Moody's rating agency

The inevitable came on Friday night, with credit ratings agency Moody’s listing South Africa’s credit rating as junk. This means institutional investors that own the country’s debt but are not allowed to buy or hold risky debt will be forced to sell off the country’s debt. It will also be more expensive for the government to raise debt.

The downgrade means that the ratings agency effectively says there is a chance that South Africa might not be able to pay back its debt, making buying that debt riskier.

Moody’s — the last agency to do this — said the outlook for the country was negative and their rating reflects the risk that “economic growth will prove even weaker and the debt burden will rise even faster than currently expected”.

The key drivers behind the downgrade are “continuing deterioration in fiscal strength and structurally very weak growth,” the ratings agency said in a statement.

The outlook on the rating remains negative.

Moody’s added that the rapid spread of Covid-19 globally will likely exacerbate “South Africa’s economic and fiscal challenges and will complicate the emergence of effective policy responses”.

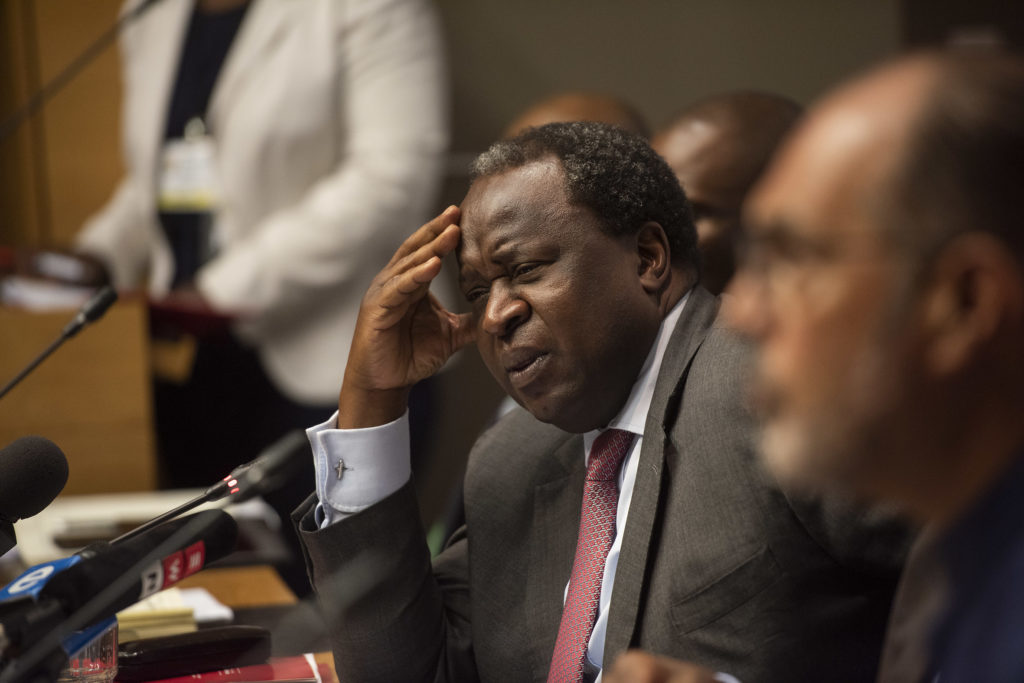

In a statement on Friday, finance minister Tito Mobweni said: “To say we are not concerned and trembling in our boots about what might be in the coming weeks and months is an understatement.”

Finance Minister Tito Mboweni. (David Harrison/M&G)

Finance Minister Tito Mboweni. (David Harrison/M&G)

Friday was also the first day of the 21-day, nationwide lockdown, started after President Cyril Ramaphosa declared a national disaster. On Friday, the first person died as a result of Covid-19 in South Africa with the number of people tested positive passing 1 000.

The economic impact of countries shutting down has been massive and has taken a toll on South Africa. This is after the country already announced that it was in a recession after the economy shrunk in the last two quarters of 2019.

Treasury said on Friday: “The impact of Covid-19 is felt across various sectors of the economy including the financial markets which experienced a significant sell off in equities, bonds and exchange rates as investors retreated to safe haven securities amid the uncertainty.”

It added: “The decision by Moody’s could not have come at a worse time” and that it “will truly test South Africa’s financial markets”.

Before Friday’s announcement by Moody’s to downgrade South Africa, it was the last of the three big ratings agencies — Moody’s, Fitch and S&P Global — to have kept the country’s rating as stable.

Economists had hoped that Moody’s would give South Africa a reprieve as the country battled with the economic and health impact of the coronavirus.

To curb the spread of the virus, which has so far claimed one death, the government has implemented a three week lockdown effectively bringing the country’s economy on a standstill. To offset the impact that the lockdown will have on businesses, households and individuals announced a string of measures to cushion the economy, including a Solidarity Fund which has a capital seed of R150-million from the government.

The country’s financial markets have also seen increased volatility since the outbreak of Covid-19, prompting the South African Reserve Bank to cut interest rates by 100 basis points. The bank earlier this week also announced that it would be buying government bonds in the secondary market, in a bid to inject liquidity into the local market.

The downgrade will see South Africa excluded from the FTSE World Government Bond Index. Economists have said that the impact of this downgrade was already priced into investments and the market, because it was expected. But junk status will force some institutions that have not already sold off the country’s debt to do so.

It will also make it more expensive for the state to borrow money, with lenders expecting more interest in return for what is now a risky investment.

In its Friday statement, Treasury added that: “The interest rate for the government, households and the broader economy is also expected to increase as a result.”

The country’s currency declined by as much as 1,7% in trade against the dollar to trade at R17.63 following Moody’s announcement.