Exxaro, which supplies about 35% of power utility Eskom’s coal, was named in the Centre for Environmental Right’s Full Disclosure 5 report in November as one of the country’s top 10 emitters.

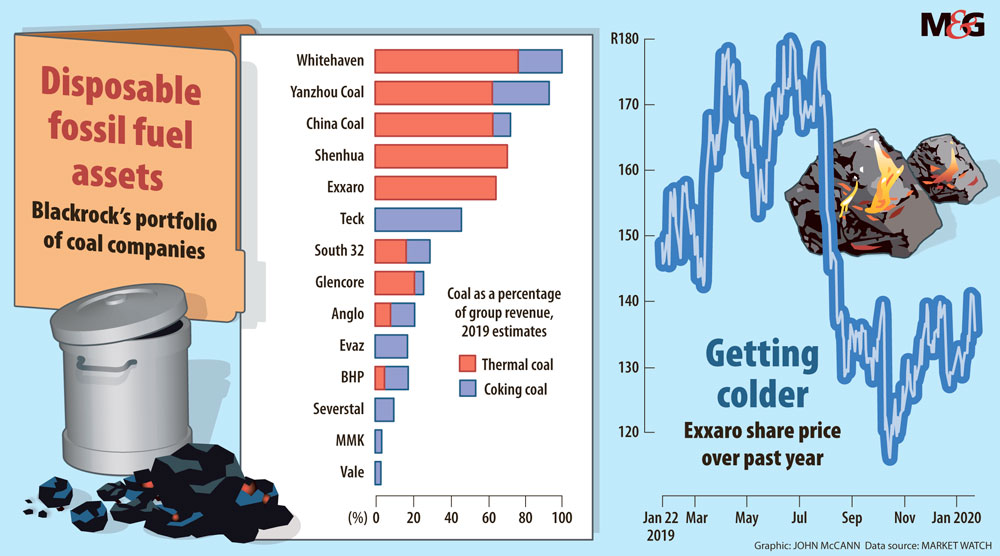

Exxaro Resources, a domestic mining giant listed on the JSE with a market capitalisation of R50-billion, finds itself in the cross-hairs as BlackRock, one of the world’s largest asset managers, has said it will cut investments in companies which earn more than 25% of their revenue from thermal coal.

At the same time India, one of Exxaro’s biggest export markets, has said that it will phase out coal imports in the next four to five years.

Business website Marketwatch, citing analysis by Bank of America, reported earlier this month that Exxaro, which derives 60% of its revenue from coal, is a BlackRock target for divestment.

BlackRock, with $7.43-trillion under management, expects to cull companies from both its actively managed equity and bond portfolios.

Responsible investment activist Tracey Davies of Just Share says BlackRock’s decision to divest from companies that earn more than 25% of their revenue from thermal coal applies to companies in its “discretionary active investment portfolios”.

“While 1.28% of Exxaro’s shares are held by BlackRock, it appears that these shares are held via an emerging market ETF, and not as part of an active investment portfolio. However, BlackRock’s decision is still very significant for companies like Exxaro, because it sends a strong message to local and global investors that it is becoming increasingly untenable to claim to be a responsible investor while holding significant positions in thermal coal.”

Davies says Exxaro has in the past experienced a backlash from some local shareholders against mooted plans to adapt its business model to make it more resilient to the transition to a low carbon economy.

“Hopefully this position by BlackRock will help to persuade those shareholders who objected to Exxaro’s forward thinking that their resistance was misguided.”

Exxaro’s Mzila Mthenjane told the Mail & Guardian investments are held through different funds with differing mandates and consequently the approach to exiting thermal coal exposure will be different across investment managers and among their investment funds.

“The ESG [environmental, social and governance] theme will dominate this calendar year and climate change will be amongst the top issues of concern and discussion for shareholders,” he said

“We have noted the announcement from BlackRock. Our 2018 integrated report details our sustainability strategy and has provided sufficient detail to inform investors of their key ESG parameters. Exxaro has continued to perform well above its peers in this regard and we believe this performance will be a key consideration in any investment decision.”

Exxaro, which supplies about 35% of power utility Eskom’s coal, was named in the Centre for Environmental Right’s Full Disclosure 5 report in November as one of the country’s top 10 emitters.

This report listed Exxaro’s main shareholders as empowerment vehicle Eyesizwe RF (30%), the Public Investment Corporation (11.8%), Coronation Asset Management (3.89%), The Vanguard Group (2.45%), Sanlam Investment Management (1.62%), Old Mutual Investment Group (1.41%) and Prudential Investment Managers (1.29%).

It found Exxaro’s climate strategy wanting. It said Exxaro does not mention climate change as a material risk in its mainstream reports although it is one of the companies most at risk in this report.

It said its strategy to strengthen the resilience of the company in response to climate-related risks is weak and does not rely on scenario analysis.

“Exxaro does not have a risk management process in place to manage climate-related risks. It does not disclose that climate-related risks form part of company-wide risk management programmes or a specific climate-related risk management process,” the Full Disclosure 5 report says.

“The company committed to setting a science-based target in 2015 but this is yet to be implemented.”

Exxaro’s finance director Riaan Koppeschaar said late last year that under the current trajectory Exxaro expects the transitional and physical risks of climate change on its business to be medium to high in the next 20 to 30 years.

“This will require a response that will ensure a sustainable Exxaro in a carbon-constrained environment. On June 4 2019 the board passed a unanimous resolution to reassess the group’s climate change risks and opportunities in line with the recommendations of the financial stability board’s task team on climate-related financial disclosures (TCFD).

(John McCann/M&G)

(John McCann/M&G)

“An internal multifunctional task team is currently developing the strategy using the TCFD recommendations,” Koppeschaar said.

Mthenjane said that recent shareholder roadshows received feedback on how and where they can improve on ESG disclosure.

“We are aiming to improve our disclosure in future integrated report publications.”

In a letter to investors in January, BlackRock chief executive Larry Fink said they will demand greater disclosure from firms on their carbon emissions and climate risks, as well as increase BlackRock’s sustainable assets from $90-billion to $1-trillion within a decade, The Economist reported.

Its announcement can be seen as a seminal day for coal, but critics note the decision as yet only applies to active funds, those managed through ongoing buying and selling, and not passive funds, where the investment simply tracks an index. Its active funds reportedly comprise 27% of the total.

The 25% revenue cut-off means major players such as Glencore are probably exempt.

“Glencore, the world’s largest exporter of seaborne thermal coal, has 25% of its industrial revenue coming from coal, and another 6% of trading revenue, according to Bank of America, meaning it will probably be below BlackRock’s 25% benchmark,” Marketwatch reported.

Critics have also said the decision only applies to thermal coal and excludes other fossil fuel investments, namely oil and gas.