Doth protest too much: Floyd Shivambu denies benefiting from VBS Mutual Bank looting and that he sold his ‘old’ BMW to his brother Brian, the amout of which equalled the shortfall for his new Range Rover

NEWS ANALYSIS

In the official story, Floyd Shivambu — the second-in-command of the Economic Freedom Fighters — got R680 000 in “clean” money from his brother to buy a high-end Range Rover Sport in 2018.

This is the narrative Floyd pushes. His younger brother, Brian, who benefited from the looting of VBS bank, was just buying an old 2002 BMW 7 series from him for R680 000 — which happened to be the shortfall for his new Range Rover Sport.

Since then, details have emerged, through the investigation of the now defunct VBS Mutual Bank, that the money Brian got is considered proceeds of a crime. The Hawks are mum about their investigation into all the individuals who benefited from VBS. But they have begun their first round of arrests of those who were directly involved with the collapse of the bank.

The money trail shows that Brian, Floyd’s brother, had gained from the more than R1-billion heist of VBS through two of his companies — Sgameka and Grand Azania. That money included the life savings of gogos who may now never see a cent from their investments because the bank went under liquidation.

Through Sgameka, Brian owed the mutual bank more than R4-million through a mortgage from 2016 and a “loan” facility in 2017. Brian, through the companies, had also been revealed as having benefited from a separate R16-million taken from VBS accounts. He therefore had cash floating around.

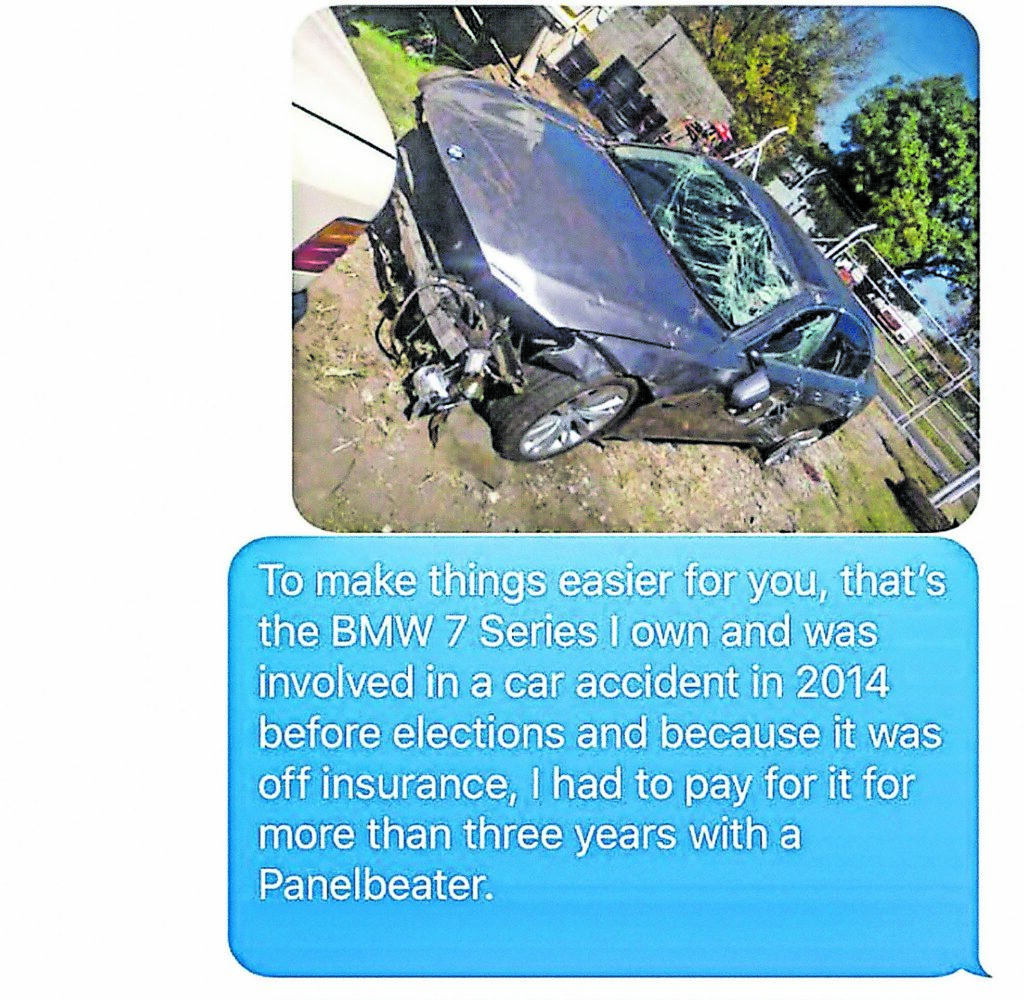

Floyd told the Mail & Guardian last year that the R680 000 was a payment by Brian to buy his old 2002 BMW 7 series. This was a car that had been brought back to life by a panel beater after it was involved in a serious accident in 2013. The two maintain that this is a fair price for a 16-year-old vehicle that has been in an accident.

Floyd Shivambu’s old BMW

Floyd Shivambu’s old BMW

Coincidentally, they would have us believe, this was the same amount as the shortfall in Floyd’s trade-in of his old Range Rover Sport to acquire his new Range Rover Sport. The R680 000 was paid directly from Sgameka’s bank account into Trenditrade 23, a company that trades as the Land Rover dealership in Sandton.

By simply following the money, this would suggest that Floyd became an ultimate beneficiary of proceeds of a crime, because the monies that ended up with Brian are gratuitous payments — they were paid without any justification. In law enforcement circles, this is called “ultimate beneficial ownership”, a term used in money-laundering investigations. It refers to a juristic individual who, despite not appearing on company documents, effectively controls and benefits from that company.

The Shivambu gratuitous payments were referred to law enforcement agencies, particularly the Hawks, which also visited the dealership in its investigation of various individuals who had bought vehicles there with suspected VBS money.

Brian’s company, Sgameka, also bought an apartment at Pine Avon in Fourways in Gauteng, with various transactions for the apartment ranging from R100 000 to R300 000.

According to Floyd, that was not his flat; Brian had entered into a rent-to-buy arrangement. The M&G visited Pine Avon last year, and the intercom for the apartment showed “FLO”. Some residents said Floyd was there more than his brother, and that they thought it was his.

Brian’s real wealth also came into question in 2018, when Nedbank hauled him before the courts for failing to pay a monthly instalment of R4 580.50 on a 2016 Toyota Corolla Quest. Strange for someone who, on the face of it, ran two companies that took in a great deal of money from the looting of VBS bank.

Details of the payments were discovered by Terry Motau SC, who investigated the bank on behalf of the South African Reserve Bank. His investigation revealed that more than a R1-billion had been looted from VBS by a range of people.

When the report was released, Brian threatened to challenge it in court. But he has never acted against the South African Reserve Bank. Instead, Brian ended up paying back about R4-million for a mortgage from 2016 and a “loan” facility from 2017, after the liquidator, Anoosh Rooplal, dragged him and his companies to court.

When the M&G published the story about the R680 000 and the Range Rover Sport on September 26 last year, Floyd demanded a retraction and an apology and if that didn’t happen he threatened a R3-million lawsuit. The story was never retracted. and the lawsuit never followed.