Unemployment epidemic: These men, gathered together to wait for the possibility of a piece job, are some of the 34.9% of South Africans who are without work, the highest figure among 82 countries monitored by business news agency Bloomberg. (Delwyn Verasamy/M&G)

South Africa has recorded better-than-expected GDP growth for yet another quarter. But the country is still lagging behind its peers — and economic recovery hasn’t been robust enough to rescue its citizens from an unemployment death spiral, analysts say.

According to GDP data released earlier this week, South Africa’s economy grew for the fourth consecutive quarter, expanding 1.2% in the second quarter of 2021.

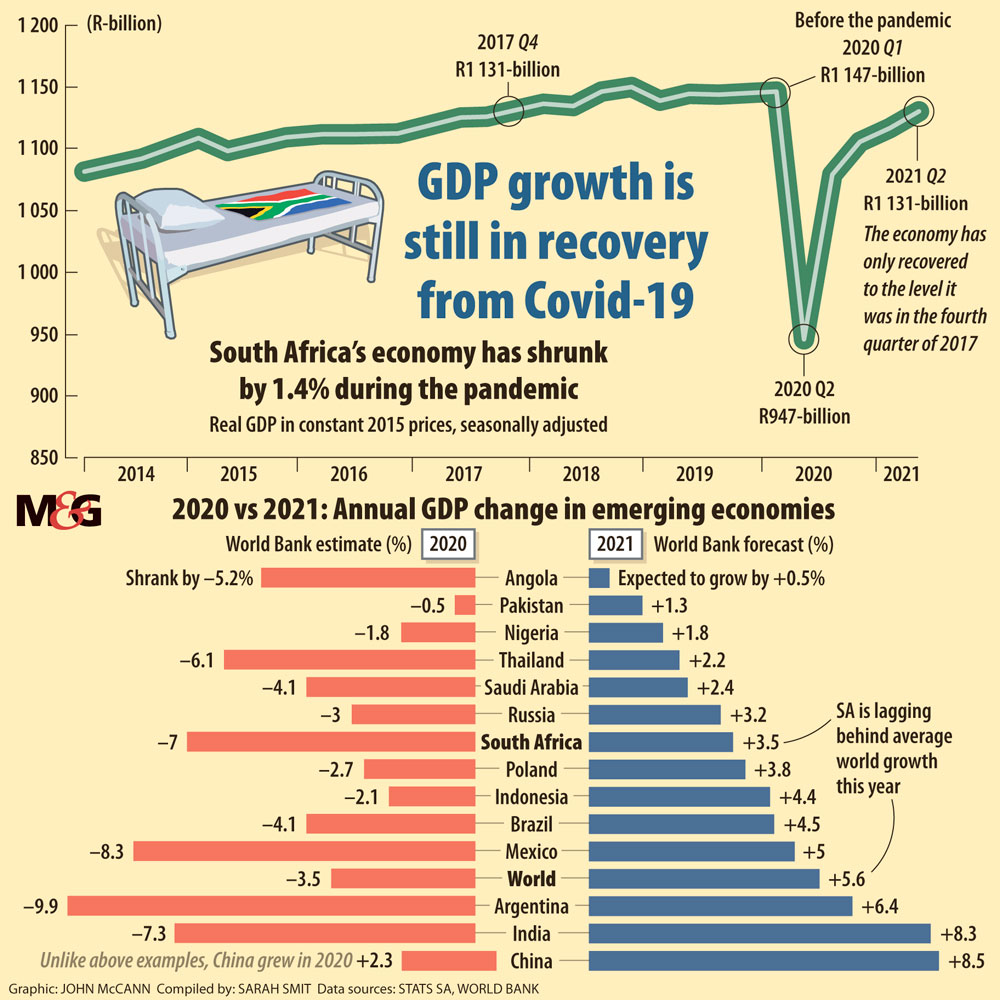

Though the country’s GDP has risen steadily from the low base in 2020, which caused the economy to contract by 6.4%, the economy is still 1.4% smaller than it was before the Covid-19 pandemic.

South Africa’s sharp contraction in 2020 already left it lagging behind other emerging economies, which as a group contracted by 2.1% last year, according to data from the International Monetary Fund (IMF).

The group’s economies, the IMF forecasts, will grow by 6.3% in 2021, while South Africa’s GDP is expected to rise by 4%.

The South African Reserve Bank has a slightly rosier forecast, projecting that the country’s GDP will rise by 4.2% by the end of the year. Growth projections by the bank’s monetary policy committee were muted as a result of July’s unrest, which negated better-than-expected first-quarter results.

However the central bank’s projection is expected to be revised upwards — not necessarily because of an upswing in economic activity, but because of Statistics South Africa’s recent overhaul of the country’s national accounts data.

As a result of the overhaul, in which the statistics agency changed its base year from 2010 to 2015, the revised GDP at current prices shows that the economy is 11% larger in 2020 than previously estimated. The real GDP for the first quarter was revised upwards by 1%.

Bureau for Economic Research (BER) chief economist Hugo Pienaar notes the IMF’s data for the emerging market group is skewed by the inclusion of Asian economies, which the IMF forecasts will see 7.5% GDP growth this year.

Other economies that contracted even more sharply than South Africa, such as Mexico (-8.3%) and India (-7.3%), are also expected to grow faster. Mexico’s GDP is forecast to grow by 6.3% in 2021 and India’s by 9.5%.

Pienaar concluded: “In general, it is safe to say that we are lagging behind some of our peers.”

PwC South Africa chief economist Lullu Krugel said the country is not keeping pace with other economies, but if its GDP does manage to keep up with Reserve Bank projections it may be able to catch up. PwC, Krugel said, is not optimistic about this prospect — projecting that the GDP will struggle to hit 3% growth in 2021.

In its South Africa Economic Outlook 2021 report, published last month, PwC put South Africa’s 2021 GDP growth at 2.5%, which it conceded was a conservative figure compared to other forecasts. “However, the central bank admitted in its latest monetary policy committee statement that recent unrest, the impact thereof on the vaccine drive, a longer-than-expected lockdown, limited energy supply … as well as policy uncertainty ‘pose downside risks’ to economic growth,” the PwC report notes. “It is likely that the major difference between the Reserve Bank’s current forecasts and our own projections is that PwC has already incorporated more adverse impacts from these downside risks into our assumptions.”

Krugel said: “If you take the growth that we saw in the first and the second quarter and we can repeat that in the third and the fourth quarter, then we will see growth of close to 4%. But my concern is that we will not be able to do that because of the unrest that we saw in KwaZulu-Natal and Gauteng.”

(John McCann/M&G)

(John McCann/M&G)

Economists are expecting muted, or even negative, growth in the third quarter as a result of July’s riots.

Speaking to the Mail & Guardian earlier this week, Citibank economist Gina Schoeman said, “There is a good chance that we will see a contraction in the quarter-on-quarter growth in the third quarter.”

Recent high-frequency data on the health of the manufacturing sector and vehicle sales in July are a portent of what is to come, Schoeman said. “We are waiting for the rest of the monthly data and that will give us a better feel for what the unrest did.”

Momentum economist Sanisha Packirisamy said third-quarter growth was likely to be “very soft, if not negative”. “[The unrest] is going to shave off a significant portion of growth, because the two economic hubs that were affected account for half of the country’s GDP,” she said.

“I am not convinced the momentum behind the GDP growth will continue into the third quarter. I think we will see a deterioration in the third quarter before slightly picking up in the fourth quarter.”

Reflecting on the second-quarter GDP results, the economists interviewed by the M&G also noted that the recent economic growth has not been robust enough to drive job recovery.

According to the most recent figures, South Africa’s unemployment rate stands at a whopping 34.4% as of the second quarter. This is the highest jobless rate on a global list of 82 countries monitored by Bloomberg.

The BER’s Pienaar said: “The recovery since the first quarter last year has been better than expected. The second-quarter number was better than expected. But despite that, the economy has lost jobs in the first half of this year.”

The country needs higher growth rates to support job recovery, Pienaar added. “We are growing, but the overall level of economic activity is still down from where it was before Covid. And bear in mind that the pre-Covid level of activity was not great to start off with. So you need to get back to at least where we were — but actually quite a bit above that — before we really start to see employment numbers grow.”