The global financier announced that it had approved a $1 billion loan to help the country’s shift to cleaner forms of energy

Both companies have been labelled “carbon criminals” — and both hold South Africa’s climate future in their hands.

As the country takes its negotiating position to the crucial COP26 climate summit this week, how state-owned power utility Eskom and petrochemicals giant Sasol transform their dirty, coal-dependent operations, will determine the country’s ability to meet its plans for decarbonisation.

Debt-ridden Eskom, which briefly plunged the country into stage four blackouts again this week — reflecting a 4 000-megawatt shortfall in capacity — is seeking billions of dollars abroad to help fund its plans for the closure of most of its coal-fired power plants by 2050 and in championing renewable energy. Eskom is South Africa’s biggest greenhouse gas emitter.

In 2019, South Africa’s delegation arrived at the COP25 climate summit in Madrid in Spain as Eskom escalated the rolling blackouts that have plagued the country for more than a decade to stage six, an unprecedented move that meant that the utility’s capacity was slashed by 40%.

The latest round of power cuts shows how “desperate” South Africa is for new reliable capacity, Mandy Rambharos, the general manager of Eskom’s Just Energy Transition (JET) office, told the Mail & Guardian.

“Why would we throw more money into maintaining an old coal plant, which is becoming obsolete, which is not operationally and economically viable, when we should rather take that money and build new clean capacity?” Rambharos said.

“If you think back to when people used a horse and a cart and then the car was invented — if the horse and cart weren’t working properly, you didn’t look at ways of fixing that — you’d rather move towards a car.

“That’s how I think of the electricity system right now. I think people feel comfortable with the coal stations because that’s what we’ve known for so many years and there’s a little bit of discomfort in moving into something new, even though it’s cheaper, more reliable and cleaner and ticks all those boxes,” she added.

Eskom is expected to decommission three of its oldest coal-fired power stations by 2026.

The latest assessment by Climate Transparency International shows that 74% of the country’s total primary energy supply in 2020 was derived from burning coal — more than double the average of 31% among the G20 group of industrialised and developing nations.

Renewables accounted for 7.6% of the country’s power generation last year, a significant increase from previous years, but still well below the G20 average of 28.7%. As with the G20 as a whole, South Africa’s current emissions trajectory is not compatible with the goal of limiting global warming to 1.5°C, the assessment found.

Coal is becoming a risky business and financiers are increasingly dumping the black rock from their portfolios. Pakistan, SA’s second-largest coal export market, announced a plan to end all coal imports as it transitions in its latest climate plan submitted to the UN Framework Convention on Climate Change.

Financing Eskom’s transition

Despite hopes that the utility’s unbundling into three separate entities — transmission, generation and distribution — will put it in a better financial position, it is unclear how it will share its unsustainable debt among the three entities. By September this year, Eskom had slashed its R401-billion debt by R81.9-billion.

Minister of Public Enterprises Pravin Gordhan told reporters on Wednesday night that there was finance waiting for Eskom to tap into.

“There’s a lot of money that is waiting to be invested in renewables, some institutions tell us up to R120-billion can be invested, which can make a huge difference. And that is why, as we go to COP26, as a government and a country, Eskom plays an important part in designing the just component for workers and for the communities that are actually impacted and that will play an important part in attracting funding to South Africa as well,” he said.

COP26 is an opportunity for Eskom to secure further international grants and concessional finance aligned to climate mitigation conditions and its JET strategy. The utility will, however, be decarbonised in a phased manner, Rambharos said.

“If you look at the just transition, let’s say in Germany, for example, where they have all of those millions of euros, it still took them 18 years to transition. So from a South African perspective, given the dependency we do have from communities in areas where coal stations are, we’re not going to transition overnight,” she said.

In the near term, Eskom will take off 22 gigawatts of coal-fired power from the grid by 2035.

“We’ve got 46GW of installed capacity. So it does mean that we will still have coal in the system for a number of years to come. The newer stations, and the better-performing stations and units, will be kept running for a while to come as we transition,” Rambharos said.

The message to developed nations is that the cost of carbon abatement or “offsetting” — which is when a country reduces global emissions by mitigating elsewhere from its operations — is cheaper in South Africa than in their home countries.

It is cheaper because South Africa is still working on its electricity sector’s decarbonisation as opposed, for example, to European countries that are starting to decarbonise their transport sectors.

“And you would have a bigger bang for your buck in terms of carbon abatement, you know, because carbon emissions can be abated anywhere, right? And it has a positive global impact,” Rambharos said.

To enable and accelerate Eskom’s just energy transition, which has been endorsed by the cabinet, from coal to other forms of electricity generation, Eskom has proposed a multi-tranche, multiyear facility, funded by a multi-lender syndicate. Eskom hopes this will provide concessional funding to JET projects in the country on a “pay-for-performance” basis, with funds to be advanced as progress payments for different stages of various projects.

Deputy Finance Minister David Masondo has aired his personal views on Eskom’s precarious position amid the transition, once suggesting that the state utility be listed on the JSE to raise capital, and on another occasion stating that debt-for-climate swaps was another option.

Eskom’s transaction plan, according to the Centre for Environmental Rights (CER), does not address the massive problem of its debt and the systemic risk that poses for South Africa. “This limits our ability to finance future investments in our power sector.”

The transaction “does not include a plan to deal with the impacts of coal phase-out along the coal value chain – in particular, coal mine workers and coal-affected communities, and SMMEs in Mpumalanga. So while the Eskom JET is an important first step, South Africa will have to be far more ambitious if we are going to achieve a transition that is truly just.”

Using new fossils as transition ‘enablers’

Last month, Sasol, the country’s second-biggest emitter of greenhouse gases, announced that it was tripling its 2030 emissions target and aimed to reach net-zero emissions by 2050.

“We are the second-largest emitter of greenhouse gases; we have a huge emissions profile and we have to transition,” Shamini Harrington, the vice president of climate change at Sasol, told the M&G. “So we have an important role to play, together with Eskom, as the large emitters.

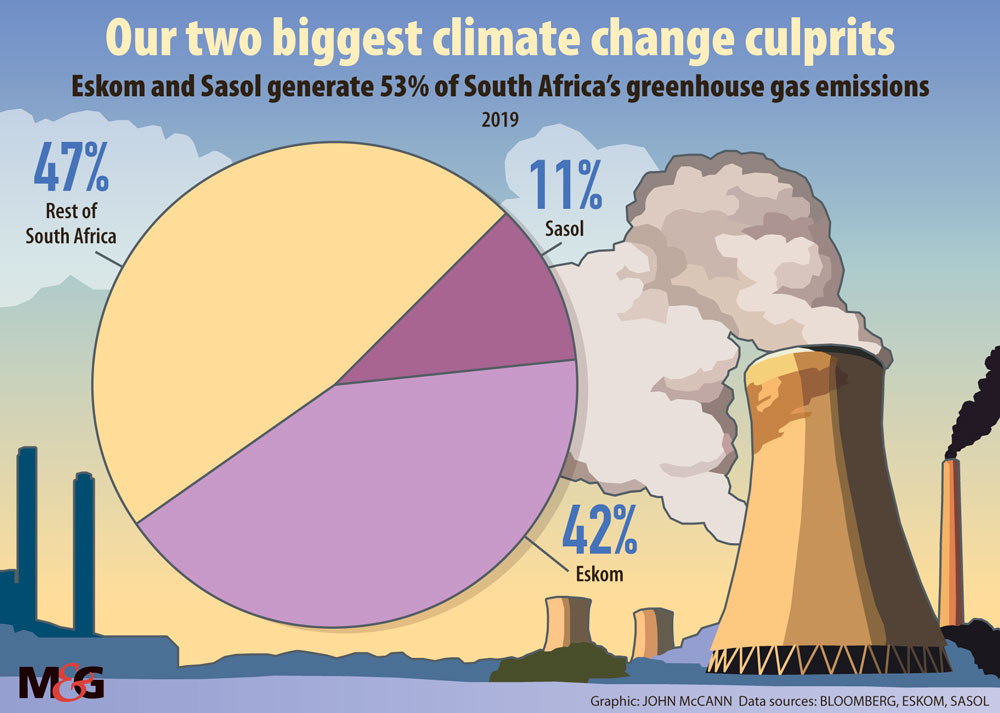

“Together we would make up more than 50% of the emission profile and if we are decarbonising, that goes a long way towards the country being able to meet its ambitious nationally determined contribution that it has put forward,” Harrington said.

According to the CER, both Sasol and Eskom have a “shocking history” of avoiding and delaying reducing both their greenhouse gas emissions and air pollution.

Robyn Hugo, the director of climate change engagement at Just Share, a nonprofit shareholder activist organisation, said while the two companies had both recently proposed plans that would influence the energy transition, “neither demonstrates appropriate levels of ambition or urgency”.

Both have been avoiding compliance with air pollution standards for more than 11 years. “Given this history of disdain for legislated standards, it is difficult to have faith in either Sasol or Eskom’s commitment to meet climate ambitions, which are not currently prescribed by law,” Hugo said.

“Eskom has indicated an investment need of around R18-billion to R20-billion in generation, of which almost half is for 4GW of gas capacity versus around 3GW for renewable energy and microgrids. It estimates that R120-billion is required for transmission and a further R45‑billion for distribution.”

It is highly problematic that Eskom’s plans include spending a “huge chunk” of limited climate finance support on gas capacity, she said, adding: “Transition and climate finance should not include any funding for new fossil fuels, including new gas.”

Gas is much more potent than carbon dioxide — with a global warming potential of 84 to 86 times that of carbon dioxide over 20 years.

Rambharos said while Eskom’s focus was on renewables, gas provides flexibility and stability.

“I know gas is also fossil fuel, but it’s a lot less carbon-intensive than coal. And so the idea then is that we have gas on the system that provides that flexibility and standby capacity that you need on days when we may not have renewables on the system.

“And we get a lot of criticism for the gas we have in the system. But until there’s a new commercially available technology that can provide that flexibility and stability, gas is the backup,” she said.

Sasol’s coal-to-liquid Secunda plant is the highest single point source of greenhouse gas emissions in the world. The company, Harrington said, is committed to developing a low-carbon economy and to the objectives of the Paris Agreement on climate change.

Sasol: The petrochemical company’s coal-to-liquid plant in Secunda is the world’s highest single source of greenhouse gas emissions. Photo: Planetkb

Sasol: The petrochemical company’s coal-to-liquid plant in Secunda is the world’s highest single source of greenhouse gas emissions. Photo: Planetkb

“We are very much in support of climate action, and we’re now accelerating that because that’s what the science is telling us we have to do.”

To align with its 2050 ambition, the company has tripled its 2030 greenhouse gas emission reduction targets to 30% off a 2017 baseline for its South African operations, from an initial 10%. Its 2030 target will be delivered through the direct decarbonisation of its existing assets — through a mix of energy and process efficiencies, investments in renewables as well as a shift to incremental natural gas as a transition feedstock for its Southern African value chain.

This transition will see the company progressively shift away from coal to cleaner energy sources such as green hydrogen. Beyond 2030 Sasol has more than one viable pathway to reach its net-zero ambition by 2050, with different options to transform its value chain. This entails progressively shifting its feedstock away from coal towards gas and then to green hydrogen and sustainable carbon over the longer term “as economics improve for these options”.

From 2004 until 2015, Sasol had reduced its emissions by more than 10-million tonnes, which is a “huge feat”, Harrington said. “So we are continuing to put ourselves on a reduction path by 2030 — we want to get as low as 40-million tonnes. Today we’re emitting in the region of 62-million tonnes. We really want to move fast.”

On the use of gas as a transition fuel, Harrington said: “We can’t be bound by coal at the volumes we are as a company and as a country.

“Sasol is a very carbon-intensive company, we’re using large volumes of coal, and we need to find a transition fuel. Even with the best efforts, rolling out renewable energy at large volumes is not going to be able to run big plants like Sasol. We need a transition fuel at times when the wind isn’t blowing and the sun isn’t shining … And transition gas is therefore the opportunity to then wait for those low-carbon emitting fuels to come in.”

Eskom agrees, and said it cannot wait for commercial green hydrogen to come online in ten years’ time before it takes climate action.

Sasol’s latest 2030 target remains highly contingent on it being able to access sufficient, affordable quantities of fossil gas, and this, says Hugo, “is not at all certain”.

Its 2050 net-zero target relies heavily on green hydrogen becoming cost-effective and on significant quantities of both renewable power and water being available.

There are insufficient details in Sasol’s climate change report 2021 for shareholders and other stakeholders to be able to assess the feasibility or cost implications of these ambitions.

“Sasol regards the ‘greater use of gas’ as a ‘critical step in the transition away from coal’. Fossil gas is very clearly not a ‘green’ option, and regarding it as a ‘bridge’ or transitional fuel creates the very serious and significant risk of ‘locking in’ emissions and crowding out the policy and financing space for the mass construction of least-cost renewable energy,” Hugo said.

“Even if Sasol is able to access sufficient affordable gas to support its emission reduction ambitions, the risks this creates should not be underestimated.”

According to the CER, after “years of obfuscation and resisting calls for change”, Sasol has in the last three years improved its climate-related disclosures measured against the recommendations of the Task Force on Climate-related Financial Disclosures. “These developments (net-zero commitment) are positive, but insufficient and its feasibility questionable.”

Sasol, the CER said, had failed to disclose concrete coal phase-out commitments: “Instead, it appears that the company will continue to rely on coal until 2050. Simultaneously, Sasol’s plans rely heavily on gas as a ‘transition’ replacement feedstock — particularly for meeting its 2030 target. And this while renewable and biogenic alternatives are available, and could be transitioned to at a faster pace.”

The CER said if community and civil society organisations were successful in the so-called Deadly Air case and the court recognised the air quality on the Mpumalanga Highveld as a constitutional violation, “it will provide a strong legal ground for accelerating the phase-out of coal power stations that are contributing to the violation of constitutional rights by not meeting the minimum emission standards for air quality (weak as they are)”.

The case centres on toxic air pollution in Mpumalanga province, home to 12 of Eskom’s 15 coal-fired power plants, Sasol’s coal-to-liquids plant and the Natref refinery in Sasolburg.

The case centres on toxic air pollution in Mpumalanga province, home to 12 of Eskom’s 15 coal-fired power plants, Sasol’s coal-to-liquids plant and the Natref refinery in Sasolburg.

The reduction of Sasol’s coal use will lead to air quality improvements, water use and waste improvements, Harrington said.

Divided messaging put energy minister at odds with SA’s COP26 position

Meanwhile, South Africa’s COP26 position on phasing out coal differs from mineral resources and energy minister Gwede Mantashe’s publicly stated sentiment on the future of coal and other fossil fuels.

While President Cyril Ramaphosa’s climate commission was declaring the idea of clean coal a “fantasy”, earlier this month, Mantashe was, according to News24, telling a coal conference that there should be no rush to abandon coal for renewable energy.

At the time, climate envoys were meeting with the South African government on ways the country could accelerate a phasing-out of coal.

Mantashe did not attend the meeting with the department of public enterprises and the department of the environment, forestry and fisheries. Instead, he told the coal conference that he opposed energy finance being conditional on phasing-out coal, according to Bloomberg.

Mantashe supports the Integrated Resource Plan (IRP2019) for energy, which includes an additional 1 500MW of new coal coming onto the grid by 2030.

The CER and other environmental groups have threatened to challenge him in court should he not accommodate recent developments, including a regulatory change to the licensing threshold for independent power generation, which is anticipated to unlock 5 000MW of new capacity.

“This thing is complex,” political analyst Ralph Mathega told the M&G. “It’s beyond Mantashe. It’s okay for his political survival now, because, remember, he comes from the union lobby, from the mining that actually produced the tycoon we call President Cyril Ramaphosa, which is a culprit in this sector of heavy consumption … And if you look at that, you look at the intricate link of the unions, you realise that Mantashe has got historical vested interests in the mining sector, coming from the National Union of Mineworkers (NUM), and then the role that they play within the ANC … All the ANC has known since it has been in government is to drive patronage by its policy control through the energy sector,” he said.

“So, we should not be naive — we are talking about decoupling the oldest industrial energy complex. It’s not an easy job … Remember, ours is not even abstract. It doesn’t require studies. Go to Mpumalanga and talk to people there. They will tell you exactly about the problems from the power stations and the transportation of coal from the mines to the power station. It has destroyed the quality of air in small towns.”

This week Mantashe urged the NUM to save coal from extinction while addressing the union’s policy conference in the Eastern Cape, warning that shutting down coal mining would destroy the economy, especially in Mpumalanga.

According to a TimesLive report, Mantashe told the conference he had been called “a coal fundamentalist” and “a fossil fuel dinosaur” by lobbyists, but had come to terms with these labels because “I think the position we are taking on energy is a correct one”.

Mantashe’s spokesperson Nathi Shabangu said the minister’s position on the energy transition has little or nothing to do with politics, or allegiance to a union.

“It is about the right thing to do for the country’s economy. The minister has always maintained that a ‘just energy transition’ from high carbon to low carbon emissions should be inclusive and [use] mixed energy sources, as directed by the IRP2019. The minister does not favour any source over others,” Shabangu said.

Tunicia Phillips is an Adamela Trust climate and economic justice reporting fellow, funded by the Open Society Foundation for South Africa