Against the grain: Matshela Koko told the Constitutional Court that Koeberg’s current steam generators are ‘fast approaching the end of their lifespan and have to be replaced’ to ensure the plant’s safety.

The government’s embattled state-owned entities are one of the chief obstacles to its aims of stabilising national debt and government finances.

In Wednesday’s medium-term budget policy statement, Finance Minister Pravin Gordhan included for the first time a “fiscal risk statement” to the government’s budgeting plans.

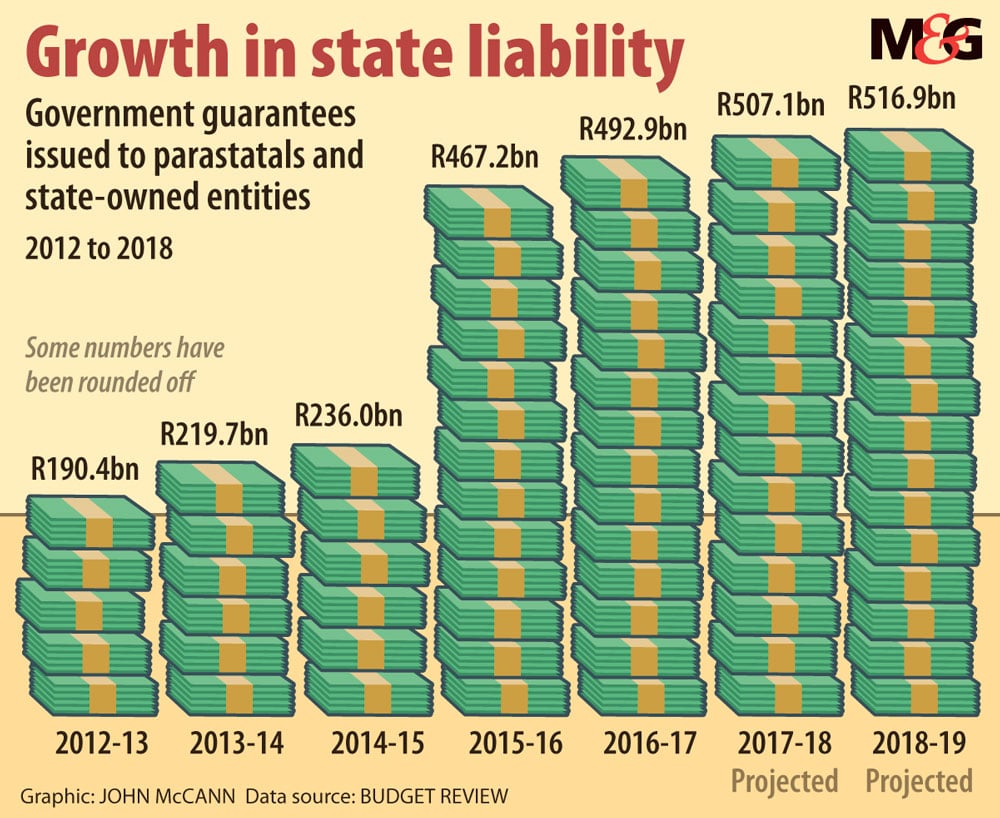

It highlights the almost R500-billion in government guarantees issued to parastatals and state-owned entities (SOEs) such as Eskom, SAA and the South African National Roads Agency (Sanral), which are weighing down state finances.

Gordhan delivered the statement at a time when the parastatals, with their billions in lucrative procurement budgets, have become the coalface of battles over state capture.

The fallout has threatened Gordhan personally — he faces what are seen as spurious charges of fraud relating to ongoing political battles at the South African Revenue Service — as well as with efforts by the treasury to rein in wasteful and corrupt expenditure.

The parlous financial state of many SOEs, exacerbated by poor governance, has seen private sector asset managers such as Futuregrowth Asset Management halt lending to some of them, including Eskom.

In his speech, Gordhan emphasised the government’s efforts to overhaul these entities and stop them draining its resources. He also said, in line with the commitments made in the February 2015 budget, no support would be granted to SOEs without them meeting strict conditions, which included that financing them cannot affect the budget deficit.

Total guarantees to SOEs stood at R469.6-billion at the end of the 2015-2016 financial year, according to the riskj statement. The government’s full exposure to these is R263-billion, because several entities have not used the full amount available to them.

At more than R170-billion, Eskom’s capital expansion programme is the government’s largest exposure. A further exposure of R200-billion is for independent power producers (IPPs), to cover Eskom’s obligation to buy power from them over a 20-year period. If Eskom cannot do this, the government must cover the costs.

Factors such as Eskom’s recent recapitalisation, governance reforms and operational recovery have improved its liquidity and profitability. The national energy regulator also includes the cost of IPPs in Eskom’s tariffs, mitigating the risk these guarantees pose to the government.

But any deterioration in Eskom’s financial position would “increase the risk of both exposures”, the fiscal risk statement noted.

Other major contingent liability risks stem from guarantees to, among others, the Passenger Rail Agency of South Africa (Prasa) and Sanral.

About R53-billion has been committed to Prasa’s purchase of new rolling stock and signalling equipment, but weak expenditure controls and contract management raised “concern that Prasa will not be able to complete the programme on time and within budget.

“In addition, projected declines in Prasa’s fare revenue and ridership numbers raise concerns about the company’s sustainability,” the statement said.

Exposure to Sanral debt, thanks to the embattled e-tolling of Gauteng’s freeways, stood at R35-billlion by March this year.

E-toll collections and auctions are still being closely monitored against projected collection levels to ensure recovery. But the treasury warned: “If government does not proceed with tolling to fund major freeways, difficult trade-offs will need to be confronted to avoid a deterioration in the national road network.”

Meanwhile, SAA has received more than R19-billion in guarantees, without which it cannot continue operating. Despite this, it is still making huge losses, most recently announcing it was R5.6-billion in the red.

Gordhan said a new, “full strength” board had been appointed, tasked with returning SAA to financial sustainability and filling vacant executive management positions.

In light of these risks, Gordhan drew attention to the government’s efforts to reform the parastatals.

“Reform of our state-owned companies is similarly both about addressing financial vulnerabilities and about long-term investment and broadening participation in our economy,” he said.

He pointed to guidelines for the oversight of parastatals that have been agreed to by the interministerial committee reviewing SOEs, led by Deputy President Cyril Ramaphosa.

These include principles for private sector investment in economic infrastructure, a framework for the processing of board appointments, and the separation of costs relating to the development mandates of state firms from their commercial mandates.

Gordhan also noted the progress made in rationalising parastatals, announced in February’s budget, including merging various housing development finance agencies and restructuring the state airlines by possibly bringing in strategic equity partners.

Reform efforts will also include the work of the recently established Presidential State-Owned Companies Co-ordinating Council, which will play a “monitoring and co-ordination” role.

The council is to be headed by President Jacob Zuma, sparking concerns because some believe it will gives the president even greater influence over these entities.