Torn ANC poster in Tshwane.

International investors will be watching next week’s local government elections more closely than they have in the past.

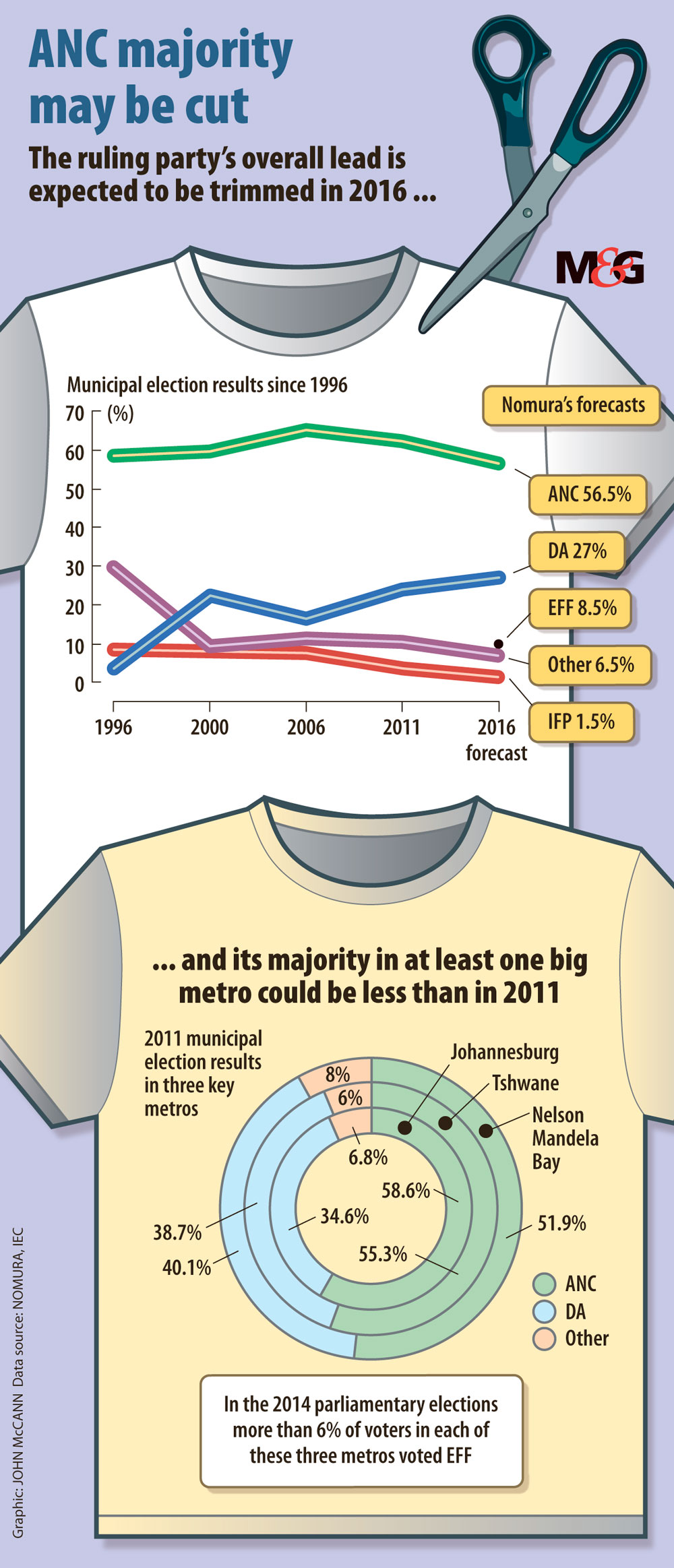

The vote next week is expected to reveal the extent to which the ruling ANC’s traditional iron grip on voters is slipping, especially in some of the more hotly contested metropolitan areas, ushering in a more competitive democracy.

But the hype building up over the likelihood of the ANC losing the Tshwane, Nelson Mandela Bay and possibly even Johannesburg metros, may not happen, according to analysts. Even if the ANC does lose its outright majority in these metros, a complete hiding at the polls seems unlikely and this increases the likelihood of coalition-led governments.

Although greater competition in the democratic space is a good thing, analysts warn that leadership coalitions at local government level can be fraught with their own problems.

From a democratic and governance point of view, more competition among political parties is a good thing, says Professor Steven Friedman, director of the Centre for the Study of Democracy at the University of Johannesburg.

But, he says, even if the ANC loses major metros, the party’s share of the vote will still remain well above 50%.

What the elections may provide is a more general sense of where things in the country are going. If ANC voters in the major cities no longer support the party, this will change how elections are fought in South Africa.

Should the ANC do badly in these metros, a coalition is more likely than any party taking over from another, says Friedman. “Sometimes coalitions can be a problem for voters. It certainly doesn’t mean that we would automatically have more effective local government.”

Recent polls by eNCA and market research firm Ipsos suggest the Democratic Alliance has a slim lead in Tshwane, Johannesburg and Nelson Mandela Bay – but no outright majority.

Metros have become investment hubs of their own, says Ralph Mathekga, head of political economy at the Mapungubwe Institute for Strategic Reflection, noting examples such as Johannesburg, which recently received a credit ratings upgrade of four notches by ratings agency Moody’s.

One of the reasons the city achieved this is a result of stable governance and decisionmaking processes, Mathekga says, adding that this is tied to the “clearcut majority” the ruling party has.

Should these metros change hands, it’s likely to be on a very thin margin, “which urges coalitions”. Very often, this could lead to decisionmaking processes becoming overburdened, says Mathekga. With time, the system may mature but in the short term this kind of governance “ushers in instability” – a negative for investors.

The ANC is priming itself to rule in coalitions, according to a report in Business Day, citing Ayanda Dlodlo, head of the party’s subcommittee on governance and legislature.

The party wanted a “uniform approach to the management and handling of these coalitions”, Dlodlo was quoted as saying.

Somadoda Fikeni, a political analyst at Unisa, also thinks it is possible that the ANC may lose its 50% majority hold on some of the metros.

It would then be a question of whether it could garner the support of smaller parties to get a 50% plus one needed to retain control. In the same vein, opposition parties could form coalitions large enough to take the ANC “out of the picture”.

This could be positive, if it shocks the ANC out of its complacency, says Fikeni, and forces it to “renew itself as a organisation”.

But it could introduce weaker local governments ruled by unstable coalitions “made up of unlikely partners” such as the DA and the Economic Freedom Fighters, which have “diametrically opposed political interests”.

Traditional ANC constituencies may also not be “psychologically ready for a loss outside of the Western Cape” and they may keep these metros unstable through “never ending protests”, Fikeni adds.

It remains to be seen how national and provincial governments will work with coalitions in large metros. Fikeni questions whether it might be quick to trigger interventions such as placing metros under administration when a coalition was not working well, which could cause instability.

Friedman says there is a risk that investors have built up unrealistic expectations over the extent to which the ANC would lose support during the August 3 polls. Given the overheated debates running up to election day, the ANC would have to do “really, very badly” to meet these predictions, he adds.

In a recent research note, Nomura analyst Peter Attard Montalto says investors are “overestimating the electoral hit” the ANC will receive after various controversies such as Nkandla and the axing of former finance minister Nhlanha Nene late last year.

“We are expecting a likely moderate acceleration of a trend decrease in support, with ANC voters particularly staying away and opposition party supporters gaining share – as opposed to [the] mass abandonment of the ANC for opposition parties,” he says.