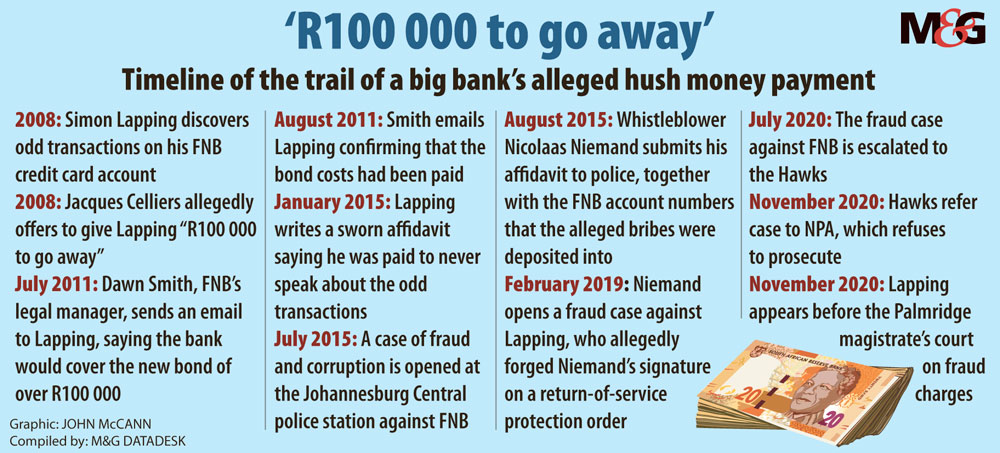

The chief executive of First National Bank (FNB), Jacques Celliers, has been accused of paying a client R155 000 to stop making claims that the bank was involved in an alleged scam.

These accusations are contained in sworn statements made by a Democratic Alliance Ekurhuleni councillor, Simon Lapping, and his one-time friend, Nicolaas Niemand.

The two men met when Niemand, according to his affidavit, wanted to expose alleged FNB corruption and came across Lapping, who said he would assist. The payments are also detailed in an email from FNB to Lapping. One email allegedly threatens Lapping that if he continues speaking about the alleged scam the bank would “revoke” the payment made to cover his bond.

The matter dates back 10 years, when Celliers was the head of the credit-card division.

The bank, on behalf of Celliers, called the allegations “baseless, misleading and false”. Lapping alleges that when he approached the bank in 2008 about odd transactions on his credit card. “Mr [Celliers’s] response was, ‘I will give you R100 000 to go away’.”

In Niemand’s affidavit, he said Lapping had given him a supporting statement, alleging “that he received a bribe from [chief executive] Jacques Celliers from FNB”.

Now the Hawks want answers as to why the National Prosecuting Authority (NPA) will not prosecute the case opened by Niemand against the bank in 2015.

By handing over the case to the NPA, the Hawks would have indicated that they think there is enough evidence for prosecution to follow.

The allegations against Celliers and the bank are contained in affidavits and emails that form part of another case in which Lapping has been accused of fraudulently signing details on a protection order that he filed against Niemand.

Lapping and Niemand met in 2015, before the former became a DA councillor in the 2016 local elections.

According to both the men’s signed affidavits they had, at different times, approached FNB about fraud claims stemming from a procedure allegedly used by the bank known as the non-authenticated early debit order system, through which FNB would allegedly take money from its clients’ accounts without informing them about it.

The bank says this is normal practice, recognised by the South African Reserve Bank. “A non-authenticated early debit is the accepted industry practice, which allows qualifying service providers to process an early debit order instruction, in line with a credit agreement.”

However, Lapping says that in 2010 he had a meeting with Celliers and Dawn Smith, FNB’s former legal manager, during which he explained what was going on in his account and that is when the bank officials wanted to pay his bond and make him “go away”.

This was after FNB had allegedly “harassed” Lapping in 2008 on money he owed.

Lapping states that in about September 2011, his marital property was transferred into his name with a new bond of R155 000. “My outstanding balance was R125 000. A month later … I paid R2 800 into this bond, the only payment I ever made,” Lapping alleged. “A few days later, a mysterious amount of R155 000 was paid into my bond, therefore leaving me with a credit of about R30 000. It was confirmed that FNB Credit Card paid this money.”

He goes on to say that the R30 000 was paid directly to him shortly after.

However, this week FNB denied that Lapping’s 2015 affidavit alleged any fraud or corruption on the bank’s part, and said it was not involved in any legal proceedings, including Lapping’s current court matter.

The M&G sent detailed questions to Celliers, and FNB said it would respond on behalf of its chief executive. “As a normal course of business, FNB encourages customers to engage with the bank when they are in distress … In 2008, the client concerned [Lapping] escalated a request for assistance after experiencing financial distress,” FNB said.

“The resolution process in such cases may involve the relevant business head, head of credit and our legal and/or compliance officials, and this procedure was followed in this case. Consequently, any allegations of impropriety are baseless, misleading and false. The bank and/or any of its officials have never been part of any litigation concerning the matter and law enforcement authorities have found no merit to the allegations.

“The affidavit filed in 2015 makes no reference to allegations of fraud and/or corruption against any of the bank’s officials.”

But emails dating back to when Lapping alleges he was paid off paint a different picture. One email from Smith to the DA councillor, dated July 2011, warned him not to speak about the alleged non-authenticated early debit orders scam, otherwise the bank would revoke the bond payments it made.

“We [FNB] will cover the costs of your bond registration, constituting R7 000. However, should you lodge a complaint [about non-authenticated debit orders] on any forum or medium … then these costs plus the capital haircut (capital haircut is over R100 000) will be added to your bond account and you will be liable for the full amounts,” read Smith’s email, which the M&G has seen.

DA councillor Simon Lapping

DA councillor Simon LappingSmith, FNB’s former manager, echoed the bank’s response, saying that a bribe was never paid to Lapping.

“I’m not aware of [Lapping’s] statement. Regarding the emails, I do know that there is no corruption or bribe. This was a commercial arrangement [between FNB and Lapping] and companies do this regularly,” Smith said.

“FNB was a fantastic employer; I worked closely with Jacques Celliers and he is probably one of the most ethical business leaders in the country at the moment,” she added.

Meanwhile, the NPA has failed to provide the M&G or the Hawks with a reason why it will not prosecute the alleged bribery. The M&G has seen an internal note from the Hawks’ headquarters in Tshwane suggesting that a nolle prosequi certificate should be sought from the NPA.

A nolle prosequi certificate is part of the NPA Act and allows for private prosecution should the authority decline to prosecute a matter.

The Hawks’ note, written in Afrikaans, said that a “court application should be made for a nolle prosequi certificate so that they [the NPA] can explain why they don’t want to forge ahead with the case”.

The M&G has established that the Hawks received the docket in July and were probing the matter. Last week, Hawks spokesperson Colonel Katlego Mogale confirmed that the unit had been investigating the matter since July this year, but could not continue with the probe because the NPA declined to prosecute.

Repeated attempts to obtain comment from the NPA since last week have failed, despite assurances that the body would respond.

(John McCann/M&G)

(John McCann/M&G)

Meanwhile, the Lapping case of protection-order forgery will continue to be heard at the Palmridge magistrate’s court this month.

Last Monday, Lapping, who spoke outside his court appearance, called the M&G a “crap publication” for allegedly targeting DA councillors. “I have no [further] comment; the matter is sub judice,” he said.

Meanwhile, speaking on the DA’s behalf, Gauteng leader Fred Nel said the party was aware of Lapping’s criminal matters. “The matter does not relate to his party work or his council work, so no immediate action is envisaged against Mr Lapping until the conclusion of the case.”

[/membership]