The US consumer confidence index rose in January by 2,3 points to 55,9 — its highest level in nearly a year and a half — but in February this has promptly fallen back by 10,5 points to 46. This is the biggest decline since last February and the general consensus was for a gain.

Source :Wells Fargo Securities

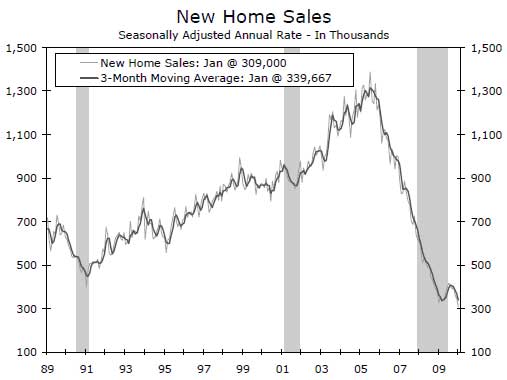

On Thursday, house sale stats from the US reflected a plunge in new single-family homes sales of 11,2% month-on-month to a record low annualised 309 000. This follows an upward revised 3,9% decline in December and so this fresh data correlates with the lower consumer confidence.

Source: Wells Fargo Securities

US real GDP for Q4 of 2009 came in at a quarter-on-quarter annualised 5,7%.

GDP in the eurozone came in at 0,4% in quarter Q3 and 0,1% in Q4.

GDP numbers in the UK came in at 0,1% for Q4. The consensus indicates that this will be revised slightly upwards to 0,2% on February 26.

Japan’s GDP, like the US, rebounded at a strong 4,6% annualised for Q4.

A report from Standard Bank noted this on the UK and Eurozone GDP: ‘ … we see a considerable risk of negative growth in Q1 after the ‘recovery’ we saw late last year. The market is perhaps not fully priced for this outcome and hence the weak pound and the weak euro can get weaker”.

The recent turmoil in Greece has given investors a foretaste of potentially bigger problems around the world, with the developed markets operating on large fiscal deficits and ballooning government debt.

Technical offshore markets

There is a lot of flip-flopping in global markets at present as the conflicting data is processed.

Investors are trying to determine the sustainability of a global recovery and more importantly, how much is already priced into the market. At this stage it is not that apparent that after the strong uptick in global prices that there will be a strong continuation in the shorter term.

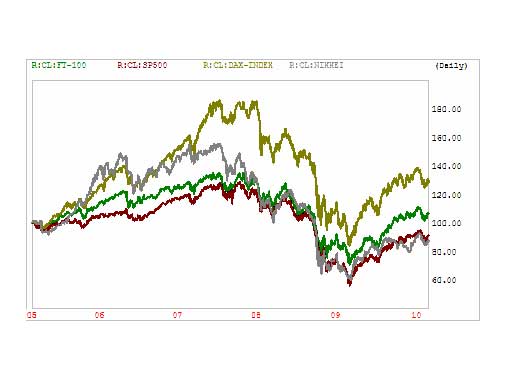

Source: Sharenet and Market Tracker

Global markets have had a very strong 11 months, but are now showing some signs of being unable to continue with their gains.

The JP Morgan technical analysis is looking for the MSCI World index to move from its current level of 1 129 to break through the 1 200 level, confirming the upward move — however at the moment, they view this as unlikely.

The chart below reflects the four major global indices, the UK’s FTSE100 index, the US’s S&P500, Germany’s DAX and Japan’s Nikkei index, over a five year period from a common starting point.

While equity markets have gone sideways for five years and longer; depending on which market, relative to cash and bonds they are more attractive taking a five to 10-year view.

According to some value manager reports, there is also a growing dispersion in valuations between the more expensive cyclical shares on the one hand and the global consumer staples and high quality companies on the other, that still have good value relative to 10-year bond yields.

Global economic report by Seed Investments