Emerging economies installed the most wind-generated power in 2014, giving them the lead in an area in which investment lagged in developed economies.

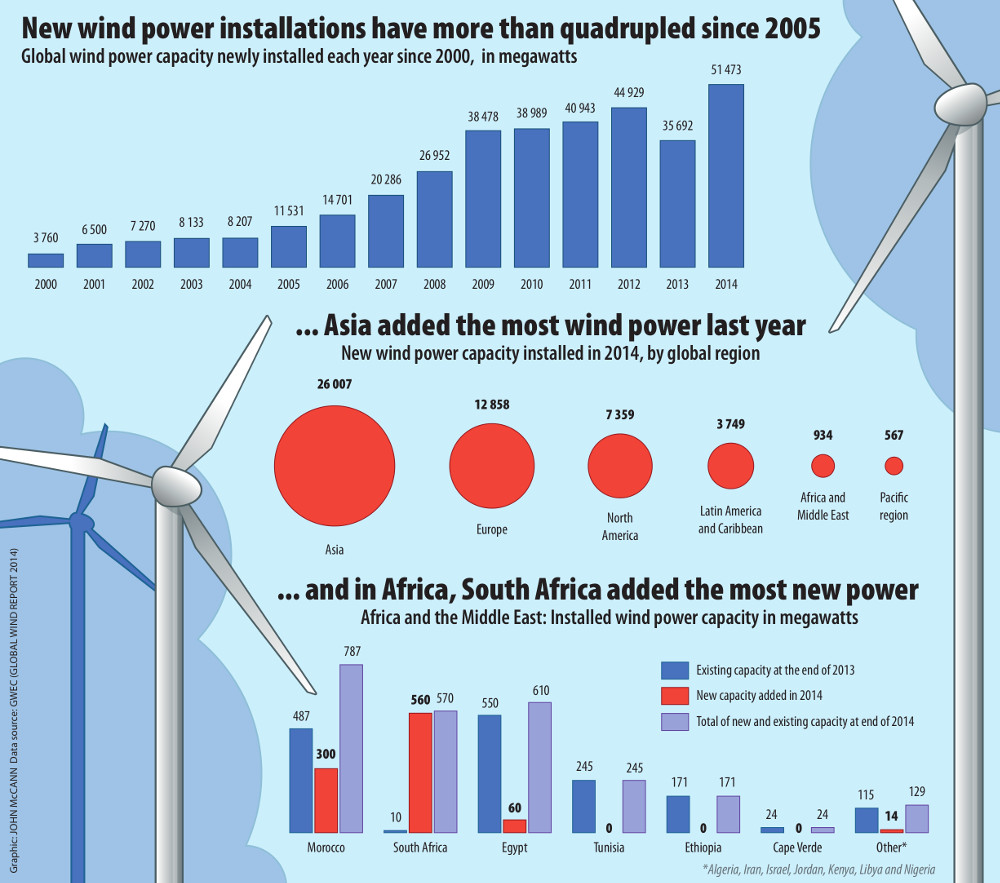

Developing nations contributed significantly to a record year for newly installed wind power and, of the 51 gigawatts (GW) installed in 2014, emerging markets accounted for 30GW, or 60%, according to the 10th annual Global Wind Report released by the Global Wind Energy Council in Istanbul on April 1.

The surge was largely bolstered by 23GW of new power installed in China, which in itself is a new record and more than what the runners-up, Europe and North America, together installed last year. Investments in the global wind sector rose 11% to $99.5-billion during the year, also a record. Only 35.6GW of wind energy was installed in 2013, a sharp downturn from an installed 45GW in 2012.

South Africa installed 560 megawatts (MW), the most in Africa and the Middle East, which the council described as “the big news story” for wind for 2014. The country had installed just 10MW by the end of 2013 and is now considered one of the leading wind power markets.

Helped by projects in South Africa, Morocco and Egypt, more than 934MW of new wind power was introduced to Africa this year.

“2014 was a milestone year for the African market, as almost a gigawatt of new capacity came online,” the report said. “Africa is likely to emerge as a new hot spot for wind energy development, with new projects in South Africa, Kenya, Tanzania, Morocco, Ethiopia and Mauritius coming on line.”

Global generation

Latin America and the Caribbean had a good year, too, with 3 749MW of new capacity. It was led by Brazil, which alone accounted for 2 437MW and is now ranked 10th in the world in terms of cumulative installed wind power.

Wind power also grew in Turkey, which installed 804MW last year, to reach a total of 3 762MW. India contributed 2 315MW to the global total.

But this is not the first year the developing world – led by Asia, the world’s largest regional wind energy market for the past seven years – has been the frontrunner in new wind power.

“In 2014, as in 2013, the majority of wind installations globally were outside the OECD [Organisation for Economic Co-operation and Development] once again. This was also the case in 2010 and 2011, and is likely to continue to be so for the foreseeable future,” the report noted.

More than 80 countries now generate wind energy, 24 of which have more than 1 000MW of capacity installed and 11 with more than 5 000MW, according to the report.

Uncertain market growth

However, “at the end of 2013, the expectations for wind power market growth were uncertain, as continued economic slowdown in Europe and political uncertainty in the US made it difficult to make projections for 2014, which we called at just over 47GW, not anticipating the dramatic growth in the Chinese market.”

Wind power generation accounted for 2.78% of China’s total electricity generation in 2014 and the nation aims to nearly double it to 200GW by the end of 2020.

But the ambitions of developed countries for wind energy are less clear.

Germany set a new record, installing nearly 5 300MW, which is the first time that any country other than China or the US has installed more than 5 000MW in a single year. This, and with the installation of more that 1 000MW in Britain, France and Sweden, helped to shore up the European figures, despite disappointing numbers from many other European countries.

Together these four countries account for more than three quarters of all installations, the report said.

EU consumption

Although by the end of 2014, grid-connected wind power was enough to cover 10.2% of the European Union’s electricity consumption, weakened legislative frameworks, economic crises and austerity measures are hitting the wind industry hard. “The year ahead will be tough, and the long-term prospects for the wind industry are closely linked to the outcome of the debate over the EU’s 2030 targets for climate and energy,” the report said.

“In early February this year, the European Commission’s Energy Union proposal was made to establish post-2020 legislation for renewables. The plan is to put forward a renewable energy package, possibly sometime next year.”

Meanwhile, after China, the US is the second largest market in terms of total installed capacity but remains the hardest market to call, the council said.

“2014 saw the US market rise with new installations of 4 854MW, bringing the total installed capacity to 65GW … Wind energy accounted for almost 31% of all new generating capacity installed over the last five years … (and) by the end of 2014, more than 12 700MW of wind capacity was under construction across 98 projects in 23 states,” according to the report.

However, the council said, uncertain federal policies in the US continued to inflict a “boom-bust” cycle on the country’s wind industry.

“With a strong pipeline of projects under construction under the existing incentive arrangements, 2015 and 2016 are likely to be good years. But what happens after that?

“It remains the case that energy (and climate) are ideologically charged political issues in Washington, and it’s difficult to see how the current administration and Congress can work together to come up with much in the short term to fill the looming policy gap.”

Australian politics

In Australia, the report said, investments in large-scale wind, solar and other clean energy sources dropped 88% in 2014. This was a result of Australia’s new coalition government, led by Prime Minister Tony Abbott, which came into power in 2013 and does not support renewable energy. This has caused significant damage to the industry.

“But given the dramatic progress of both wind and solar in Australia, we expect that to be short-lived, although it will no doubt depress market figures for the next few years in the Pacific region,” the council said.

The two big issues as far as wind energy is concerned continue to be the drop in the price of oil – which halved last year and remains low – and growing concerns about climate change, leading up to the COP21 summit in Paris at the end of 2015.

“It’s often suggested that the lower oil prices will have an effect on the wind sector, but there’s no evidence of that yet.

“By and large, we don’t compete with oil, and the price of gas is no longer tied to the price of oil as closely as it once was,” the council said in its report.

“But price, speed of deployment and fighting local air pollution have been the main drivers in most of the major growth markets this year. As for 2015, we’re projecting another 50-plus GW year, and continued growth from there.”

Market dominance

For Africa, the council says it’s going to be a contest between Egypt and South Africa for dominance of the continent’s wind energy market. With contributions from other African nations, the council projects there will a total installation of slightly more than 13GW in the region through to 2019.

“South Africa’s emergence in 2014 is the ‘take-off’ after an extremely long countdown. Despite the political instability in the country, the electricity situation is dire, and they need the power,” the report said.

“The industry in South Africa is in a very rapid growth phase. The country’s chronic energy shortages mean that the renewable energy procurement programme is likely to be expanded …

“South Africa is evolving into the hub for manufacturing and development that the industry has been looking forward to for many years.”

The South African wind industry wants to develop about 5GW by 2019.

The cost of wind power has grown increasingly competitive with that generated by coal-fired power stations in South Africa, the report said. The average selling price of electricity is about 63c a kilowatt/hour, and wind power is being procured for about 65c/kWh.

New coal-based power is likely to cost R1.05/kWh, if it is not cross-subsidised from existing plants.