The Supreme Court of Appeal (SCA) on Thursday overturned a much-criticised high court ruling in the early days of South Africa’s Covid-19 lockdown that struck down most of the restrictions imposed by the state as unconstitutional.

(Delwyn Verasamy/M&G)

President Cyril Ramaphosa’s economic advisory council has recommended that the country should grow its economy by cutting the public wage bill and adopting serious reforms.

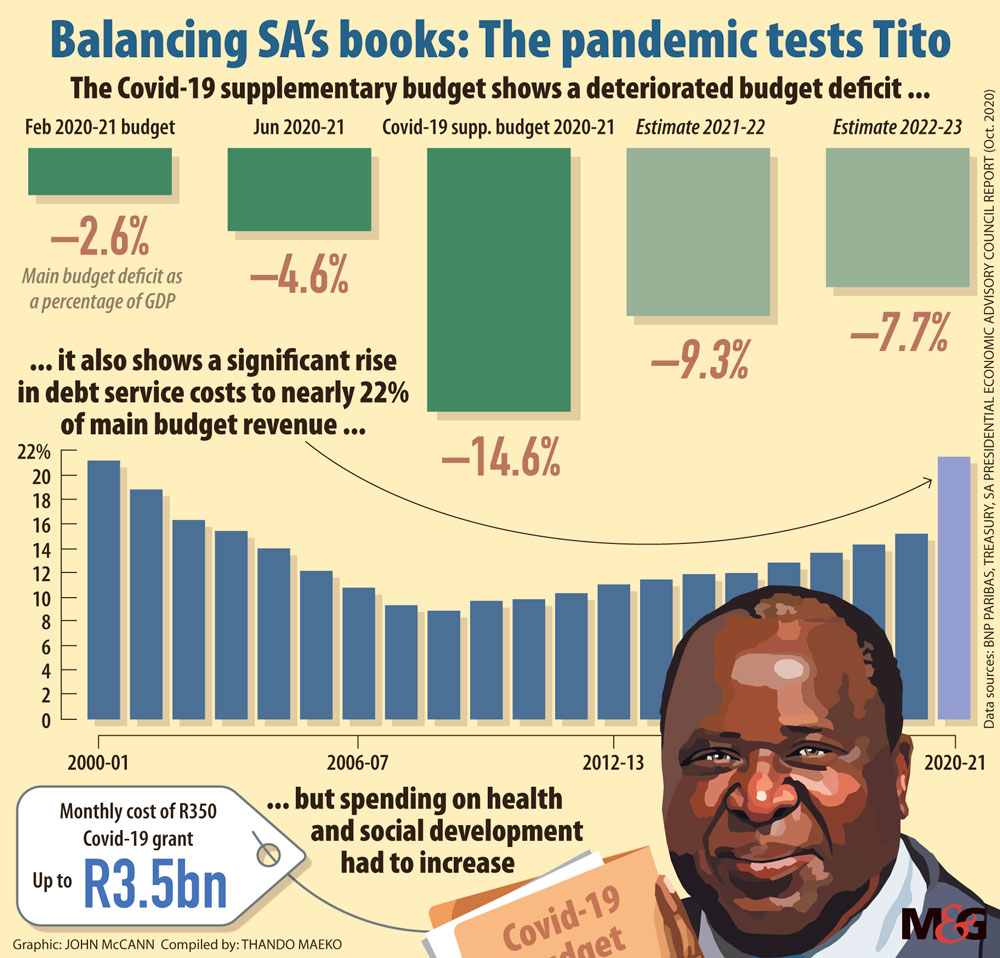

According to the “active scenario” presented in the Supplementary Budget in June, the country’s debt-to-GDP ratio is expected to peak at 87% in 2023-24 before falling to under 74% in 2028-29, rather than the passive approach which would lead to debt spiralling.

This reflects the precariousness of South Africa’s public finances and the unsustainability of its debt trajectory. It also reflects the country’s battered economy after the Covid-19 pandemic and the lockdown.

The government aims to cut expenditure by R250-billion over the next two years through various measures such as the rationalisation of state-owned enterprises and a combination of reforms that boost economic growth and measures to increase revenue collection and lower expenditure.

Details of these measures are expected to be presented in the medium-term budget policy statement on October 28.

Despite the treasury’s commitments, the panel says the government will not be able to stabilise debt in the medium term: “Even if it were possible, it may not be desirable to force a drastic contraction of spending while the economy is already being battered by the Covid-19 lockdown.”

The 18-member advisory panel was appointed last year by Ramaphosa. It includes a wide range of academics, experts from the private sector, labour, community, think tanks and other constituencies.

The panel says the country’s recovery plan should focus on implementing reforms that would drive “inclusive growth”.

This includes implementing sectoral reforms that would unlock investment in infrastructure and business activity across a wide range of sectors and, secondly, budget reprioritisation aimed at improving access to public infrastructure and services, effectively increasing the social wage.

The government spends 34% of its budget on wages, debt servicing costs, social grants and fee-free education. This means spending on crucial growth-enhancing initiatives such as infrastructure has been “crowded out”.

(John McCann/M&G)

(John McCann/M&G)

“If correctly managed, expenditure on infrastructure and facilities will not only improve service delivery but will also have the benefit of generating direct economic activity, employment and skills transfer for those involved in building new infrastructure,” the panel says.

According to University of Free State economist Phillip Burger, who is quoted in the panel’s recommendations, the country should pursue a more gradual approach to debt stabilisation.

This will have to be accompanied by “visible structural change to be time consistent and credible, including wage-bill reduction and fundamental restructuring and privatisation of SOEs [state owned enterprises] and/or some of their subsidiaries”.

Jeffrey Schultz, senior economist at BNP Paribas, says the reduction of the wage bill is crucial to treasury’s plan to be able to achieve its additional non-interest expenditure cuts in the following two years.

Delays in the settlement of the agreement might also hamper the treasury’s ability to finalise the next three-year agreement before the budget in February 2021, Schultz says.

Outside of reducing the wage bill, the panel recommends that the Covid-19 grant increases not be made permanent and that no new grants should be announced.

The government estimates that revenue will be R202-billion below its February projections.

To plug the hole left by dwindling revenue, the panel recommends that the government implement a solidarity levy over the next three years for personal income taxes.

Based on the recommendations of the Davis Commission, this would generate additional income of R2-billion if there were a 1% increase in the marginal tax rate to 46% for income earners above R1.5-million and another 1% increase for those above R2-million.