The Covid-19 lockdown slowed the economy to a point where businesses across all sectors are operating below capacity. (Delwyn Verasamy/M&G)

South Africans should brace themselves for a further slump in the economy, as gross domestic product (GDP) numbers for the second quarter of the year are expected to plummet.

Statistics South Africa is due to release the GDP numbers on Tuesday next week. The organisation said the Covid-19 lockdown had affected its ability to collect data.

Jeff Schultz, a senior economist at BNP Paribas SA, believes the worst of the coronavirus disruptions are behind us, but says the GDP numbers are likely to be less than desirable.

BNP has downgraded the country’s second quarter GDP growth forecast to -51.5% from the previous 40% estimate.

BNP says the South African Reserve Bank’s GDP estimates for both this year and the next remain tilted to the downside.

This contraction is despite the Reserve Bank’s efforts to cut rates by 300 points this year to mitigate the negative effects of Covid-19.

Last month, Reserve Bank governor Lesetja Kganyago speaking at the Cape Town Press Club, said inflation would not be a problem for the country for the next 12 to 18 months. He added that quantitative easing — where the central bank increases money supply by buying government securities or other financial assets — is something the bank would not embark on because the country’s interest rates and inflation are not at zero percent.

Second quarter slip

The supply side of the economy will primarily drive the second-quarter downturn. This includes mining, manufacturing, construction and utilities, which Schultz estimates have contracted by more than 70% in the second quarter. He says the lockdown has made a significant number of consumers financially more vulnerable, which means they are more likely to save their money or use it only in case of emergencies.

The Covid-19 lockdown slowed the economy to a point where businesses across all sectors are operating below capacity.

“The only bright spot that we are anticipating in the second quarter numbers is going to come from the agricultural sector because it was one of the few sectors that were permitted to operate uninterrupted during the hard lockdowns,” says Schultz.

But the agriculture sector contributes only 2.5% to the country’s GDP and is unlikely to offset the expected slump in GDP for the second quarter.

All sectors hit

The hard lockdown saw many industries’ output slowing or coming to a standstill, according to the BeyondCOVID Business Survey by Redflank, a specialist management consultancy.

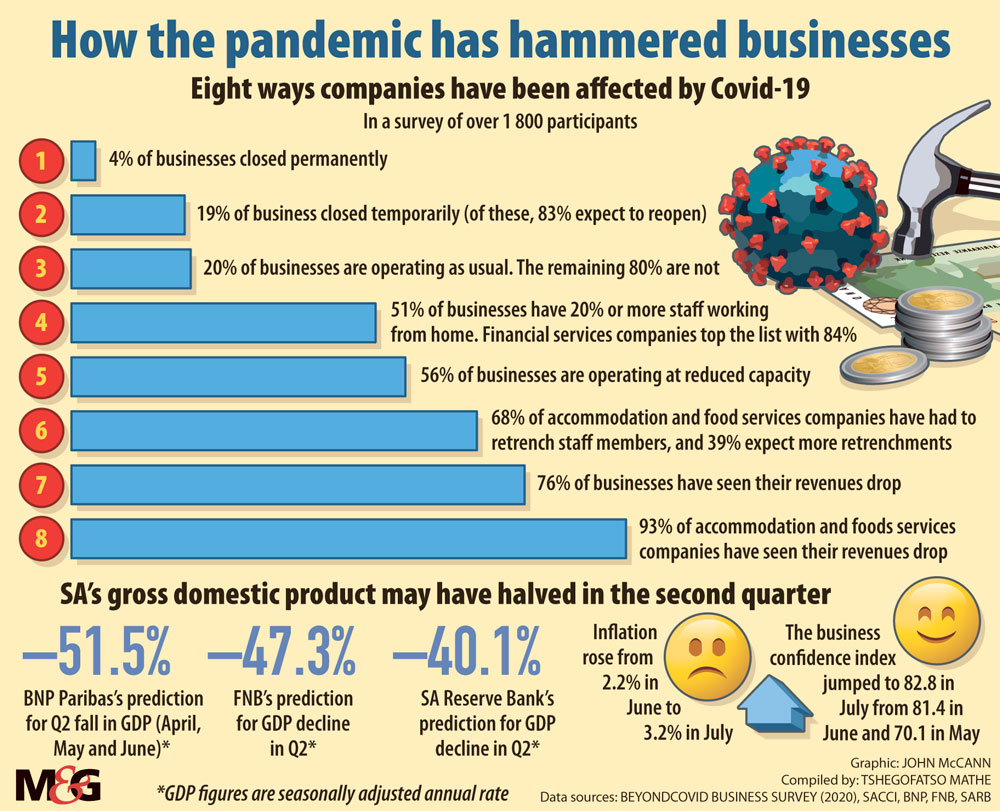

The survey, conducted between June and August, shows that 76% of the more than 1 800 companies that participated in the study have seen their revenues drop since March.

Beyond that, more than 56% of participants across all sectors are operating under their standard capacity. An even bigger percentage, 76%, has seen their revenues shrink and 23% have had to shut down, temporarily or permanently. For only two out of 10 companies is it business as usual. And a tiny fraction, 2%, have expanded their operations.

The sectors affected the most include accommodation and food outlets such as restaurant, the arts, entertainment and recreation. The contraction has severely affected businesses such as hairdressing and beauty salons, wholesalers and retailers, construction and travel companies such as car hire firms and travel agencies.

The survey also focused on retrenchments. The accommodation and food services companies top the list.

Redflank director Lings Naidoo says about 68% of respondents in these sectors have had to let all, most, or some of their employees go.

“This is followed by hair and beauty salons (62%), construction firms (61%) and entertainment, arts and sports (57%).”

(John McCann/M&G)

(John McCann/M&G)

Glimmer of hope

Although most sectors were affected, Rhangani Mbhalati, the managing director of Chapu Chartered Accountants, says small- and medium-sized enterprises are hardest hit because most of these businesses do not have reserves. But they still have fixed costs such as salaries and rent to pay.

He says those companies withstanding the Covid-19 storm have adjusted to working with a reduced labour force and may attempt to achieve the same output as before with the reduced number of employees.

“This situation may present an opportunity for people to start small businesses,” he added.

But Stanlib’s chief economist, Kevin Lings, says that “many parts of the business sector have adopted a wait-and-see approach to new investment, thereby limiting future economic growth and job creation”.

He says that without a vibrant business sector with new investments the economy cannot gain significant momentum to lead to widespread job creation.

The banks, which have been given R200-billion by the state to provide customers with payment relief, say many of their clients are asking for longer payment holidays while others have missed their credit card payments.

The banks have also been negatively affected by the contraction in the economy. This week Bidvest Bank announced that it was considering retrenching at least 400 of its employees.

Tshegofatso Mathe and Thando Maeko are Adamela Trust business reporters at the Mail & Guardian