Power utility has 4 588MW on planned maintenance, while another 16 142MW of capacity is unavailable due to breakdowns

The national utility, Eskom wants consumers to pay more for electricity. This is although its sales of electricity have been declining over the past years.

According to information from the National Energy Regulator of South Africa (Nersa), electricity demand has declined from 210 million megawatts per hour (Mwh) in 2010/11 financial year to 195 million megawatts per hour in 2018/19.

However, this has not discouraged Eskom from making customers pay more for electricity.

Eskom applies to the National Energy Regulator of South Africa (Nersa) for revenue to cover their cost of generating electricity. This process is opened annually through a revenue clearing account process.

Nhlanhla Gumede, responsible for electricity regulation at Nersa, said the second step in the pricing process is translating this total revenue into Eskom tariffs that will be charged to different customer classes. Then municipalities based on one of the Eskom tariff structures purchases power from the power utility in bulk, and sells to its customers, adding their costs to come up with their Municipal tariffs.

“Each Municipality has its tariff structures, and annual increases that are only affected on the 1st of July of each year, are approved by Nersa based on a guideline that is consulted widely”, said Gumede.

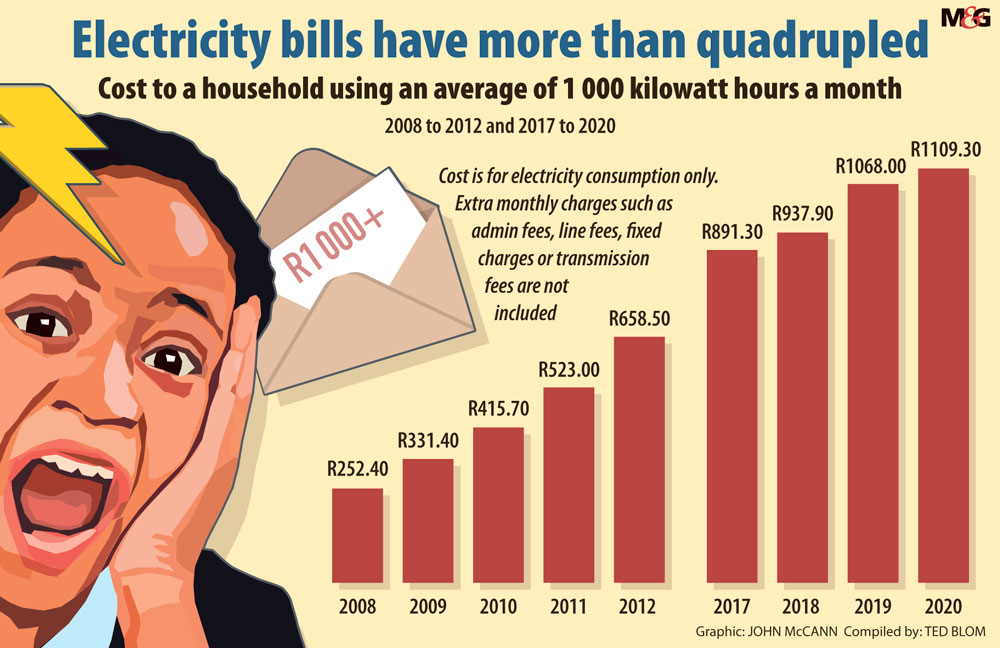

Using a worldwide average consumption of 1000 kilowatts per hour, the Mail & Guardian calculated electricity’s average price over the years. In 2010, monthly consumption charges of electricity were R415.70 per month, and in 2018 they spiked up to R937.90 then to R1068.00.

However, the utility is in debt amounting to R480 billion and has been relying on governments bailouts.

In January, the energy regulator allowed Eskom to recover an extra R6 billion from its consumers after the high court ordered the previous applications’ re-adjudication.

The tariffs relate to a price structure application made by Eskom for the three financial years from 2014 to 2017 and a supplementary revenue application for 2018/2019.

At first, Nersa had given Eskom a total R32.6-billion for recovery. But following the court order, Nersa allowed for another R6 billion to be recovered from its customers.

Energy analyst Chris Yelland said that the national utility said that the price of electricity is not covering the actual cost of generating power. To be cost-effective, it must raise prices by 30%. A hike which Yelland said: “It’s not going to fly.”

(John McCann/M&G)

(John McCann/M&G)

Yelland said there is no silver bullet to Eskom’s woes. He said the power utility could try to do the following, just a little better: borrow, cut cost and increase prices.

If not, increasing prices will be unsustainable, and it will damage the economy, he said. “The consumption [of electricity] is lower, but our population has increased significantly in the last ten years. It means per capita consumption of electricity is going down.

In a developing country, you would expect prices to go up because people are getting more money and they are purchasing houses and appliances”.

But now, people are using less, and there is also theft and non-payment. Increasing prices could further this trajectory, he explained.

Energy expert Ted Blom told the M&G that he predicts that Eskom would need to increase tariffs by 25% every year under the current business model.

He says to avoid this; the utility must open up the grid, “that is the only solution.”

Tshegofatso Mathe is an Adamela Trust business reporter at the Mail & Guardian