Garnishee abuse is order of the day (Photo Archive)

?

?

South Africa, compared with other nations, is faring badly when it comes to garnishee orders — it is the only country surveyed that does not have a limitation on the amount that can be deducted from salaries or restrictions on multiple deductions.

A study by the University of Pretoria Law Clinic investigated the practices in a number of countries, including some in Africa, the United States, England, Wales and Germany.

It found that, unlike South Africa, all the other countries surveyed "had some form of limitation on the amount that can be deducted in terms of emolument attachment orders" and that "multiple deductions are either prohibited or strictly regulated".

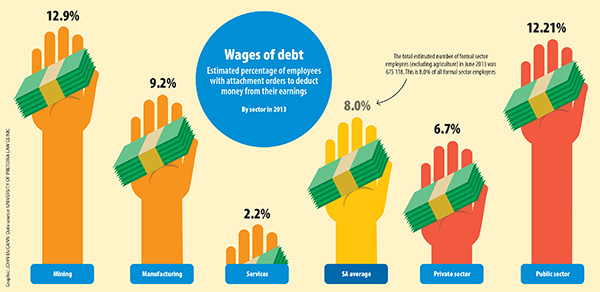

Based on June 2013 data, about 8% of 8 436 820 employees in the formal sector had a deduction made for either debt, maintenance or an administration order.

Garnishee orders, technically known as emolument attachment orders, are issued by magistrate's courts and compel employers to deduct money owed from workers' salaries.

The recently completed report comes at the time the government is presenting its medium-term budget. One of its priorities is to reduce debt and encourage savings.

Shortcomings still not addressed

But many of the lending shortcomings highlighted by the law clinic in its original 2008 study have not been addressed. To quote the report: "It's clear that these recommendations were never acted upon by authorities."

That report found that "irregularities in obtaining, serving and applying of emoluments orders and thus exploitation of debtors abounds".

The impact of the lack of regulation and control, as well as the high levels of indebtedness among consumers, in South Africa made headlines in August 2012 after the shooting of the Marikana mineworkers, which followed a wage dispute between mining companies and their workers.

It was found that many mineworkers were taking home almost no salary because of emolument attachment orders.

The situation does not appear to have changed. The law clinic study shows that the highest number of employees with garnishee orders on their salaries relative to the number of workers employed in a sector is in mining — 12.9%.

The total number of employees in the mining sector is 511 106, according to Statistics South Africa.

Mining sector leads with garnishee orders

The report said: "This corresponds with the media reports highlighting the mining sector as one of the sectors experiencing trouble with over-indebtedness and possible exploitation."

Although the mining sector has the highest number of staff with garnishee orders, in the services sector, which includes real estate and financial intermediation, employees have more garnishee orders per individual.

The average number of orders per garnisheed employee was 1.76, compared with 1.43 in the mining sector.

In the manufacturing sector, which employs 1 142 979 staff, it is estimated that 9.2% of employees have garnishee attachments on their salaries.

Public sector employees have also been hit hard by garnishee orders — 12.2% have orders against their salaries, as opposed to the private sector with 6.74%.

Public sector employees are also more likely to have more than one garnishee order against them than those in the private sector.

National and provincial departments employees

The average number of orders was 1.6 for national department employees and 1.57 for employees in provincial departments.

But the research suggests that there may not be as many public sector employees with garnishee orders against them as originally believed.

The current estimate is that 240 034 government employees have garnishee orders. The value of the orders is not revealed in the report.

A review of public sector indebtedness conducted six years ago revealed that garnishee orders to the value of R1.01-billion had been issued to government staff in the 2006-2007 financial year.

A review of 33 companies in five provinces that administered emolument orders in-house found that 1 081 out of 10 752 employees had attachment orders on their salaries.

This amounted to 10.05% of the total number of employees. The companies were from the metal and engineering industry, hospitality, the education sector, agriculture and transport.

Debtor "misled"

The report, which also looked at the effectiveness of garnishee administrators, interviewed four unidentified national employers that employed 82 378 staff, of whom 7 532 had garnishee orders issued against them.

Although the reports were generally positive, namely that garnishee administrators understand the law and relieve the administrative burden of employers, some companies believed that the administrators "misled the debtor by stating they can assist them by lowering the monthly instalment" while not explaining that it will increase the interest and extend the repayment period.

They also feel that the administrators are also not adequately versed in debt collection and the legal requirements.

Finance Minister Pravin Gordhan said in his national budget speech in February that the government is concerned about the rapid growth in unsecured credit and the number of garnishee orders in the system.

The National Credit Amendment Bill, which is before Parliament, is intended to strengthen the powers of the National Credit Regulator.

It emerged soon after the Marikana shootings that companies and some government departments were using garnishee administrators because their salary divisions were unable to cope with the number of orders, or were not well versed in the law.

Large number of errors

The administrators were finding a large number of errors in the orders issued by the courts.

Research by the law firm Edward Nathan Sonnenbergs has revealed that, out of 45 000 workers at a multinational company, 13 000 had garnishee orders against their salaries, and 39% of these were being made against loans that had been paid up or did not exist.

The firm also found a number of orders were irregular and missing vital information, such as the total amount owed and even the correct name and details of the person being held responsible for the debt.

Differences of opinion among various groups, including lenders, retailers and the department of trade and industry, over how to control the garnishee system has been attributed to the slow implementation of changes to the system.

The treasury and the department started reviewing the policy framework on consumer credit "with the purpose of analysing and amending the current policy" in June last year.

The final draft policy framework, drawn up after the review, was tabled before the Cabinet on July 31 but was later withdrawn at the request of the treasury for further discussions between it and the department.

Ensuring more efficient regulation

Among the key issues raised is the need to strengthen the powers of the regulator to ensure more efficient regulation and to assess the norms and standards of affordability assessment criteria.

The aim is to empower the regulator to issue affordability assessment guidelines and to establish how best to ensure that consent to garnishee orders and judgments is handled by properly trained staff.

Frans Haupt, director of the law clinic, has said that abolishing garnishee orders is not the answer. It would make it harder for lenders to recover unpaid debts and could result in access to credit becoming more difficult for lower income earners.

It could even see a return to the courts for orders to attach goods in lieu of the debt.

The main problem is the lack of regulation. High interest rates, add-on fees and charges for statements often mean that poorly educated debtors find themselves trapped in a debt cycle.

Holding debt to rights

This is what the University of Pretoria Law Clinic report found:

• A lack of uniformity among different magistrate's courts when granting orders;

• Fraud by court officials who collaborated with law firms applying for orders. Two magistrate's court officials are under investigation for issuing fraudulent orders;

• Orders being granted without the amounts owed being stipulated, resulting in debtors paying instalments with no prospect of ever settling their debts;

• No affordability tests being conducted for those applying for credit;

• No cap on the amount that can be deducted, resulting in employees being left without sufficient means to pay their monthly bills;

• The charging of excessive fees, incorrect calculations of interest and inadmissible charges being levied — not all of which was picked up by court officials or salary officers;

• Credit being granted recklessly and multiple deductions being made from employees' salaries;

• Fees being charged for statements, despite the law declaring that free statements must be issued on "reasonable request".

• Uncertainty surrounding the interpretation of section 103 (5) of the National Credit Act, which pertains to the amount of interest that can be paid; and

• Payroll officers unsure of when to stop deductions, resulting in unnecessary costs and interest payments.