The global trade system has been jolted by the emerging trade war initiated by US President Donald Trump. Photo: Delwyn Verasamy, M&G

Stock exchanges will always remain relevant, according to the chief executive of the local bourse, Leila Fourie. This is after intense criticism of the JSE for failing to stem the tide of delistings. Twenty companies reportedly delisted from the JSE last year.

Fourie has pointed out that the delisting spate is indicative of a global phenomenon. The economic downturn triggered by Covid-19 caused a number of companies, particularly ones with smaller market capitalisation, to lose investor support and, ultimately, have to delist.

But, Fourie says: “You will always have smaller companies wanting to cash out on an exchange. And you will always have large entities wanting to raise capital for large capital investment.”

Private equity and the private-capital-formation space is growing, Fourie noted in an interview with the Mail & Guardian. “But I do believe that the public markets and IPO [initial public offering] market remain relevant. They will continue to remain relevant into the future. The public market plays a very important role.”

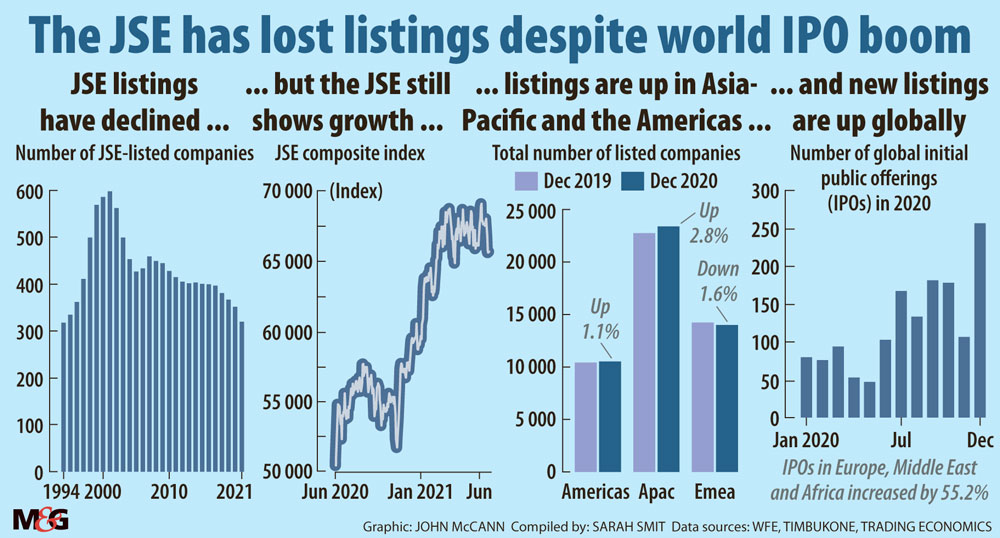

According to data from information and technology firm TimBukOne, in 2001 the JSE had about 600 listed companies, but by March 2021 this had reduced to 318. The data shows that the JSE has about as many listed companies as it did in 1994.

A report by the World Federation of Exchanges shows that in 2020 there was only a 1.1% increase in the number of listed companies globally compared to 2019 — marking the lowest increase in four years. The report also makes note of the growing IPO market, which increased 36.4% in the last quarter of 2020 compared to the same period in 2019.

Delistings, especially by smaller entities, raise concerns about the JSE becoming even more top heavy than it already is. During a downturn, less liquid small-cap companies don’t enjoy investor support.

The top 10 shares on the JSE all-share index make up between 50% and 60% of the index.

“The exchange is highly concentrated — and high concentration has always been a feature in South African financial markets and the exchange,” Fourie said.

“We are constantly working to try to grow and enhance the diversity of the exchange, both in the investor base and also in the listed base …. We really need to do everything that we can to encourage inbound investment and confidence by foreign and international investors,” she said.