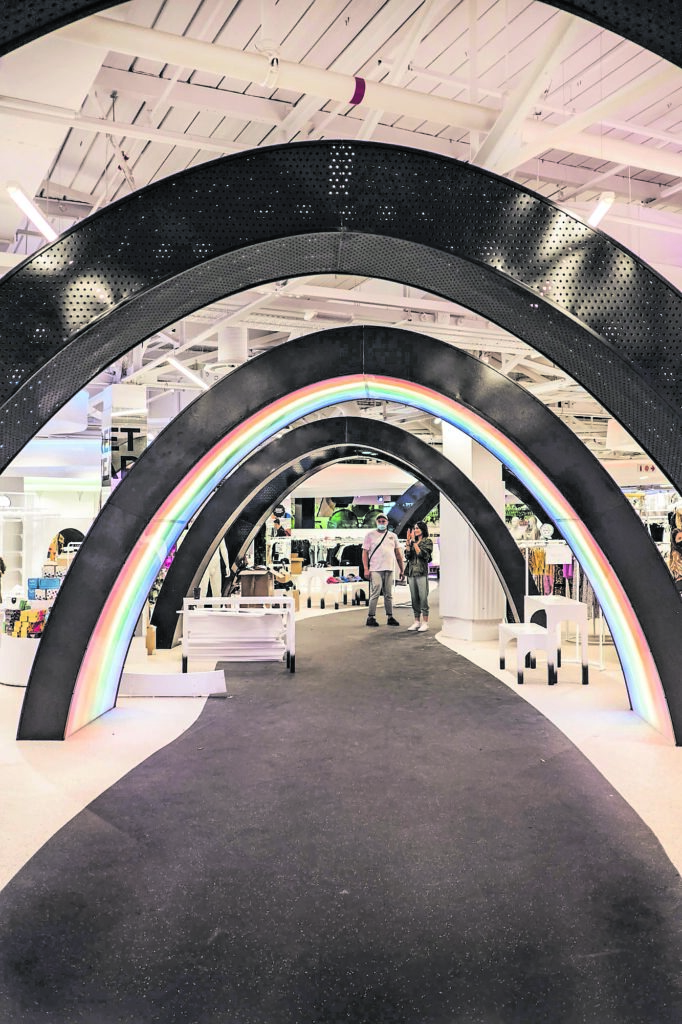

Free-range: EGG, like Paul Simon’s previous store YDE, offers prime retail space at a lower risk to smaller designers. (Chelsea Bartz)

Cape Town-based entrepreneur Paul Simon wakes up at 3am every morning.

“One morning I would wake up, throw my hands in the air and say, ‘Paul, you’re a genius. This is going to be incredible. You’re going to revolutionise retail in South Africa,’ ” Simon tells the Mail & Guardian. “And the next morning I’d wake up and put my hands over my eyes and say, ‘Are you absolutely daft? What are you doing? We’re in the middle of a global pandemic.’ ”

Simon opened the retail concept store EGG at the end of 2020, a year that left major fashion retailers struggling to survive. The launch marked Simon’s first re-entry into retail since founding and eventually selling the Young Designers Emporium (YDE) to Truworths in 2004.

In South Africa, Covid-19 forced big fashion retailers to catch up with the global shift to e-commerce. But with storefronts still playing a role in the future of fashion retail, experts say innovating the traditional “click and mortar” strategy is crucial.

“I think it’s imperative. If you don’t innovate, you might not survive. In this day and age, you can pretty much get anything from behind your computer,” Simon says. “So why would a consumer come to a brick-and-mortar store? The answer to that is, in a nutshell, innovation. Create something that you cannot get from behind a computer screen.”

The case for bricks

EGG’s first store is in Cape Town’s Cavendish Mall. Like YDE, it gives small local brands a mainstream marketplace to sell their products without entering into onerous lease agreements.

“Our philosophy towards retail, and one of the reasons we call it retail of the future, is that I don’t believe tenants should be tied into long leases in this day and age … We’re looking for much more of a win-win scenario. We’re giving [tenants] the same access to A-grade shopping malls, but de-risking it.”

The strategy makes sense in the current period, when retail businesses are uncertain about how lockdowns will affect foot traffic.

Truworths recently said that although its South African stores did not have to endure further hard lockdowns, its UK stores were forced to close during the recent efforts to curb the spread of Covid-19.

In a note to shareholders last week, Truworths revealed that group retail sales for the 26 weeks ended 27 December 2020 decreased by 8.5% to R9.7-billion. It also estimated that its earnings per share would fall by between 14% and 19% relative to the prior period.

The higher decline in earnings per share is attributable to an impairment of R162-million for retail store leases, as lockdown restrictions on nonessential retail in the UK and Europe continue to pressure store-based retailing.

This week, The Foschini Group (TFG) reported a similar story: Its South African stores fared well given the current trading conditions.

But its UK outlets continue to feel the pressure of government-enforced national lockdowns, losing 40% of its trading hours during the nine months to December 2020.

(Chelsea Bartz)

(Chelsea Bartz)

Making clicks count

According to TFG’s trading update, online sales in the UK failed to compensate for the lost sales from physical outlets.

Veteran retail analyst Syd Vianello told the M&G that Covid-19 had accelerated the need for fashion retailers to have an online presence.

“If you develop the strategy actively and correctly, it can act as a buffer against any further lockdowns.”

Vianello said concerns about physical outlets’ future would accompany the shift to online retail. “Somewhere down the line, the retailers have got to turn round and say, ‘Whether there was Covid or not, we know that online retailing started small and got bigger and bigger.’ Every sale that went online effectively meant that one less sale was made in the shop,” he said.

Simon believes that mall-based retailers are here to stay.

“One of the things people kept telling me was that e-commerce had cannibalised the market, and brick-and-mortar retail is dead. And those are two very strong statements, with neither of which I agree.”

E-commerce and brick and mortar work optimally together, Simon says. “Call me old school, but I am a firm believer in human nature. I don’t believe brick and mortar is going anywhere. I believe it needs to adapt, and it needs to pivot to be relevant in these times.”

EGG is tackling the brick-and-mortar dilemma by integrating digital technology into the physical space.

The store has an app that allows a customer to either shop and checkout online or to shop in-store and then pick up your items at a click-and-collect counter. “You can literally just walk out with it,” Simon explains.

The store also has beacon technology, which connects to customers’ mobile devices. The app will then help customers navigate the store — giving them information about the various brands they can shop.

Designer and brand consultant Shingai Nyagweta points out that the vision of

more digitally integrated shopping spaces is closer to what global retailers are moving towards. The Brazilian retailer C&A, for example, has clothes hangers that show how many likes each garment has on social media.

“There is amazing innovation happening. Especially because now brick-and-mortar stores have to be smarter about how they service their clients in person,” Nyagweta says.

(Chelsea Bartz)

(Chelsea Bartz)

“Their clients, who are incredibly digitally savvy, now expect to have the same digital experience in-store — the same convenience, social distancing, and still being able to interact with the brand.”

Nyagweta agrees that it is difficult to get South African consumers to move entirely online because of its mall culture.

“Shopping is not just a necessity, it’s an event … As much as I have been trying to punt online shopping — it’s convenient, it’s safe — people are like: ‘Ja, but I want to shop and feel.’ ”

But she concedes that in 2020 the South African fashion retail industry did “10 years of catching up in the space of a year”.