Freedom to express fundamental rights versus administrative action by the South African Revenue Service exposes a fundamental link to communal interests and justice in a constitutional democracy. (Oupa Nkosi)

The taxman has collected more than R4 billion in tax revenue from a surge in “two-pot” retirement withdrawal claims, with billions of rands being accessed by people seeking immediate financial relief from debt.

There are about 20 million debt-active people in South Africa, according to a credit stress report by Eighty20, a customer strategy consultancy.

Of these, middle-class workers are paying about 80% of their net take-home pay on servicing debt.

Since the launch of the two-pot system, companies say applications have skyrocketed, with major retirement fund administrators processing hundreds of thousands of claims.

Tax specialist Joon Chong, of Webber Wentzel law firm, noted that the two-pot retirement system is meant to provide relief to members in the short term.

“It’s to heed the calls of the trade unions that people need some financial relief without needing to resign to get access to their retirement savings,” Chong said.

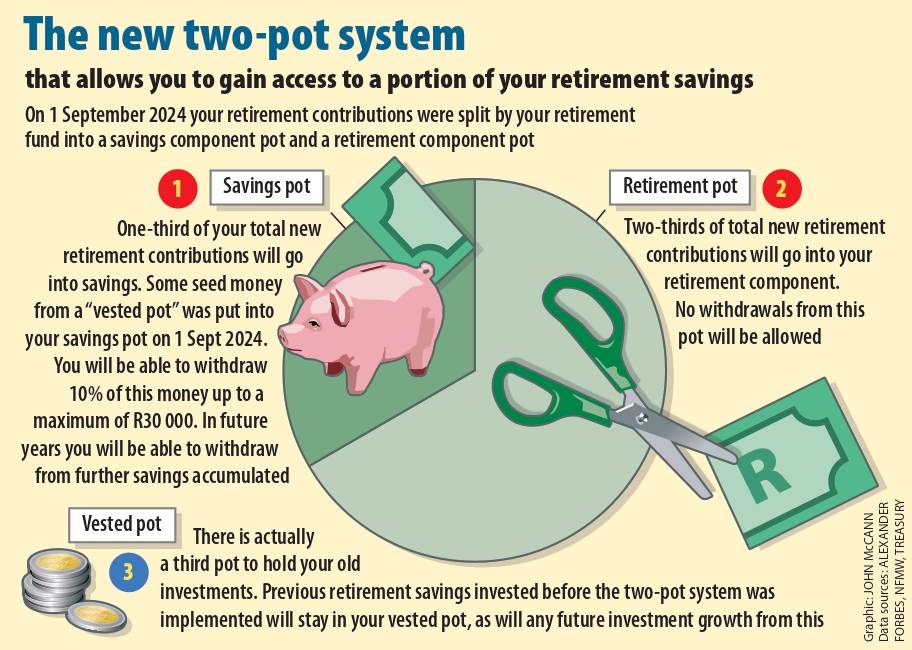

It is called a two-pot system because all the future contributions to the retirement fund will be split into two pots: a savings pot and a retirement pot. This system commenced on 1 September after President Cyril Ramaphosa signed into law the Revenue Bills Amendment Act on 1 June. The Act established a system that gives members of retirement funds access to savings in case of emergency while ensuring that they preserve the majority of the money for retirement.

Ramaphosa said the amendment was to address the concerns related to the lack of preservation before retirement and to assist households in financial distress.

A concern was that although this may alleviate temporary financial distress it could leave people poorer during their retirement. But Chong said members tapping into their retirement savings will not be vulnerable when retirement comes because the retirement pot remains inaccessible.

The new system allows South Africans a once-off withdrawal each financial year of 10% of their previous retirement savings — up to R30 000 — which will be taxed at their marginal rate.

“The Actuarial Society of South Africa has conducted studies and it has found that even if members withdraw from their savings pot every year, by virtue of the fact that the retirement pot is frozen, individuals will have money in the long term during retirement,” she said.

Two-pot retirement claims have gone up to billions cumulatively, with Old Mutual disclosing that it has seen 170 000 applications worth R2.2 billion in two-pot savings withdrawals since it began processing them on 18 September.

This is more than twice the early fund withdrawals the financial services group usually processes in a year, it said.

Azola Daweti, a 37-year-old school administration clerk in the Eastern Cape who qualified to get R25 000 from her two-pot claim but is still waiting for it, said she would use the money to pay off debts so that she can have some space to breathe.

“The rest I will use to buy Christmas clothes for my children in December,” she said.

Daweti said she applied for the withdrawal on 20 September, even though applications opened weeks prior, because the app was giving trouble. “So I had to wait for the traffic to reduce before I could do my application.”

The pensions of civil servants are held by the Government Employees’ Pension Fund (GEPF) and it is this fund’s app that Daweti had difficulty accessing.

(Graphic: John McCann/M&G)

(Graphic: John McCann/M&G)

The GEPF said it was sorting through a backlog of queries related to the two-pot system, and expected that the 252 592 withdrawal applicants would have to wait up to two months for their claims to be processed.

Daweti said she has not yet received a reply to her application, but that the calculation showed that she would receive R25 000 after the 16% tax from the capped R30 000 that is accessible to retirement fund and pension holders.

She explained that she wanted to ease her R12 000 debt burden, which was weighing heavily on her credit score. Paying off her debt would improve her credit score, allowing her some financial freedom.

“I need to pay R8 000 towards my credit card and pay off R4 000 for a short-term loan I took in 2018 and had been struggling to pay off,” Daweti said.

The single mother of four said she has been trying to secure finance for a car, particularly to make school drop-offs and pick-ups easier. But her credit score was a constant issue.

“This is my money that I have been saving since 2017 when I started working for the government. Do you know how good it feels to get money that you saved and the loan shark can’t take? I feel entitled to this money. It’s mine,” she said.

South Africa’s largest retirement fund administrator, Alexander Forbes, said it had paid out more than R1 billion to clients and processed about 78 000 withdrawal claims in the first week of the two-pot system.

“This is equivalent to the number of claims we were processing over a six-month period before the new legislation,” it said in a statement.

Momentum Group said it had received 112 449 two-pot withdrawal applications to a cumulative value of R1.7 billion.

One of the key trends it observed since the two-pot launch is the age distribution of applicants. Initially, most requests came from people aged 40 to 49, which made up almost 40% of applications.

But, as the days passed, applications from the 30 to 39 age group increased relative to the others, closely reflecting the demographics of national contributors to retirement funds, the group noted.

Momentum said that while the two-pot system has provided some clients with much-needed financial relief in tough financial conditions, it has also prompted deeper conversations about retirement savings and financial security.

“As the two-pot system continues to gain traction, we encourage South Africans to engage with a trusted financial adviser, and to consider alternative routes than drawing on their retirement savings,” said Dumo Mbethe, the chief executive of Momentum Corporate.

“They need to consider the significant tax implications and negative impact on future retirement planning.”

Previously it was unattractive to withdraw the retirement funds before maturity because of high tax implications.

The South African Revenue Service (Sars) said the quantum of applications to tap into retirement savings totalled R4.1 billion by 11 September.

The revenue service has not yet confirmed what the total tax offtake has been to date.

Sars commissioner Edward Kieswetter said contributions made to a pension or retirement fund were not taxed at the time of payment to the fund, but deferred until the person retires and are then taxed at a reduced rate.