Strong performance from the markets over the last few days has re-couped this year’s losses and technology shares have outperformed.

The JSE all-share index gained 0,37% for February, after declining 3,5% in January. However in the first three days of March, the JSE has made further gains and is now trading flat for the year.

For the month of February:

- Industrial: 25 gained 1,17%

- Financial: 15 gained 0,61%

- Resources: 20 down 0,98%

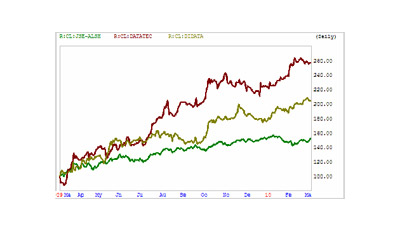

From the low point exactly 12 months back the JSE is now up 48,3%, with a high variation between the three main sectors as follows:

- Industrial: 25 up 51,2%

- Financial: 15 up 61,7%

- Resources: 20 up 41,4%

Performance from sectors is converging

While there has been some disparity in these main JSE sectors over the last 12 months, looking back over a shorter six month period, the performance has converged — up about 10% as resources pulled back from mid January.

Sharenet and market tracker

Technology shares shine

A sector that has outperformed both locally and globally over the one and three months is technology. Locally this sector gained almost 10% in February and 16% over the last three months.

Two of the larger companies in this sector are Didata and Datatec with market caps of R17,4-billion and R5,6-billion respectively.

The chart depicts the outperformance over the last six months.

At these levels, overall valuations for the JSE are not cheap, but like global markets, investors are anticipating some rebound in earnings. The overall price to earnings ratio for the JSE, at 18 times, gives some indication of the expectations built into prices.

Seed Investments