Tenants are often told they are paying off someone else’s bond. But with low interest rates because of the Covid-19 pandemic’s effect on the economy, and the South African Reserve Bank’s resolve to keep interest rates at 3.5%, more people are ready to enter the housing market.

The first step is to get financing for your bond. First improve your credit score. Check your score with a free credit report from a credit bureau such as TransUnion or ClearScore.

Next, assess what you can afford before you go househunting so you don’t fall in love with a property you cannot afford. Dodge this pitfall by only looking at houses in your price range. A rule of thumb is that your monthly bond repayment should not exceed 30% of your gross monthly income.

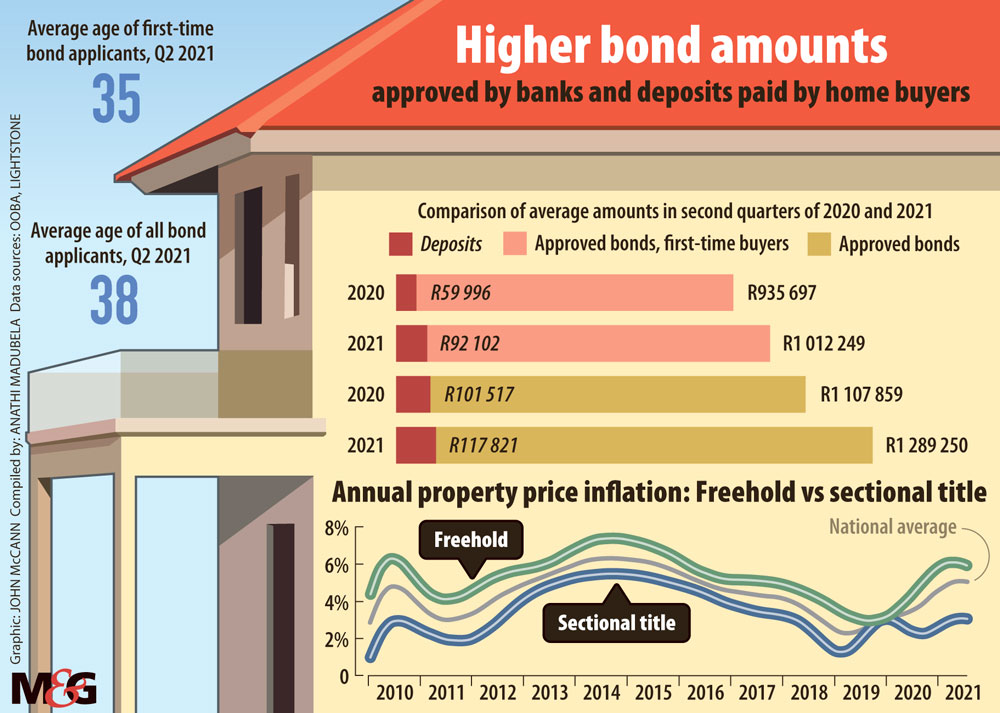

Saving up a deposit comes next. A deposit increases your chance of getting your bond approved, and a higher deposit means your bond repayments will be lower.

Now the house-hunt can begin.

Stick to your budget, consider your needs, assess the area and the security of the property. Evaluate the condition of the property to see if it will need repairs or extensions. Research prices of houses in the area to find out if the seller is asking for too much.

Once your heart is set on a house and you have received your offer to purchase (OTP) document, find a financier. Before signing, read the OTP carefully to understand your rights and obligations.

The OTP is then taken to a financing institution such as a bank, or a mortgage finance company such as SA Home Loans, where the application will be assessed and you will receive an approval in principle. After this, when the house has been evaluated, a loan offer will be made to you.

There is a further step for first-time home buyers who qualify for a government subsidy, the finance-linked individual subsidy programme (FLISP). The FLISP subsidy is paid to the buyer’s bank or financial institution and makes it more affordable to buy a home.

Requirements are that you should be a first-time home buyer earning either a single or joint gross monthly household income of between R3 501 and R22 000; have financial dependants; have never benefited from a government housing subsidy scheme; and have an approval in principle for a home loan from an accredited financial institution.

Once the loan offer has been accepted and signed, the bank will formally grant the loan and instruct the bond attorney to register the bond.

The registration and transfer process can take up to three months. Three attorneys are involved in the process and these include the transfer attorney (selected by the seller) who handles the transfer of the property. The cancellation attorney (selected by the seller’s bank) cancels the seller’s existing bond. Finally, the bond attorney registers the new bond in the name of the buyer and is selected by the buyer’s bank.

Some buyers find themselves in a situation where they are ready to move, but the transfer hasn’t taken place yet. This is where the occupational rent clause comes into effect because when a property is sold it can take up to 12 weeks for transfer to be finalised.

Occupational rent is an amount payable by the occupant of a property to the owner, before transfer of the property has taken place. It is often more viable to pay occupational rent, especially if the buyer is moving from rented accommodation.

When the transfer has been finalised you can finally move into your new home!

Anathi Madubela is an Adamela Trust business reporter at the Mail & Guardian.