ArcelorMittal South Africa and smaller manufacturers, including the vehicle industry, are facing headwinds. Photo: Patrick Pleul/picture alliance/Getty Images

The steel sector strike — which lasted almost three weeks and saw employers accuse labour of jostling an industry already on the brink — is over.

The strike, led by the National Union of Metalworkers of South Africa (Numsa), hit the sector when it was in the midst of a recovery from the Covid-19 pandemic’s onslaught. The current global market conditions at play in this recovery meant that workers took on the local industry when stakes were higher than ever, experts say.

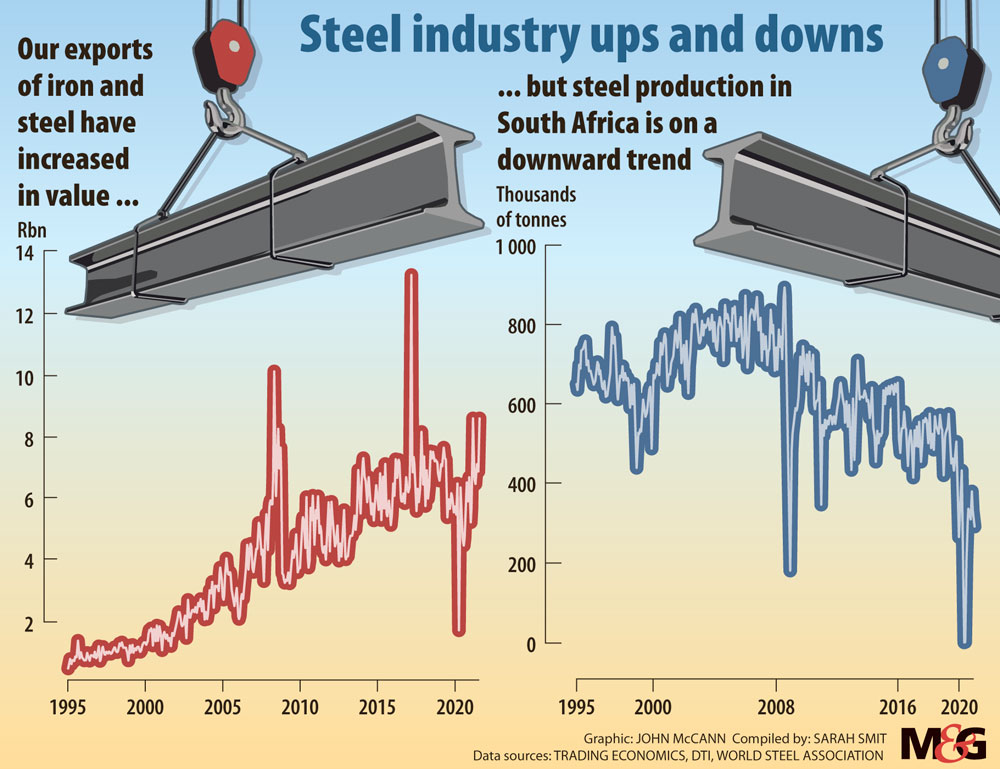

Recent data indicates that, despite persistent inflation risks and China’s slackened growth, global steel demand is expected to reach pre-pandemic levels this year. Local figures released last week showed that manufacturing sales of basic iron and steel products improved by 42.2% in August compared to the same month last year.

South Africa’s steel industry, which has been slow to adapt to global trends, has been in decline for years.

The local industry has been hit on a number of fronts: South Africa’s stagnated economic growth has meant there has been little in the way of infrastructure investment. The energy-intensive sector has been hit by load-shedding and high electricity tariffs.

The industry was given a lifeline earlier this year, when stakeholders signed the steel master plan which provided for R1.5-billion in government funding and set out ways to support steel makers and manufacturers grappling with an Eskom-related electricity crunch.

‘Disastrous’

Steel market expert Charles Dednam said the industry was in bad shape prior to the pandemic. “A large portion of the steel industry didn’t really make any money. There were absolutely no profit margins. And you can judge that based on the number of bankruptcies that actually happened,” he said.

Highveld Steel retrenched its entire workforce in 2015, amid mounting electricity bills. In 2019, Saldanha Steel announced it would be halting production, letting go of about 900 workers.

Last year, Dednam wrote in a policy brief that the pandemic had left the global steel industry “in a disastrous situation, far worse than anything experienced since the beginning of this millennium”. The health crisis led to steel production in South Africa plummeting to a never-seen-before-low.

When the lockdown eased, the industry restarted very slowly, Dednam said this week. Then something unexpected happened: the pent-up demand for steel outstripped supply, driving prices “through the roof”.

Earlier this year ArcelorMittal South Africa, the world’s second largest steel producer, reported its strongest interim earnings in a decade amid a 79% increase in average international dollar steel prices. The company recorded a headline profit of R2.48-billion after enduring a R2.6-billion loss in the first half of 2020.

Now, as China curbs its steel production amid power cuts, prices are expected to increase towards the first quarter of next year, Dednam said. China is the world’s biggest producer of the construction and manufacturing material. Steelmakers in Europe and the UK, including ArcelorMittal, have also recently been hit by the global energy crisis.

The price rally does not necessarily mean the local industry would have been able to withstand the effects of the Numsa strike, Dednam said. The strike, he said, had been bad for the industry in general.

“The reason for this is that we are actually operating in a commodity market which is very cyclical,” he said.“So you get these spikes and they only last so long before they come down again.”

High stakes

Development economist Ayabonga Cawe said favourable price condi-tions meant the stakes were much higher for an industry hit by strike action. “Every day lost in production meant they could not exploit the favourable price environment for many of the companies involved here — many of whom I guess have had to weather some very difficult conditions.”

Cawe added: “So in a sense you have got a very challenging situation, where the trade unions are very alive to the fact that the stakes are much higher now. And the employers will be under more pressure to come to some sort of an agreement.”

Workers are also entitled to a share in the steel rally, Cawe said. “Workers share in the downside because they have a high likelihood of being retrenched or having their wages cut,” he said.

“There was a moratorium on bargaining last year because unions were alive to the fact that they are in difficult conditions on the back of Covid-19. Now there isn’t a similar discussion when there is an upswing in the sector.”

Lucio Trentini, chief executive of the Steel and Engineering Industries Federation of Southern Africa (Seifsa), said prior to the strike there were “greenshoots on the horizon”.

“We had begun to see some of the clawing back from the economic devastation that Covid had on the economy … There was a ray of light coming into this year. But one must bear in mind that coming off a very low base, we weren’t exactly over the moon even though things were on the mend,” he said.

The strike had “completely wiped out the hope that the steel industry could stabilise in the next four years”, Trentini said, adding that tensions between labour and employers delayed the implementation of the steel master plan.

Wiped out

Last week, after the release of Statistics South Africa’s manufacturing data, Seifsa said it expects production and growth patterns to be “significantly lower in the months ahead”. Growth, the industry employer organisation said, will probably be hampered by the pandemic’s fourth wave, on-going load-shedding and the industrial action.

Trentini said the uptick in steel demand and prices would not trickle down to manufacturers and engineers in the sector. “It does not assist the owner-managed engineering workshop in an industrial area, because he is not producing steel. The steel producers are riding on the back of that uptick in the demand for steel, but that’s not trickling down to the over eight and a half thousand engineering companies that are in the industry.”

Among its various pre-pandemic woes, the industry has been beset by high labour costs, Trentini said.

At the centre of the recent standoff between employers and labour was whether wage increases would be made on a rands and cents amount or on what workers actually earn. “We have been awarding increases on actuals for the last 30 years,” Trentini said.

“That has made the labour input costs unsustainable, uncompetitive. And it has led to massive job losses and no job creation.”

Earlier this week, Numsa spokesperson Phakamile Hlubi-Majola said workers sacrificed their wage increases last year by signing a standstill agreement which ensured their working conditions would not be affected by the Covid-19 downturn. “They agreed not to take an increase in order to protect the industry, in order to protect business.”

She added: “Whatever suffering that employers can claim to be going through, none of it compares to the suffering that workers and their families are going through.”

On Tuesday, Seifsa made its final offer to labour, sticking to a rands and cents increase, after which Numsa called an urgent meeting of all its regions to discuss whether to call off the strike.

On Thursday morning Seifsa announced that a deal had been reached.