The green economy can pave a way to a thriving South African society by unlocking economic value, fighting climate change and improving human wellbeing. It is a win-win-win.

An increasing number of investors are expecting asset and wealth management firms to make environmental, social and governance (ESG) issues integral to their investment strategies, PWC said in its report, Asset and Wealth Management Revolution: The Power to Shape the Future.

This shift in approach when it comes to investing will affect product design, fund allocation and performance objectives.

The report was conducted by drawing on data analysis, experts’ insights and the econometric modelling of PwC’s Asset and Wealth Management Research Centre.

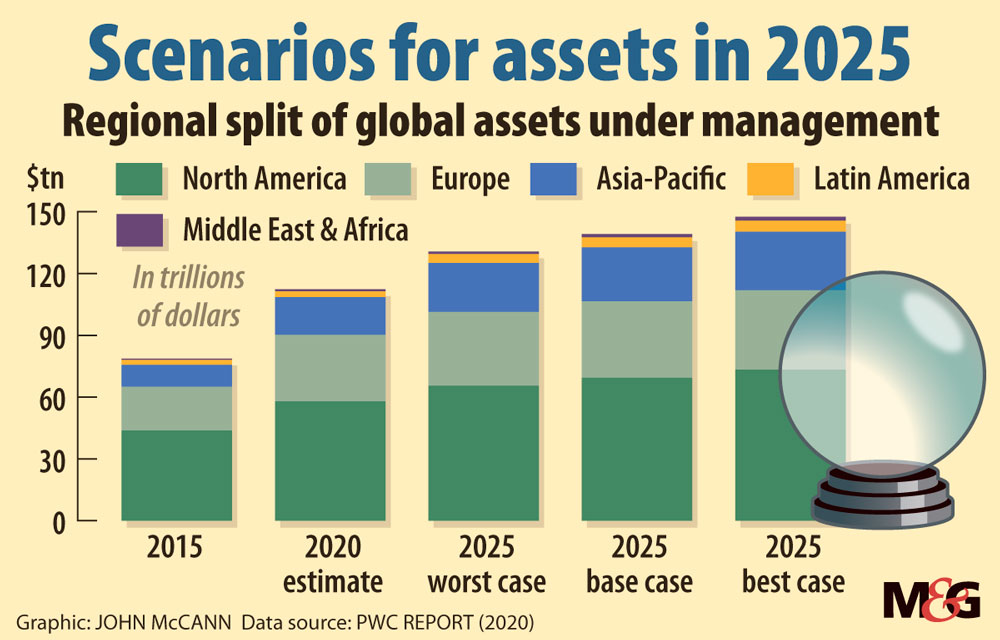

The study found that global assets under management (AuM) are projected to grow by up to 5.6% a year to $147.4-trillion by 2025 despite this shift in strategies. Currently, there is $110-trillion in assets under management directed towards environmental, social and governance priorities, which gives investors “the power to change the world”, the report says.

PwC’s research shows that ESG-aligned funds cumulatively outperformed their traditional counterparts by 9% from 2010 to 2019. Businesses that score highly on sustainability tend to outperform those that don’t. And companies that are diverse and inclusive are, on average, 15% more profitable than those that aren’t.

Iraj Abedian, chief economist and founder at Pan-African Investment and Research Services, said that over the past 10 years, the concept of “impact investing” has become popular because people are more conscious of the need to put money into social and environmental needs for the sake of the world’s future. He said it’s better to invest in commodities such as renewable energy rather than coal, which causes air pollution and harms people’s health.

Although there is an increasing interest in how money invested is used, assets under management growth of these investment vehicles will depend on the speed and sustainability of countries’ economic recovery from the Covid pandemic.

PwC’s research centre presented three scenarios. The best case is if there is an increase in fiscal stimulus measures to revitalise economies and boost investor confidence. Economies would see a rapid recovery from the fourth quarter of 2020, which would have a positive effect on assets under management growth.

The worst-case scenario is a double-dip recession. Many countries would face further waves of Covid infection and lockdowns. These circumstances would be accompanied by a delay in vaccine development and use, resulting in economic recovery being slowed until the end of 2021.

“The difference between AuM under the best- and worst-case scenarios is more than $16-trillion, demonstrating how much is at stake”, the report said.

(John McCann/M&G)

(John McCann/M&G)

European markets are leading the way on embedding ESG. PwC’s analysis shows that this type of assets will make up between 41% and 57% of total mutual fund assets by 2025.

“And more than 75% of European institutional investors surveyed this year by PwC said they plan to stop buying European non-ESG products within the next two years. However, only 14% of European asset managers intend to stop launching non-ESG funds in the near future,” according to the report.

Greer Blizzard, strategy and operations manager at Just Share, a nonprofit shareholder organisation, said ESG investment should continue to grow significantly in South Africa.

Given that the country is the most unequal in the world, investments that “fail to have meaningful regard to ESG issues will certainly exacerbate this inequality and worsen South Africa’s already extreme vulnerability to climate change.”

She added the sooner “informed decisions” that are made to fully address inequality and climate change, the better the prospects of creating a just, inclusive and sustainable economy. “Institutions must use their significant investor power to drive businesses to operate in a manner that supports a regenerative and just future, giving future generations a world in which they will be able to thrive, and one that we would be comfortable retiring into”, she said.

Although there is a shift to ESG investments, the report said “there aren’t agreed-upon criteria to define responsible investing. And what is acceptable now may not be in the future, so it’s important to keep your ear to the ground and be proactive in responding.”

Tshegofatso Mathe is an Adamela Trust business reporter at the M&G